Demikian disampaikan Analis Global Market Bank Mega, James Evan Tumbuan dalam risetnya seperti dikutip detikFinance, Rabu (28/12/2016).

Sementara di regional, Sterling masih dalam range yang sempit antara 30-35 pips dengan tahanan atas masih di angka 1.2300. Data fundamental AS yang dirilis juga menjadi faktor yang menahan kenaikan GBP.

Untuk JPY level 117.90 masih menjadi strong resistance untuk chart harian di mana yen secara jangka panjang masih memiliki potensi menguat hingga 119.14.

Dari sisi global, Dollar Index terhadap majors mengalami penurunan sebanyak 7 basis poin ke level 102.98 di mana nilai tersebut merupakan rekor kedua tertinggi dalam beberapa pekan terakhir.

Saham AS rekor 20.000 kemudian ditutup di level 19.945,04 atau menguat +11,23 di bandingkan pembukaan. Dari sektor komoditas, gold melanjutkan tren bullish ke 1140.28 setelah preferensi para pelaku pasar memegang Gold sebagai safe haven asset selama periode libur Natal dan tahun baru.

Di dalam negeri, bursa saham Indonesia melesat sebesar 1,5%, ditutup di level 5.102 pada penutupan kemarin. US$/IDR spot rate mengalami penurunan sebanyak 5 poin seiring dengan penguatan mata uang IDR.

Rupiah diperkirakan bergerak di angka Rp 13.400-Rp 13.480. Pemerintah Indonesia merilis pertumbuhan GDP berada di angka 5% untuk tahun 2016 dan akan terus menjaga defisit di bawah 2,7% dari GDP. Inflasi MoM di bulan Desember diperkirakan berada di kisaran 0,2-0,3%. (drk/drk)

👌

TEMPO.CO, New Jersey - Ekspor Cina tercatat naik sebesar 0,1 persen dalam denominasi dolar pada November ini. Seperti dikutip dari kantor berita CNBC, Jumat, 9 Desember 2016, peningkatan itu cukup menggembirakan setelah pada Oktober ekspor Cina mengalami penurunan sebesar 7,3 persen.

Pada November ini, pertumbuhan impor juga mengalami laju yang tercepat sejak September 2014, meningkat sebesar 6,7 persen dibandingkan dengan tahun lalu. Sementara itu, impor ke Cina pada bulan sebelumnya atau Oktober mengalami penurunan sebesar 1,4 persen.

Angka itu membawa Cina mencatatkan surplus perdagangan sebesar US$ 44,61 miliar pada November, lebih rendah dibandingkan Oktober yang mencapai US$ 49,06 miliar. Sebelumnya diperkirakan, ekspor Cina turun 5,0 persen, impor turun 1,3 persen, dan surplus perdagangan mencapai US$ 46,3 miliar.

Adapun dalam denominasi yuan renminbi, ekspor Cina juga tercatat meningkat sebesar 5,9 persen dibandingkan tahun lalu. Sementara itu, impor pun naik, yakni hingga 13 persen dibandingkan tahun lalu dalam denominasi yuan renminbi.

"Peningkatan ekspor tersebut mencerminkan adanya penguatan permintaan global, dengan survei bisnis baru-baru ini yang menunjukkan bahwa negara maju berada di jalur yang tepat untuk mengakhiri tahun ini dengan catatan yang menguat," kata ekonom Capital Ekonomi Cina Julian Evans-Pritchard.

Sementara itu, impor Cina yang juga meningkat mencerminkan adanya kenaikan harga komoditas industri yang cenderung mendorong nilai impor. "Volume impor mungkin akan terus bertahan dengan baik mengingat tanda-tanda pemulihan ekonomi Cina sudah mulai terjadi sejak bulan lalu," ujar Julian.

Meskipun terjadi penurunan mata uang yuan renminbi, pengiriman komoditas utama ke Cina termasuk bijih besi, minyak mentah, batubara, dan tembaga juga naik pada November. Meskipun begitu, ekspor Cina secara keseluruhan sepanjang tahun ini masih turun 7,5 persen dan impor turun 6,2 persen dibandingkan tahun lalu.

CNBC | ANGELINA ANJAR SAWITRI

🙌

Bisnis.com, BEIJING—Aktivitas sektor jasa China tercatat mengalami perkembangan signifikan dengan level tercepat dalam 16 bulan terakhir pada November 2016.

Survei swasta Indeks Manajer Pembelian (PMI) Jasa Caixin China menunjukkan, pertumbuhan di sektor jasa China meningkat menjadi 53,1 pada November 2016, dari 52,4 pada bulan sebelumnya.

Angka itu mengalami akselerasi mencapai 16 bulan tertinggi pada November 2016, meskipun peningkatan kontrak baru sedikit menyusut, dan ekspektasi bisnis tumbuh moderat.

Angka di atas level 50 menunjukkan ekspansi aktivitas pada basis bulanan. Angka November menandai level tertinggi sejak Juli 2015.

Survei juga sekaligus menunjukkan momentum pembangunan bagi ekonomi China pada akhir tahun yang memperlihatkan pertumbuhan yang stabil, meskipun sejumlah ekonom menilai peningkatan harga yang tak berkelanjutan berdampak besar terhadap kekuatan ekonomi saat ini.

Input prices perusahaan jasa tumbuh pada laju tercepat sejak Februari 2015, diiringi harga komoditas dan upah yang lebih tinggi dari sejumlah perusahaan yang disurvei.

Kendati demikian, persaingan yang ketat membatasi kenaikan harga untuk konsumen, dan meningkatkan masalah perampingan margin keuntungan.

Survei produsen pekan lalu menganjurkan adanya peningkatan harga pada level tercepat selama lebih dari lima tahun terakhir, dengan peningkatan harga komoditas yang memberi kontribusi terhadap keuntungan industri.

Pemerintah China mengatakan pertumbuhan organik masih relatif lemah. Sementara itu, analis yakin dorongan dari harga akan berlangsung singkat tanpa diiringi pertumbuhan permintaan.

"[Tekanan harga] mencerminkan pergerakan mata uang dan kenaikan harga komoditas. Hal itu tidak baik untuk margin, dan pada saat kondisi finansis ketat, hal ini pasti aan membebani investasi,"ujar Wakil Kepala Ekonom Peneliti Asia HSBC Frederic Neumann dalam sebuah laporan seperti dikutip Reuter, Senin(5/12/2016).

👋

NIKKEI: December 1, 2016 10:30 am JSTChina manufacturing, services pick up speed in November - official PMI

BEIJING (Reuters) -- Activity in China's manufacturing sector grew more than expected in November, expanding at its strongest pace in more than two years, as the world's second-largest economy picks up momentum heading into what promises to be a tumultuous 2017.

The official Purchasing Managers' Index (PMI) stood at 51.7 in November, accelerating from previous month's 51.2 and above the 50-point mark that separates growth from contraction on a monthly basis.

November's reading was above the prediction of a Reuters poll for 51.0 and matched a previous high in July 2014, when it also stood at 51.7. The last time China's PMI was higher was in April 2012 when it was 53.3.

After a rocky start to the year, China's manufacturing sector has picked up in recent months, buoyed by a government infrastructure building spree and a housing boom.

A jump in commodity prices also has boosted profits for firms selling building materials from cement to steel, though futures prices have plunged this week as major commodity exchanges took further steps to tame a spectacular months-long rally.

China's economy expanded at a steady 6.7 percent clip in the third quarter and looks set to hit Beijing's full-year target of 6.5 to 7 percent, fueled by stronger government spending, record bank lending and a red-hot property market that are adding to its growing pile of debt.

Factory output quickened in November, with the sub-index rising to 53.9 from 53.3.

Total new orders saw another month of solid improvement in November, rising to 53.2 from October's 52.8.

New export orders also increased and hit at least a 12-month high of 50.3, though they were still barely in expansion territory. Any pickup in external demand will be a welcome sign for China's massive factory sector.

Jobs were again lost, with the employment sub-index sitting at 49.2, compared to 48.8 in October, as the country pledged to cut excess capacity over a range of industries.

👏👏

Beijing, Nov 1, 2016 (AFP)

Manufacturing activity in China expanded at its fastest pace in more than two years last month on improving production and demand, an official measure showed Tuesday, boding well for the world's second-largest economy.

Investors closely watch the purchasing managers' index (PMI), which gauges conditions at Chinese factories and mines, as the first indicator of the health of the economy each month.

The PMI came in at 51.2 for October, its highest since July 2014, figures from the National Bureau of Statistics (NBS) showed.

It rose from September's 50.4 and was well ahead of the median forecast of 50.3 in a Bloomberg News survey of economists.

A figure above 50 signals expanding activity, while anything below demonstrates shrinkage.

"Production and market demand is picking up again, accelerating expansion," NBS analyst Zhao Qinghe said in a statement.

But Zhao added that downward pressures remain on imports and exports due to the sluggish recovery in global growth.

The key manufacturing sector has been struggling for months in the face of sagging world demand for Chinese products and excess industrial capacity left over from the country's infrastructure boom.

"This might be as good as it gets," HSBC Holdings economic researcher Frederic Neumann told Bloomberg.

"A generous stimulus injected earlier this year is still winding itself through the economy," he added, and with the government now "tapping the brakes" in the property sector "growth will likely cool again in the coming months".

China is a vital driver of global growth, but its economy expanded only 6.9 percent in 2015 -- its weakest rate in a quarter of a century -- and has slowed further this year.

Beijing has said it wants to reorient the economy away from relying on debt-fuelled investment to boost growth and towards a consumer-driven model, but the transition has proven challenging.

rld/slb/amj

<org idsrc="isin" value="GB0005405286">HSBC</org>

Bisnis.com, JAKARTA – Pasar properti China menunjukkan tanda-tanda pendinginan sementara, sejalan dengan upaya pihak otoritas meningkatkan langkah batasan pembelian rumah demi menghindari gelembung perumahan (housing bubble).

Berdasarkan laporan Biro Statistik Nasional China (National Bureau of Statistics), seperti dikutip Bloomberg (Jumat, 21/10/2016), harga rumah baru – selain rumah subsidi pemerintah – naik di 63 dari 70 kota yang terdaftar oleh pemerintah pada September.

Angka tersebut turun dari 64 kota pada Agustus. Adapun, enam kota lainnya mencatatkan penurunan harga dan satu kota tidak mengalami perubahan.

Dalam pernyataannya, biro statisktik tersebut menjelaskan pasar real estate sepertinya mendingin pada Oktober akibat penerapan langkah batasan di kota-kota lapis pertama dan kedua.

Harga rumah baru di Shenzhen, pasar properti terpanas China, turun 0,3% pada pertengahan Oktober dibandingkan dengan sebulan sebelumnya. Sementara itu, harga rumah di kota lainnya turun di kisaran 1%-3,8%.

Pemerintah lokal sebelumnya telah memperkenalkan langkah batasan properti di setidaknya 21 kota, di antaranya melalui syarat down payment yang lebih besar serta pembatasan pembelian hunian untuk menurunkan harga.

“Pembatasan tersebut hanya bertujuan untuk menahan kepanikan dalam pembelian rumah serta membendung gelembung, alih-alih mengungkung pasar properti. Kemungkinan adanya penurunan harga rumah itu rendah,” ujar Wang Tao, Kepala Ekonom China UBS Group AG.

Bisnis.com, BEIJING – Pertumbuhan ekonomi China kuartal ketiga berada pada posisi yang stabil, memastikan target pertumbuhan pemerintah setahun penuh akan terpenuhi dan membuka jalan beralihnya kebijakan untuk menahan risiko finansial.

Seperti dilansir Bloomberg hari ini (Rabu, 19/10/2016), produk domestik bruto (PDB) China naik 6,7% pada kuartal ketiga dibandingkan setahun sebelumnya.

Angka tersebut sesuai dengan prediksi para Ekonom dalam survei Bloomberg serta berada di tengah-tengah target pemerintah 2016 dengan pertumbuhan di kisaran 6,5%-7%.

Industri jasa menopang ekspansi pada tiga kuartal pertama dengan pertumbuhan sektor tersebut sebesar 7,6%.

Kondisi stabil tersebut memberi ruang bagi kebijakan pemerintah yang ditujukan untuk menahan pinjaman yang membengkak serta membatasi risiko finansial berlebihan.

"Mengagumkan melihat gelembung perumahan (housing bubble) dan kenaikan utang dapat tercapai,” ujar Michael Every, Kepala riset pasar finansial Rabobank.

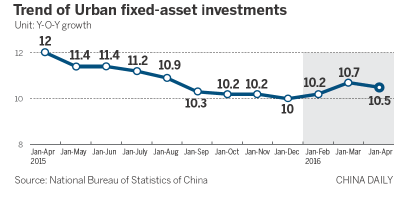

Di sisi lain, produksi industri dilaporkan naik 6,1% pada September dibandingkan dengan setahun sebelumnya atau lebih kecil dari proyeksi para analis dengan kenaikan sebesar 6,4%. Sementara itu, tingkat penjualan ritel naik 10,7% bulan lalu dan investasi aset tetap naik 8,2% pada sembilan bulan pertama.

Pertumbuhan Ekonomi China 2016

Periode

|

Persen

|

Kuartal III

|

6,7

|

Kuartal II

|

6,7

|

Kuartal I

|

6,7

|

Sumber: Bloomberg

Pertumbuhan ekonomi Tiongkok diperkirakan mantap di posisi 6,7 persen di kuartal III-2016 dengan didorong oleh belanja pemerintah dan hiruk-pikuk laju bisnis sektor perumahan. Namun, kondisi itu akan dibarengi dengan investasi swasta yang menurun, utang bergelombang, dan adanya risiko koreksi sektor properti.

Data yang dirilis pada Rabu diharapkan bisa memberikan gambaran mengenai perekonomian Tiongkok yang secara perlahan mulai bergerak stabil tapi ketergantungan semakin besar terhadap belanja pemerintah dan pertumbuhan bisnis di sektor perumahan. Hal itu diperkirakan terjadi lantaran kinerja ekspor tetap perlu ditingkatkan lagi.

Pemimpin Tiongkok mencoba untuk memacu pertumbuhan dengan menciptakan lapangan pekerjaan, tapi juga dihadapkan pada tekanan untuk mendorong reformasi struktural yang memberi tekanan karena harus memotong kelebihan kapasitas industri. Kondisi itu akan menjadi momok dan meningkatkan Pemutusan Hubungan Kerja (PHK) serta gagal bayar utang.

Ekonom percaya risiko jangka pendek terbesar adalah kemungkinan koreksi di pasar properti yang terbilang tinggi yang menyumbang sekitar 15 persen terhadap Produk Domestik Bruto (PDB). Gelombang pembatasan pembelian rumah yang dikenakan pada pembeli di kota-kota besar dalam beberapa pekan terakhir telah mengakibatkan penurunan tajam dalam penjualan.

Tekanan pertumbuhan bisa berdampak terhadap nilai bisnis setelah langkah-langkah pengetatan properti baru-baru ini diumumkan. Pertumbuhan jangka pendek juga akan cenderung berada di bawah tekanan karena penurunan pertumbuhan kredit berdampak ke penurunan belanja," kata Analis di DBS Group Singapura, seperti dikutip dari Reuters, Rabu (19/10/2016).

Pemerintah Tiongkok berjanji untuk mengurangi utang yang penuh dengan risiko. Namun, situasi itu akan memperlambat kegiatan ekonomi Tiongkok dalam jangka waktu pendek. Hal semacam ini tentu perlu diperhatikan lantaran perlambatan ekonomi Tiongkok memberi pengaruh terhadap ekonomi dunia.

Perdana Menteri Tiongkok Li Keqiang mengatakan pekan lalu bahwa ekonomi bergerak lebih baik dari yang diharapkan di kuartal III-2016 karena terjadinya rebound pada output pabrik, keuntungan perusahaan dan laju investasi, serta adanya risiko utang yang terkendali.

Namun demikian, perkiraan untuk kuartal III-2016 dinilai masih mendekati level terlemah sejak krisis global, menurut 58 ekonom yang disurvei oleh ekonom. Kondisi itu diperkirakan akan tertap terjadi meski ada perbaikan diberbagai macam aspek dan diharapkan terjadi pada output pabrik dan investasi.

Sumber : METROTVNEWS.COM

SYDNEY. Pasar saham Asia mengawali perdagangan di zona hijau setelah rentetan data memperlihatkan ekonomi China mulai stabil ditunjang oleh pengeluaran pemerintah dan pasar perumahan yang menguat. Meski demikian, kekhawatiran utang terus meningkat.

Pasar saham Shanghai SSEC naik tipis 0,2 persen. Indeks MSCI dari pasar saham Asia Pasifik di luar Jepang, .MIAPJ0000PUS, menguat 0,4 persen dengan kenaikan tertingginya mencapai 1,4 persen. Sementara pasar saham Australia menguat 0,3 persen dan pasar saham Jepang Nikkei N225 naik 0,17 persen.

Produk domestik bruto (PDB) China tercatat mengalami pertumbuhan 6,7 persen YOY pada September, persis seperti yang diperkirakan para analis. Investasi swasta tetap tinggi dengan pengeluaran pemerintah dan properti yang mendorong laju ekonomi China.

Data lainnya menunjukkan penjualan ritel naik 10,7 persen dan investasi di perkotaan tumbuh 8,2 persen. Meski demikian, produksi industri hanya tumbuh 6,1 persen.

Di sisi lain, data menunjukkan bank-bank China mencatatkan pertumbuhan pinjaman baru mencapai 1,22 triliun yuan atau sekira USD181 triliun pada September, rekor pinjaman sembilan bulan tertinggi.

Sebagian besar pertumbuhan didorong oleh pasar perumahan booming, oleh karena itu pemerintah berusaha untuk menekan pertumbuhan tersebut tanpa memicu kejatuhan harga properti.

http://economy.okezone.com/read/2016/10/19/278/1518537/data-china-positif-pasar-saham-asia-dibuka-melonjak

Sumber : OKEZONE.COM

bloomberg: Emerging-market stocks and currencies rose for a second day as Chinese economic growth met estimates and on signs U.S. monetary policy will remain accommodative.

South Korea’s won headed for its biggest two-day gain in almost a month as China reported 6.7 percent expansion in the third quarter, the same as in the previous two periods. The Taiwan dollar rose the most in five weeks. The Shanghai Composite Index increased, while the Hang Seng China Enterprises Index of mainland companies listed in Hong Kong declined.

The China data comes as a gauge of the dollar heads for its worst week in almost a month. The release of mixed U.S. manufacturing data on Monday and then consumer prices excluding food and fuel costs that rose less than forecast on Tuesday are spurring speculation that even if the Federal Reserve raises interest rates this year, its monetary policy will remain accommodative.

“China’s economy is showing further signs of stabilizing,” said Michael McCarthy, chief market strategist at CMC Markets in Sydney. “The slightly weaker read on industrial production is offset modestly by slightly better retail sales.”

Chinese factory production rose 6.1 percent in September from a year earlier, less than the 6.4 percent median estimate in a Bloomberg survey. Retail sales increased 10.4 percent year-to-date, compared with analysts’ forecasts for 10.3 percent.

The MSCI Emerging Markets Index rose 0.4 percent as of 10:30 a.m. in Hong Kong. The MSCI Emerging Markets Currency Index climbed 0.3 percent. The Bloomberg Dollar Spot Index, which measures the greenback against 10 peers, fell 0.1 percent and is down 0.5 percent this week. There’s a 63 percent chance the Fed will raise interest rates by December, futures contracts showed Tuesday, down from 66 percent at the end of last week.

Beijing, Oct 13, 2016 (AFP)

China's exports plummeted 10.0 percent year-on-year to $184.5 billion in September, government data showed Thursday, as anemic global demand weighed on the world's second-largest economy.

Imports fell 1.9 percent on-year to $142.5 billion, Customs said, and the trade surplus declined to $42.0 billion.

Kinerja ekonomi Tiongkok tercatat lebih baik dari yang diharapkan pada kuartal III-2016 dan utang pemerintah terkendali. Pemerintah Tiongkok siap menjaga kondisi tersebut dan diharapkan bisa terus mengalami perbaikan di masa-masa yang akan datang.

"Momentum pertumbuhan ekonomi Tiongkok di kuartal III-2016 tidak hanya terjadi pada semester pertama tapi juga menunjukkan banyak perubahan positif. Bahkan, indikator ekonomi utama seperti output pabrik, keuntungan dan investasi telah pulih," kata Perdana Menteri Tiongkok Li Keqiang, seperti dikutip dari Reuters, Selasa (11/10/2016).

Lebih dari 10 juta pekerjaan urban baru diciptakan dalam sembilan bulan pertama, dengan tingkat pengangguran jatuh di bawah lima persen pada September. Namun demikian, Li menegaskan, perekonomian Tiongkok masih dihadapkan pada beberapa persoalan dan tekanan.

"Tiongkok akan mampu mencapai target ekonomi utama tahun ini dan mempertahankan kecepatan pertumbuhan yang menengah dan tinggi," tuturnya.

Pemerintah Tiongkok menargetkan pertumbuhan ekonomi secara tahunan sekitar 6,5-7 persen pada 2016, dibandingkan dengan pencapaian pertumbuhan ekonomi Tiongkok di angka 6,9 persen pada 2015, ekspansi paling lambat dalam seperempat abad.

Ekonomi tumbuh 6,7 persen pada semester pertama, didukung oleh belanja infrastruktur pemerintah yang lebih tinggi dan booming perumahan. Biro Nasional Statistik akan mempublikasikan data ekonomi kuartal ketiga pada 19 Oktober.

Li mengatakan, pemerintah akan mengambil langkah-langkah efektif untuk menjamin pembangunan yang stabil dan sehat dari pasar properti, dan akan memperkuat kebijakan real estate berdasarkan tata kota.

"Lebih dari selusin kota dan kabupaten telah memperketat pembatasan pembelian properti dalam beberapa pekan terakhir untuk mendinginkan pasar real estat yang semakin 'panas'," pungkas Li.

http://ekonomi.metrotvnews.com/globals/yNL8aVqN-ekonomi-tiongkok-membaik-utang-terkendali

Sumber : METROTVNEWS.COM

Jakarta detik - Ekonomi global masih dalam kondisi pemulihan pada beberapa waktu terakhir. Ada optimisme yang muncul, akan tetapi ketika periode tersebut berjalan, realisasinya selalu tidak sesuai ekspektasi.

Deputi Gubernur Senior Bank Indonesia (BI) Mirza Adityaswara menyatakan, untuk memproyeksikan ekonomi dunia, sebenarnya hanya perlu memperhatikan China. Baik buruknya kondisi China sangat besar pengaruhnya terhadap ekonomi dunia.

"Jadi kalau bicara prospek ekonomi dunia, maka lihatlah China," ungkap Mirza dalam seminar terkait prospek ekonomi Indonesia di Kantor Pusat BI, Jakarta, Kamis (6/10/2016).

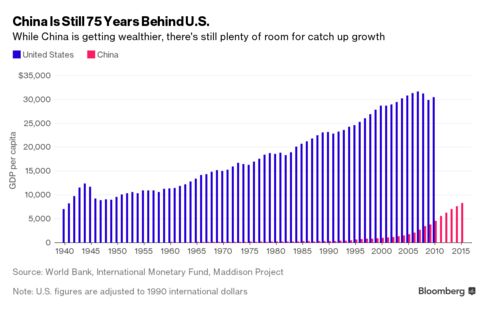

China memang menjadi negara dengan ekonomi terbesar kedua di dunia, setelah Amerika Serikat (AS). Dalam dua dekade terakhir, China bahkan menjadi pemasok dan penampung barang terbesar terhadap banyak negara di dunia.

Ketika China tumbuh pada kisaran 10-12%, maka banyak negara lain juga ikut merasakan keuntungannya. Terutama untuk negara berbasis komoditas seperti Indonesia yang sangat kaya dengan hasil perkebunan dan pertambangan. Namun ketika China melambat, maka negara lain juga mengikuti.

"Kondisinya sekarang China masih lambat. China dulu 10-12%, sekarang kita berbicara China hanya 6,3-6,5%. Ini mempengaruhi harga komoditas tambang dan perkebunan," paparnya.

China menjadi patokan, menurut Mirza, juga disebabkan oleh kondisi negara maju lainnya juga belum juga pulih. Sebut saja Amerika Serikat (AS), Uni Eropa dan Jepang yang sekarang masih berupaya keras untuk tumbuh.

"Ekonomi AS, Eropa, Jepang belum jalan. Makanya global itu ekonominya tidak sesuai dengan harapan," imbuhnya.

Pengaruh ke Indonesia

Kaitan antara Indonesia dan China sangat kuat dari sisi ekonomi. Indonesia yang bergantung dengan hasil sumber daya alam di sektor perkebunan dan pertambangan harus mengalami perlambatan ekonomi mengikuti China. Ini terjadi pada periode 2013-2015.

"Ekonomi kita sangat bergantung pada harga komoditas," tegas Mirza.

Sumatera dan Kalimantan terkena dampak paling besar. Sumatera sebagai pemegang porsi 22% dari total perekonomian nasional tumbuh sangat kecil, Kalimantan dengan porsi 12% justru bahkan negatif. Hal ini karena kedua wilayah merupakan penghasil sumber daya alam tersebut.

"Kedua wilayah itu kan isinya CPO (Crude Palm Oil), karet, batu bara hanya harganya anjlok sejak beberapa tahun lalu," tandasnya. (mkl/drk)

Deputi Gubernur Senior Bank Indonesia (BI) Mirza Adityaswara menyatakan, untuk memproyeksikan ekonomi dunia, sebenarnya hanya perlu memperhatikan China. Baik buruknya kondisi China sangat besar pengaruhnya terhadap ekonomi dunia.

"Jadi kalau bicara prospek ekonomi dunia, maka lihatlah China," ungkap Mirza dalam seminar terkait prospek ekonomi Indonesia di Kantor Pusat BI, Jakarta, Kamis (6/10/2016).

China memang menjadi negara dengan ekonomi terbesar kedua di dunia, setelah Amerika Serikat (AS). Dalam dua dekade terakhir, China bahkan menjadi pemasok dan penampung barang terbesar terhadap banyak negara di dunia.

Ketika China tumbuh pada kisaran 10-12%, maka banyak negara lain juga ikut merasakan keuntungannya. Terutama untuk negara berbasis komoditas seperti Indonesia yang sangat kaya dengan hasil perkebunan dan pertambangan. Namun ketika China melambat, maka negara lain juga mengikuti.

"Kondisinya sekarang China masih lambat. China dulu 10-12%, sekarang kita berbicara China hanya 6,3-6,5%. Ini mempengaruhi harga komoditas tambang dan perkebunan," paparnya.

China menjadi patokan, menurut Mirza, juga disebabkan oleh kondisi negara maju lainnya juga belum juga pulih. Sebut saja Amerika Serikat (AS), Uni Eropa dan Jepang yang sekarang masih berupaya keras untuk tumbuh.

"Ekonomi AS, Eropa, Jepang belum jalan. Makanya global itu ekonominya tidak sesuai dengan harapan," imbuhnya.

Pengaruh ke Indonesia

Kaitan antara Indonesia dan China sangat kuat dari sisi ekonomi. Indonesia yang bergantung dengan hasil sumber daya alam di sektor perkebunan dan pertambangan harus mengalami perlambatan ekonomi mengikuti China. Ini terjadi pada periode 2013-2015.

"Ekonomi kita sangat bergantung pada harga komoditas," tegas Mirza.

Sumatera dan Kalimantan terkena dampak paling besar. Sumatera sebagai pemegang porsi 22% dari total perekonomian nasional tumbuh sangat kecil, Kalimantan dengan porsi 12% justru bahkan negatif. Hal ini karena kedua wilayah merupakan penghasil sumber daya alam tersebut.

"Kedua wilayah itu kan isinya CPO (Crude Palm Oil), karet, batu bara hanya harganya anjlok sejak beberapa tahun lalu," tandasnya. (mkl/drk)

Bisnis.com, JAKARTA– Laba di sektor industri China meningkat pada Agustus dalam laju tercepat dalam tiga tahun terakhir, mendukung pandangan yang berkembang bahwa ekonomi negara ini mulai stabil.

Berdasarkan data Biro Statistik Nasionoal China yang dikutip Reuters Selasa, laba perusahaan industri melonjak 19,5% dari tahun sebelumnya menjadi 534,8 miliar yuan (US$80 miliar).

Biro statistik menyatakan baja, penyulingan minyak dan industri otomotif menjadi pendorong utama lonjakan laba tersebut Data ini mencakup perusahaan-perusahaan dengan pendapatan tahunan lebih dari 20 juta yuan.

Sementara itu, dalam rilis data yang sama, laba manufaktur naik 14,1% dari tahun sebelumnya, sementara laba industri pertambangan turun 70,9%.

Ekonomi China tumbuh 6,9% tahun lalu, paling lambat dalam 25 tahun terakhir menyusul surutnya permintaan global. Namun, ekonomi telah menunjukkan beberapa tanda-tanda stabilisasi dalam beberapa bulan terakhir setelah pemerintah menggelontorkan miliaran dolar dan booming properti di kota-kota besar China.

"Pertumbuhan produk domestik bruto pada kuartal ketiga dapat lebih cepat daripada kuartal pertama atau kedua, di kisaran 6,7-6,8%," kata Liao Qun, kepala ekonom Citic Bank Internasional, seperti dikutip Bloomberg.

Ia melanjutkan, pergerakan pemerintah untuk lebih banyak upaya di kuartal keempat untuk merangsang ekonomi masih dinanti.

Bank sentral China telah menahan untuk melonggarkan kredit lebih lanjut menyusul kekhawatiran adanya bubble di sektor perumahan dan pasar keuangan serta arus keluar modal.

"Momentum pertumbuhan China telah stabil, didukung oleh kinerja yang kuat dari pasar perumahan," tulis ANZ dalam catatan pada hari Selasa.

Sejalan dengan membaiknya prospek ekonomi, Asian Development Bank hari ini menaikkan proyeksi pertumbuhan China untuk tahun ini menjadi 6,6% dari estimasi terakhirnya 6,5%.

bloomberg: China’s economy is showing fresh signs of strength, from increased business confidence to an expansionary factory gauge reading, according to the earliest private indicators for September.

Most private gauges showed improvement and a proxy for factory activity jumped to the strongest level in almost two years, suggesting better readings in August data have been followed up this month.

A steady flow of credit has boosted property sales, helping offset sluggish exports and continued weakness in private investment.

Here’s what those first indicators show:

SME Confidence

Standard Chartered Plc’s Small and Medium Enterprises Confidence Index rose to 56 this month from 54.9 in August. Sales and production recovered from weather-related disruptions, even as the investment appetite remained muted, Shen Lan, a Beijing-based China economist, wrote in a report. "Expectations relating to total financing, investment and employment weakened, indicating that SMEs’ confidence has not fully recovered," Shen said.

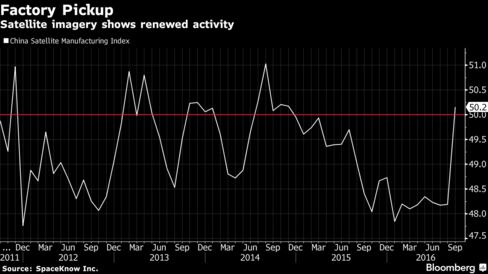

Satellite View

The China Satellite Manufacturing Index jumped to 50.2 in the first weeks of September, according to according to San Francisco-based SpaceKnow Inc., which uses algorithms and commercial satellite imagery to analyze thousands of industrial facilities. That’s the first reading above 50 since November 2014. Like the official manufacturing purchasing managers index, readings above 50 indicate expansion.

The official PMI probably held steady this month at 50.4, according to economist estimates in a Bloomberg survey. That would match the September reading, which was the highest in almost two years. The report is due for release Oct. 1.

Upbeat Executives

Business leaders are more optimistic. The Market News International China Business Sentiment Indicator surged to a 13-month high of 55.8 from a revised 54.1 in August as new orders helped to offset a softening in output. The indicator is based on a survey of executives of companies listed on the Shanghai and Shenzhen stock exchanges.

“The Chinese economy will likely end Q3 on a fairly strong note, with growth holding up in both manufacturing and services," Andy Wu, a senior economist at MNI Indicators, wrote in the report. "While the outlook remains challenging, our forward-looking activity indicators suggest that growth momentum is likely to continue into the final quarter of the year, supported by a continuation of policy easing.”

Sales Managers

An index by London-based research firm World Economics Ltd. was little changed at 51.3 in September. Services continue to be a growth engine, widening a lead over manufacturing. Business confidence remains low in comparison with previous years, and sales growth reflects continuing but modest growth, Chief Executive Ed Jones wrote in a statement.

Steel Outlook

The S&P Global Platts China Steel Sentiment Index climbed to 74.43, the second highest reading this year, from 62.68 in August. The gauge is based on a survey of about 70 to 85 China-based market participants including traders and steel mills.

Still, the steel outlook remains uncertain as surging property prices across China’s biggest cities may portend more local governments will roll out curbs on new home-buying.

"The market is definitely reacting to some potential tightening of funding and liquidity in the property sector, particularly in Tier 2 cities, to try and avoid the market overheating," said Paul Bartholomew, a senior managing editor for steel and raw materials at S&P Global Platts in Melbourne. "Many investors expect this to have a dampening impact" on demand, he said.

— With assistance by Miao Han

WASHINGTON kontan. Dua raksasa ekonomi terbesar dunia, yakni Amerika Serikat (AS) dan China menunjukkan tanda-tanda pemulihan. Hal itu diperoleh dari data-data ekonomi terbaru kedua negara yang membawa hasil positif.

Dari AS, data terbaru yang dirilis soal pendapatan rumah tangga. Biro sensus AS menyebutkan, rata-rata pendapatan rumah tangga AS pada akhir 2015 naik sebesar 5,2% menjadi US$ 56.500 per tahun. Ini merupakan jumlah terbesar sejak tahun 2007 silam.

Pertumbuhan tersebut juga menjadi yang tertinggi, sejak survei pendapatan rumah tangga mulai dilakukan pada 1968 silam. "Ini terjadi hampir pada setiap kolompok umur rumah tangga dan hampir semua golongan ras," tutur Trudi Renwick, Asisten Kepala divisi Biro Sensus AS, seperti dikutip Reuters, Rabu (14/9).

Chris Christioper, Kepala Ekonom IHS Global mengatakan, pertumbuhan pendapatan rumah tangga AS akan terus meningkat, seiring tingkat pekerjaan yang lebih baik dan inflasi terkendali. Adapun tingkat pengangguran telah jauh menurun menjadi 4,9% pada Agustus 2016, bila dibandingkan posisi Oktober 2009 silam yang sebesar 10%.

Peningkatan pendapatan rumah tangga itu pun berhasil memangkas jumlah orang miskin sebanyak 3,5 juta menjadi 43,1 juta pada akhir 2015. Sehingga, tingkat kemiskinan kini berada di level 13,5% dari posisi akhir tahun 2014 di level 14,8%.

Sebagai gambaran, pada tahun 2010 lalu tingkat kemiskinan mencapai 17%. Jumlah orang yang tidak memiliki asuransi di AS juga menurun menjadi 29 juta dari sebelumnya 33 juta. Kini, hampir 91% memperoleh perlindungan asuransi kesehatan, dari akhir tahun 2014 yang hanya sebanyak 89,6%.

Kabar positif lain datang dari China. Seperti diberitakan Shanghaidaily.com, Selasa (13/9), mengutip data biro statistik China, produksi industri di Negeri Tembok Besar pada bulan Agustus 2016 naik 6,3%, tercepat sejak lima bulan terakhir. Angka ini lebih tinggi dari ekspektasi ekonom di level 6,2%.

"Data menunjukkan bahwa risiko downside dari PDB di kuartal III telah berkurang secara signifikan," terang Louis Lam dan David Qu, analis dari ANZ Group seperti diberitakan Shanghaidaily.com.

Penjualan ritel, sebagai tolak ukur kekuatan belanja konsumen di China, meningkat 10,6%, setelah pada bulan Juli juga tumbuh 10,3%. "Perekonomian nasional telah mencapai perkembangan yang moderat dan stabil," imbuh Louis Lam dan David Qu dalam analisisnya.

Namun, keduanya mengingatkan, kondisi internal dan eksternal China sejatinya masih penuh ketidakpastian. China sendiri kini telah berupaya keluar dari ketergantungan dari hasil investasi dan ekspor. China berusaha membenahi struktur perekonomiannya dengan cara melakukan reformasi struktural dan pemangkasan kelebihan produksi perusahaan BUMN.

China's imports rose 1.5 percent year-on-year in August, Customs said Thursday, the first rise in 22 months and beating expectations in a positive sign for the world's second-largest economy.

Exports dropped 2.8 percent on-year to $190.6 billion, Customs said, also beating the median forecast in a survey of economists by Bloomberg News. The trade surplus fell 13.6 percent from last year to $52.0 billion.

Beijing, Sept 1, 2016 (AFP)

Increases in new home prices in China picked up in August from a month ago, a survey showed Thursday, raising worries of further rises in major cities.

The average price for new homes in 100 major cities gained 2.17 percent month-on-month in August to 12,270 yuan ($1,837) per square metre, the China Index Academy (CIA) said in a statement.

It accelerated from a rise of 1.63 percent in July.

Real estate is a key sector for China's economy, the world's second largest and a vital driver of global growth.

Beset by property market problems, a sluggish manufacturing sector and mounting debt, China's economy is growing at its slowest rate in a quarter of a century, and concerns about its health have roiled global markets.

Authorities have introduced several policies to try to revitalise the property sector, including reducing minimum downpayment requirements, cutting transaction taxes and providing incentives for migrant workers to buy homes.

The policy loosening led prices in some big cities to rise this year as pent-up demand was unleashed. But at the same time the country has a huge inventory of unsold new homes, mostly in third- and fourth-tier cities.

The government has vowed to take "specialised" measures to tackle diverging trends in different regions.

Cities in richer regions including the Yangtze River Delta and Pearl River Delta led the increase in August, while others stimulated buying by loosening mortgage policies or handing out subsidies, the CIA said.

"Both market supply and demand are expected to continue to go up" as the peak sales season comes in September and October, "hopefully leading to a sustained increasing trend in the average (new) home prices", it said.

Land prices in first- and second-tier cities have been hitting new highs, it said, adding: "More cities may impose tightening policies in future."

Some places including the commercial hub Shanghai have introduced or hinted at policies to tighten the market after property and land prices surged in their localities.

Year-on-year, new home prices in China rose 13.75 percent last month, up from an increase of 12.39 percent in July, the CIA said.

wf/bfc/dan

<org idsrc="isin" value="JP3153300003">INDEX CORP.</org>

Bisnis.com, BEIJING – Indeks manufaktur China secara tidak terduga naik ke level tertinggi dalam hampir dua tahun pada bulan lalu. Hal ini menunjukkan stabilitas ekonomi yang tetap utuh serta bahwa penurunan pada Juli hanya sementara.

Seperti dilansir Bloomberg hari ini (Kamis, 1/9/2016), indeks manufaktur China naik ke posisi 50,4 untuk Agustus 2016 dari sebelumnya di posisi 49,9 pada Juli. Kenaikan indeks manufaktur China pada Agustus melampaui prediksi rata-rata para ekonom dalam survey Bloomberg.

Sementara itu, indeks non-manufaktur berada di posisi 53,5 setelah mencapai 53,9 pada Juli.

Di sisi lain, indeks manufaktur China dari Caixin Media dan Markit Economics turun ke posisi 50 pada Agustus dari 50.6 pada bulan sebelumnya.

Seperti dilansir Bloomberg hari ini, rebound pada Agustus memberi ruang bagi para pembuat kebijakan untuk mendorong penerapan reformasi dalam perusahaan-perusahaan milik negara serta pemangkasan kelebihan kapasitas pada sektor penting seperti baja dan batu bara.

"Peningkatan tersebut cukup menggembirakan, terutama mengingat restrukturisai yang signifikan serta pemangkasan kapasitas yang dilakukan di beberapa sektor utama seperti produksi baja,” kata Rajiv Biswas, Ekonom IHS Markit untuk kawasan Asia-Pasifik.

Di antara komponen pada indeks manufaktur, data pesanan baru, kuantitas pembelian, dan harga input menopang rebound indeks manufaktur pada Agustus.

Menurut Biro Statistik Nasional China seiring rilis data tersebut, tingkat permintaan membaik, perusahaan mulai melakukan pengisian kembali, serta kepercayaan korporasi meningkat.

China’s official factory gauge unexpectedly rose last month to the highest level in almost two years, suggesting the economy’s stabilization remains intact and that a weakening in July was flood-related and temporary.

Key Points

- Manufacturing purchasing managers index rose to 50.4 in August from July’s 49.9 and compared to the 49.8 median estimate of economists surveyed by Bloomberg.

- Non-manufacturing PMI stood at 53.5 compared with 53.9 in July

- Numbers above 50 indicate improving conditions.

Big Picture

Floods across southeastern regions responsible for about a fifth of China’s economic output interrupted production in the summer. The rebound in August gives policy makers breathing space to push ahead with reforms of state-owned firms and cutbacks in overcapacity sectors such as coal and steel. The Australian dollar -- seen as a proxy to China’s economy because of its shipments of raw materials -- climbed.

Economist Takeaways"Underlying demand continues to stabilize, suggesting that the expansionary fiscal policy stance adopted since early this year is still supporting growth," said Julia Wang, an economist with HSBC Holdings Plc. in Hong Kong. "The economy, however still faces some downside risks as the recovery remains fairly uneven at this stage with growth being driven mostly by large companies involved in helping the fiscal expansion."

“August is the beginning month of China’s manufacturing peak season, and we expect the official PMI will go higher in the coming months,” said Iris Pang, senior Greater China economist at Natixis SA in Hong Kong. “High-tech and consumer goods are doing well. It’s a positive sign that China’s manufacturing is changing from the low-value added end to the higher one.”

The Details

- Measures of new orders, purchases quantity and input prices paced the PMI rebound.

- But the gains weren’t shared equally, with large enterprises reporting improved conditions even as medium and small firms deteriorated, the data showed.

- Demand is recovering, companies starting to restock and corporate confidence is climbing, the National Bureau of Statistics said in a statement released with the data.

- Difficulties remain as downward pressure on trade is still significant due to lackluster global growth and companies still face high financing, labor and transportation costs, the statistics agency said.

— With assistance by Xiaoqing Pi

per JULI 2016, secara teknikal, tren INDEKS BURSA SAHAM SHANGHAI n AMRIK menunjukkan TANDA-TANDA PEMULIHAN EKONOMI GLOBAL, walo lom meyakinken :

Lembaga-lembaga keuangan Tiongkok menerima 1,826 miliar yuan (274 juta dolar AS) investasi asing langsung (FDI) bersih pada kuartal kedua 2016, regulator valuta asing mengatakan pada Selasa.

Angka ini lebih rendah dari 3,501 miliar yuan FDI bersih yang diterima pada kuartal pertama tahun ini, menurut State Administration of Foreign Exchange (SAFE), lembaga yang bertugas mengatur pasar valuta asing.

Investasi langsung bersih di luar negeri dari lembaga-lembaga keuangan Tiongkok, termasuk bank, perusahaan asuransi dan perusahaan sekuritas, mencapai 37,918 miliar yuan di kuartal kedua 2016, lebih tinggi dari 11,614 miliar yuan di kuartal pertama.

SAFE telah merilis data secara triwulanan sejak 2012 untuk meningkatkan transparansi statistik valuta asing.

Perekonomian Tiongkok tetap stabil di 6,7 persen pada kuartal kedua tahun ini, tingkat kuartalan terendah sejak hari-hari gelap krisis keuangan global pada awal 2009 namun masih dalam kisaran target pemerintah 6,5-7,0 persen untuk 2016. (Ant)

Bisnis.com, JAKARTA– Pergerakan harga tembaga kontrak September 2016 terpantau melemah pada perdagangan siang ini, Selasa (9/8/2016), di tengah menurunnya inflasi di China pada Juli yang menyoroti kekhawatiran tentang kesehatan pengguna tembaga terbesar di dunia tersebut pasca pelemahan impor bulan lalu.

Harga tembaga melemah 0,88% atau 1,90 poin ke US$214,60 per pound pada pukul 14.39 WIB setelah dibuka turun 0,12% atau 0,25 poin di posisi US$216,25 per pound pagi tadi.

Seperti dilansir Reuters hari ini, inflasi di China tumbuh 1,8% pada Juli dibanding setahun sebelumnya namun sedikit turun dari 1,9% pada Juni.

Angka ekspor dan impor China pada Juli turun lebih dalam dari yang diperkirakan, menunjukkan pelemahan lebih lanjut dalam permintaan global sebagai dampak dari keputusan Inggris berpisah dari Uni Eropa.

Sementara impor tembaga China turun 14%.

“Kombinasi persediaan yang tinggi dan permintaan musiman yang lemah menyebabkan permintaan impor cenderung terus biasa saja selama beberapa bulan ke depan,” papar ANZ dalam risetnya.

Di sisi lain, tren penguatan dolar AS akibat meningkatnya prediksi penaikan suku bunga oleh The Fed pasca rilis data tenaga kerja AS yang menunjukkan peningkatan juga berpotensi mengurangi permintaan.

Indeks dolar yang mengukur pergerakan dolar AS terhadap sejumlah mata uang utama siang ini terpantau berbalik naik 0,06% atau 0,059 poin ke 96,460 pada pukul 14.40 WIB meski sempat bergerak negatif di awal dagang.

Berbanding terbalik dengan tembaga, pergerakan harga nikel dan timah di Shanghai Futures Echange terpantau lanjut bergerak positif pada perdagangan hari ini. Harga nikel untuk kontrak Januari 2017 kembali ditutup menguat 0,44% atau 370 poin ke 84.070 yuan/metrik ton.

Tindakan keras oleh pemerintah Filipina tehadap tambang nikel di negara tersebut yang telah mendorong kenaikan harga lebih dari 20% selama dua bulan terakhir dapat menyebabkan lonjakan harga, menurut Standard Chartered dalam laporannya.

Sementara harga timah kontrak September 2016 berakhir menguat 0,70% atau 850 poin ke 121.640 yuan/metrik ton setelah dibuka dengan kenaikan 0,42% atau 510 poin ke level 121.300.

Pergerakan tembaga di Comex (Commodity Exchange) untuk kontrak September 2016:

Tanggal

Level

Perubahan

9/8/2016

(Pk. 14.39 WIB)

214,60

-0,88%

8/8/2016

216,50

+0,51%

5/8/2016

215,40

-0,92%

4/8/2016

217,40

-1,11%

3/8/2016

219,85

-0,48%

Sumber: Bloomberg

Lembaga-lembaga keuangan Tiongkok menerima 1,826 miliar yuan (274 juta dolar AS) investasi asing langsung (FDI) bersih pada kuartal kedua 2016, regulator valuta asing mengatakan pada Selasa.

Angka ini lebih rendah dari 3,501 miliar yuan FDI bersih yang diterima pada kuartal pertama tahun ini, menurut State Administration of Foreign Exchange (SAFE), lembaga yang bertugas mengatur pasar valuta asing.

Investasi langsung bersih di luar negeri dari lembaga-lembaga keuangan Tiongkok, termasuk bank, perusahaan asuransi dan perusahaan sekuritas, mencapai 37,918 miliar yuan di kuartal kedua 2016, lebih tinggi dari 11,614 miliar yuan di kuartal pertama.

SAFE telah merilis data secara triwulanan sejak 2012 untuk meningkatkan transparansi statistik valuta asing.

Perekonomian Tiongkok tetap stabil di 6,7 persen pada kuartal kedua tahun ini, tingkat kuartalan terendah sejak hari-hari gelap krisis keuangan global pada awal 2009 namun masih dalam kisaran target pemerintah 6,5-7,0 persen untuk 2016. (Ant)

Investasi langsung bersih di luar negeri dari lembaga-lembaga keuangan Tiongkok, termasuk bank, perusahaan asuransi dan perusahaan sekuritas, mencapai 37,918 miliar yuan di kuartal kedua 2016, lebih tinggi dari 11,614 miliar yuan di kuartal pertama.

SAFE telah merilis data secara triwulanan sejak 2012 untuk meningkatkan transparansi statistik valuta asing.

Perekonomian Tiongkok tetap stabil di 6,7 persen pada kuartal kedua tahun ini, tingkat kuartalan terendah sejak hari-hari gelap krisis keuangan global pada awal 2009 namun masih dalam kisaran target pemerintah 6,5-7,0 persen untuk 2016. (Ant)

Tanggal

Level

Perubahan

9/8/2016

(Pk. 14.39 WIB)

214,60

-0,88%

8/8/2016

216,50

+0,51%

5/8/2016

215,40

-0,92%

4/8/2016

217,40

-1,11%

3/8/2016

219,85

-0,48%

trading economics: China Balance of Trade 1983-2016 | Data | Chart | Calendar | Forecast

China reported a USD 52.31 billion trade surplus in July of 2016, compared to a USD 41.87 billion surplus a year earlier and beating market estimates. It was the largest trade surplus since January as exports fell much less than imports. In July, exports declined by 4.4 percent year-on-year to USD 184.73 billion, following a 4.8 percent drop in the preceding month and market consensus of a 3.0 percent drop. Imports shrank by 12.5 percent to USD 132.42 billion while markets expected a 7.0 percent fall. It was the 21st straight month of contraction, as a result of declining commodity prices and weak demand. In June 2016, the country registered a USD 46.60 billion trade surplus. Balance of Trade in China averaged 85.15 USD HML from 1983 until 2016, reaching an all time high of 627.45 USD HML in January of 2016 and a record low of -319.71 USD HML in February of 2012. Balance of Trade in China is reported by the General Administration of Customs.

ROUBINI ECONOMONITOR: Key takeaway – Over the last three decades, China’s contribution to global growth tripled. The interplay of three domestic factors enabled a growth acceleration: abundant cheap labour flocked into the industrial sector and accepted the financial repression of its savings, which in turn funded massive investment via subsidized lending to state-owned enterprises (SOEs). In other words, captive savings, channelled into captive investments, enabled an export-led strategy but – because of capital controls – created bubbles in the few asset classes available to savers. Over the last two decades, real estate investment rose by almost 300 percent; over the past 10 years, the size of the shadow banking system (SBS) multiplied by 50; between 2014 and 2015, the stock market rose by 150 percent. This model is now exhausted: current demographic trends will not deliver a labour-surplus; savings are less and less captive and less and less prone to subsidize lending to SOEs. As a result, China’s potential growth has declined, from about 10 percent to 5, and even such level could soon become an ambitious target.

Over the last three decades, China’ contribution to global growth tripled. The Communist Party of China (CPC) – the Republic’s founding-and-ruling political party – started reforming[1] the economy in 1978. As reforms kicked in, the annual output grew thirty-five times, from US Dollar (USD) 300 billion (bn) in 1978 to more than USD 10 trillion (tn) in 2015. In the same period, China became the fastest-growing large economy in the world[2], and its contribution to global growth averaged 18 percent in the 1990s, 24 in the 2000s and 36 in 2010-2015[3]. Over time, such a rise supported growth and improved business and consumer confidence in many countries across the globe. In the consumption-oriented economies of developed markets (DMs), China’s low prices kept inflation in check and enhanced shoppers’ purchasing power. In commodity-producing emerging markets (EMs), China’s appetite boosted exports and spurred performance via larger trade and capital flows. China’s economic influence is now sizeable in most countries[4].

Box 1. Understanding China’s growth: the dual-sector model

| The dynamics of China’s growth can be explained by the dual-sector model[5]: at first, a developing economy has: a) an agricultural sector with surplus of unproductive labor; and b) a growing manufacturing sector, where wages are higher than the marginal product of labor in agriculture (i.e., subsistence levels) and fixed. As workers migrate to manufacturing, employment and saving rates rise. Entrepreneurs profit because sale prices are above fixed wages. When sale volumes grow, profits rise as share of income and are reinvested into fixed capital. Capital accumulates and economic growth accelerates. The process of capital accumulation ends when: i) the rise of real wages reduces profits and hence investment; or ii) surplus labor is exhausted. |

Source: Authors’ elaboration, 2016.

The interplay of three domestic factors enabled growth acceleration. China’ fast-tracked transition was mostly driven by domestic factors[6] (Box 1): 1. a large pool of labor-surplus;2. high savings, kept captive by government policy; and 3. subsidized lending to – and the ensuing capital accumulation by – SOEs. The sustained expansion of the labor pool increased savings and, as a result of capital controls, investments. Between 1980 and 2015, China’s total investment as percentage of gross domestic product (GDP) increased from 34.8 to 43.3percent[7]. Over time, costs were reduced by investment-driven productivity increases, allowing for capacity expansion without loss in competitiveness.

- Abundant cheap labor flocked into the industrial sector … For 30 years, as farmers left rural areas to work in coastal production centers, rural-urban migration supported the transition from agriculture to manufacturing (Box 1)[8]. Yet, output growth did not translate into wage pressures: between 1978 and 2015, total industrial production increased 38 times and labor costs only increased 10 times[9]. This is because China’s manufacturing workforce[10] kept expanding. Between 1978 and 2014: a) the population grew by 42 percent, from 963 to 1,368 million (mn), despite the one-child policy; b) the urban population more than tripled, to 749mn; and c) the labor force grew by 92 percent, from 402 mn to 773 mn, circa 56 percent of total population.

- … accepted the financial repression[11] of their ‘captive savings’ … For three decades, capital controls kept the capital account closed[12] and savings “captive”. In other words, money could not easily leave the country[13]; domestic investment was restricted to a few asset classes: a) real estate; b) products available in the SBS[14]; and, more recently,c) stocks (Figure 1). In absence of alternatives[15] – e.g., offshore real estate investments – and given the implicit government-guarantee on deposits held at large state-owned banks (SOBs)[16], domestic savings accumulated into SOB deposit accounts[17]. The People’s Bank of China (PBOC), China’s central bank, set the interest rate on deposits at artificially low – and even negative – rates[18] (Box 2). While repressed rates depressed the purchasing-power of depositors[19], large SOBs were able to attract large sums. Between 1980 and 2013, gross national saving rose to one of the highest levels in the world[20]. All sectors contributed actively: i) households saved because of weak social protection systems[21] and the distortions induced by the one-child policy[22]; ii) the corporate sector saved because of a lack of alternative sources of funding, given the low level of development of the financial system[23]; iii) government consumption grew at a slower pace[24] than its disposable income[25], while the PBOC accumulated foreign currency – resulting from trade surplus – by keeping the Chinese Yuan (CNY) undervalued.

- … and funded massive investment via subsidized lending to SOEs. SOBs lending to SOEs steadily transformed domestic savings into domestic investment (Box 2). While small and medium enterprises (SMEs) – lacking sound collateral[26] – struggled to obtain funding, government-linked corporates enjoyed abundant, cheap and easy credit[27]. Large-scale infrastructure and real estate construction projects managed by the Government saw their cost of capital dramatically reduced. SOEs were favored for a variety of reasons[28]: i) implicit state guarantees; ii) lower credit risk associated with privileged market position; iii) CPC connections between SOE and bank management; and iv) SOB career incentives[29].

Figure 1. China – Capital controls generate captive savings

Source: Last census (2012), National Bureau of Statistics, 2016; Bloomberg, 2016; *From 9 May 2015 to 8 May 2016; ** Bond yield data prior to 2005 not available; ***Historical data not available.

Notes: 1. Green line: financial flows, blue flow of goods, black productivity enhancements; 2. In 2014, the gross saving rate, at 49 percent of GDP, was higher than in the United States (18), United Kingdom (12) and Japan (22); 3. In 2014, the average wage (USD9,200 converted to USD using the 2014 average exchange rate of 6.149 USD/CNY) was much lower than in the US (USD 57,300), UK (USD 51,200) and Japan (USD 33,400).

Box 2. Financial repression in China

| Financial repression is the result of policies implemented by governments to benefit from capital that, in a deregulated environment, would be invested elsewhere. Simply put, it occurs when interest rates (the returns earned by savers) are held below inflation. By transferring benefits from savers (the lenders) to borrowers via negative or below-market real interest rates, financial repression works as a tax on savers and bondholders. When accompanied by inflation, it becomes a form of debt reduction[30]. By reducing the burden of repayments, financial repression allows banks to provide cheap loans to government entities. In China, low returns on savings made cheap loans to state-owned-enterprises (SOEs) possible; as a consequence, the economy could rely on savings-financed investments to grow. |

Source: Authors’ elaboration, 2016.

Captive savings, channeled into captive investments, enabled an export-led strategy …Directed credit boosted infrastructure expenditures. Between 1968 and 1978, gross fixed capital formation[31] averaged 25.4 percent of GDP, compared to a global average of24.5[32]. Despite rapid GDP growth, gross fixed capital formation rose steadily as a share of GDP, and reached 44.2 percent in 2014[33]. The majority of infrastructure spending was allocated to harbors, logistical centers, ports, hubs, favoring exports, which had averaged 3.9percent of GDP between 1968 and 1978 but rose to 22.6 percent in 2014[34].

… but created bubbles in the few asset classes available to savers. Between 1979 and 2015, investment restrictions[35], accompanied by caps on returns of bank deposits[36] and government pension plans[37], pushed yield-seeking investors into the few accessible asset classes: a) real estate; b) shadow banking products; and more recently c) stocks[38], creating a series of bubbles that now pose a threat to economic stability and increase systemic risks[39].

- Over the last two decades, real estate investment rose by almost 300 percent.According to the IMF, between 1997 and 2014, the weight of real estate in the economy increased from about 4 to 15 percent of GDP, the highest share on record, worldwide[40]. Between 2005 and 2011, real estate activity and prices accelerated. Home prices rose 99 percent nationwide, at a CAGR of 9 percent[41]. After the 2008 crisis[42], government intervention fueled a spike: in 2009 and 2010 sales of residential floor space grew between 100 percent and 150 percent year-on-year (y-o-y). Conversely, in early 2012 sales contracted at around 50 percent y-o-y. Given the high volatility, authorities regularly intervene to curb demand, by means of sales taxes, increases in down payments or restrictions in the number of properties a family could own[43]. In 2013, prices started rising again, spurring a new government intervention; as a result, since mid-2014, prices started decelerating.

- Over the past 10 years, the SBS size multiplied by 50. In China, a myriad of non-bank financial institutions[44] offer investments managed outside balance sheets[45] which return higher interest than traditional[46] deposits. Between 2002 and 2013, the sector grew by a factor of 48, rising from CNY 523bn to 25.0tn (from USD 80bn to USD 3.9tn, equivalent to 42 percent of 2013’s GDP)[47], and became a systemic risk[48]. The SBS is strongly interconnected with the real estate sector[49] and the government is concerned that defaults[50] that are already taking place in the energy and real estate sector might result into a full-blown panic, freezing credit into the economy. The country’s financial authorities have increased the supervision and regulation, trying not to suffocate the sector, which remains the main source of funding[51] for most SMEs.

- Between 2014 and 2015, the stock market rose by 150 percent. Following the demand-curbing restrictions implemented by the government in the real estate sector in 2013 and the ensuing price deceleration, investors poured their cash – mostly savings, but also fixed-assets divestment – into stocks. The markets surged, also lifted by: i) a chronic shortage of alternative investments; ii) the adoption of new pro-investment regulation such as measures to facilitate margin lending[52]; and iii) SBS institutions diverting funding from real estate to the stock market. In the first 5 months of 2015, 30mn new accounts were opened to trade in the A-share market. Between May 2014 and May 2015, China’s stock markets run: the Shanghai Composite index rose by 126 percent; theShenzhen Composite index rose by 124 percent. In mid-2015, small investors drove 80percent of the market turnover[53], increasing volatility[54].

Kabar24.com, JAKARTA - Menteri Keuangan China Lou Jiwei mengatakan keluarnya Inggris dari Uni Eropa (Brexit) telah meningkatkan ketidakmenentuan dalam pasar.

Namun dia menggambarkan reaksi pasar belakangan ini sebagai berlebihan karena implikasi nyatanya baru akan terasa lima sampai sepuluh tahun ke depan.

Lou Jiwei mengeluarkan pernyataan ini pada pertemuan tahunan pertama Bank Investasi Infrastruktur Asia di Beijing.

"Keputusan Brexit akan menciptakan bayangan pada perekonomian global. Dampak dan kejatuhannya akan terasa pada lima atau sepuluh tahun mendatang," kata Lou.

"Sulit memprediksinya sekarang ini. Reaksi spontan dari pasar mungkin sedikit berlebihan dan memerlukan peredaan dan pandangan yang objektif," sambung dia seperti dikutip Reuters dan dilansir dari Antara.

Pasar saham di seluruh dunia amblas saat referendum Brexit, sedangkan nilai tukar Sterling juga anjlok.

Lou Jiwei mengeluarkan pernyataan ini pada pertemuan tahunan pertama Bank Investasi Infrastruktur Asia di Beijing.

"Keputusan Brexit akan menciptakan bayangan pada perekonomian global. Dampak dan kejatuhannya akan terasa pada lima atau sepuluh tahun mendatang," kata Lou.

"Sulit memprediksinya sekarang ini. Reaksi spontan dari pasar mungkin sedikit berlebihan dan memerlukan peredaan dan pandangan yang objektif," sambung dia seperti dikutip Reuters dan dilansir dari Antara.

Pasar saham di seluruh dunia amblas saat referendum Brexit, sedangkan nilai tukar Sterling juga anjlok.

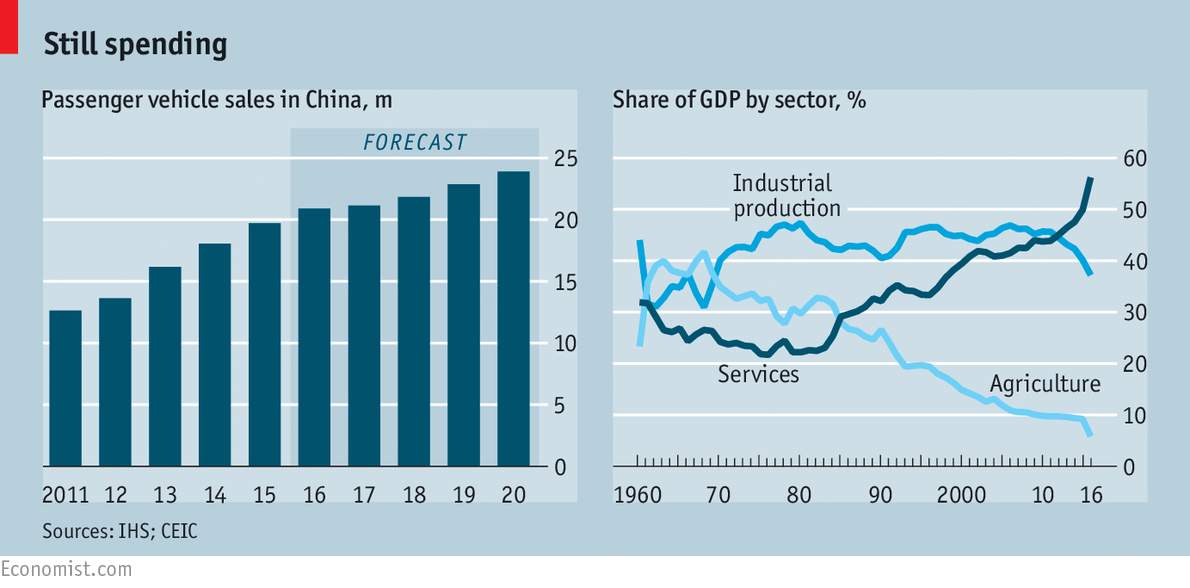

nhk: While China's economy is slowing down, new car sales continued to rise in May thanks to government incentives.

The China Association of Automobile Manufacturers says more than 2 million new vehicles were sold in the country last month. That's up 9.7 percent from a year ago.

Sales of sports utility vehicles surged. SUVs are in high demand among motorists opting to replace their cars.

Sedans haven't been a popular choice lately. But tax breaks and other government incentives helped their sales pick up, especially for smaller models.

Total new car sales for the first 5 months of the year expanded nearly 7 percent from the same period last year. That's about a percentage point higher than analysts' growth prediction for the whole of 2016.

People in China's auto industry say carmakers seem to be taking a break from their price-cutting race. They said sales will likely remain firm while tax breaks continue to the end of the year.

BEIJING. Ekspor China melemah pada periode Mei 2016, mengindikasikan permintaan eksternal masih belum bisa menyokong negara perdagangan terbesar itu.

Lembaga Bea Cukai China pada Rabu (8/6/2016) mencatat, pengiriman barang ke luar negeri dalam mata uang dolar AS turun 4,1% pada periode Mei secara year-on-year. Dengan kinerja impor yang juga turun 0,4%, maka neraca perdagangan masih surplus US$50 miliar.

Permintaan global terus menurun sementara yuan melemah terhadap sekeranjang mata uang mitra dagang tahun ini, berpotensi menyulitkan rencana pemerintah untuk memotong ekses kapasitas industri tanpa menghambat ekspansi ekonomi.

Bank Dunia pada Selasa memangkas estimasi pertumbuhan global menjadi 2,4% untuk tahun ini, yang berarti sama seperti tahun 2015, dari 2,9% yang diproyeksikan pada bulan Januari.

http://finansial.bisnis.com/read/20160608/9/555595/ekonomi-china-ekspor-mei-turun-neraca-dagang-masih-surplus

Sumber : BISNIS.COM

China's Forgetting the Keys to Success

26

By

China is arguably the valedictorian of Asia’s MBA program. When Deng Xiaoping ditched the radical economics of Mao and steered China into the global economy beginning in the early 1980s, he borrowed liberally from programs and policies that had earlier ignited rapid growth in Japan, South Korea, Taiwan, Hong Kong and Singapore. The student quickly outshone the teachers, riding an export-led, investment-heavy strategy to years of double-digit growth.

Now, however, China’s President Xi Jinping appears to have misplaced his textbooks. Rather than continuing to heed the experiences of Asia's tiger economies, he's ignoring critical lessons at his -- and China's -- peril.

Probably the key truism to emerge from the region's postwar boom is that if countries are to grow quickly, development must subsume all other priorities. Former South Korean President Park Chung Hee, who launched his country’s economic ascent, put it best when he wrote: “In human life, economics precedes politics or culture.”

What separated East Asia’s high-growth economies from the rest of the developing world back in the 1960s and 1970s was their leaders’ single-minded -- almost maniacal -- commitment to raising incomes and building industries. Park would often sit in his office in Seoul’s presidential palace with a notepad, doing his own calculations with economic data.

True, these early leaders also had little time for the niceties of representative democracy. But at least the policy making process was shielded from political debates and hassles, giving experts the freedom to carry out reforms. By contrast, those countries that mixed other agendas into the process ultimately ran a ground. Malaysia’s attempt to re-engineer the nation's social structure by promoting the economic interests of the Malay community helped strand the economy in a middle-income trap.

Xi has pushed economic reform too far down his to-do list. Instead, he's devoted much of his attention and energy to an anti-corruption campaign, a drive for ideological purity within the Communist Party, greater control over social media and civil society, and squabbling with neighbors over territorial issues. Rather than separating economic and political agendas, he appears to have placed the former at the service of the latter.

A corollary of this is that leaders need to trust their technocrats. Even the strongest of strongmen, from Korea’s Park to Indonesia's Suharto, relied on experienced, talented economists and other experts to devise and direct economic policy. In Indonesia, Suharto eagerly took notes while his "Berkeley Mafia" of U.S.-trained economic advisors lectured on sound policy. Singapore’s Lee Kuan Yew was blessed with a crack team of professional policy wonks, most notably Goh Keng Swee, one of the economy’s main architects. During Japan’s go-go years, the economy was effectively run by talented bureaucrats, not by elected politicians.

Technocrats certainly populate all rungs of the Chinese leadership and central bank; Premier Li Keqiang himself has a Ph.D. in economics. But President Xi has grasped more and more authority over policymaking in his own hands, effectively sidelining his deputy. The experts seem to have been reduced to writing papers laying out worthy reform proposals, only some of which are eventually heeded.

After a certain point, money can't cover up for other mistakes. Much like China is doing today, policymakers in Japan flooded their economy with cash in the late 1980s in an attempt to avoid structural reform; the strategy only further inflated the bubble that led to the country's years of stagnation. Nor have other Asian countries been all that successful in employing state-directed money to spur innovation, as Xi is attempting. The effort by Japan to “target” certain industries for development with special government support had as many failures as successes, while many of the most competitive Japanese industries, from video games to robotics, were never the beneficiary of state coddling.

This raises perhaps the most important lesson of all: Eventually, governments have to get out of the way. South Korea tumbled into a financial crisis in 1997 in part due to continued state manipulation of the financial sector; the gradual government pullback that followed has helped spur an explosion of entrepreneurship and innovation. In Japan, on the other hand, where bureaucrats have resisted letting go their grip on the economy, a lack of deregulation continues to crimp the economy’s potential.

Even though Xi has pledged to undertake a sweeping liberalization program, progress has been slow, especially in the reform of critical areas such as the financial sector and capital flows. Even more, Xi has made it clear that the government intends to retain the “commanding heights” of the economy, merging and bolstering state enterprises, for instance, rather than letting them die a natural death.

No doubt Xi is hoping to avoid the fate of leaders in places like South Korea and Taiwan, who yielded to demands for democracy as their economies grew richer and more advanced. Unfortunately for China, he's likely to miss out on their success, too.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

The growth model is now exhausted. For three decades, captive savings served the country well, but the party is over. China is unlikely to grow again at similar rates.

- Current demographic trends will not deliver a labor-surplus. Adopted in 1978, population-control measures have depressed natural population growth[55]. In 2011 the working age population[56] declined for the first time[57]. In 2012 the total number of workers peaked[58]. In 2014, labor force participation[59] declined. In 2022, China will be overtaken by India as the world’s most populous country and by 2028, if not earlier, the total population will start to contract[60]. As a result, the pool of potential rural-urban migrants is shrinking steadily[61]. Additionally, workers are less willing to migrate to distant coastal cities without having access to basic rights, like education or health. As an increasingly smaller workforce moves to manufacturing centers, the labour market tightens – i.e.: a labor-shortage increases the migrants’ bargaining power – forcing firms to improve working conditions and increase wages. In 2008, the government adopted measures to improve the conditions of migrant workers[62], aware that: i) the previous model could create social instability; ii) the corporate sector was capturing a disproportionate share of the income; and iii) higher wages and benefits could contribute to the desired increase in consumption.

- Savings are less and less captive … As financial markets develop, alternative asset classes become available, de facto reducing the deposit pool. Despite a changing regulatory framework[63], the bond market has grown sevenfold, from around USD 300bn in 2008 to USD 2.3tn[64] in 2015. Stock markets have also developed fast: the joint market capitalization of the Shanghai and Shenzhen stock exchanges rose from USD 1.7tn in 2008 to USD 5.7tn in 2015 at a CAGR of 18 percent[65], fueled by an increase in initial public offering (IPO) activity. Shadow banking will keep attracting numerous individuals and corporates – hence capturing a larger share[66] of savings – by offering investments in high-yielding sectors currently restricted by the government, such as real estate or energy. Finally, the government is making efforts[67] to provide domestic savers with access to foreign markets, such as the Shanghai-Hong Kong Connect and theShanghai Free Trade Zone.

- … and less and less prone to subsidize lending to SOEs. Years of cheap credit created overcapacity[68]. As a result, the rate of return of investments declined[69] making lending to SOEs less attractive. Additionally, the ongoing liberalization of the financial sector – by pushing banks towards a more efficient use of funding – and the exponential growth of the SBS are de facto reducing the availability of funds for SOEs. Indeed, SMEs are benefitting from increased lending because: a) the flexibility in interest rates setting – by reducing the spread[70] between SOEs and SMEs – is aligning credit decision in large banks to market criteria, reallocating lending from SOEs to more efficient SMEs[71]; b)SMEs are the natural destination of shadow lending as the SBS is not subject to caps on lending volumes, has lower capital requirements, no CB reserve requirements, no unrealistic non-performing loans (NPL) targets[72], greater price flexibility and better capacity to assess risk in smaller firms.

Box 3. A misunderstood slowdown

| China’s growth peaked in 2007[73]. Since, most economists have underestimated China’s deceleration. Thirty years of real growth averaging 10 percent anchored expectations in double-digits and resulted in years of overoptimistic forecasts[74]. The 2009-2010 post-crisis rebound was mistakenly taken as a return to the “normal” in spite of an abundance of data suggesting otherwise[75]. Only recently, the new reality of low structural growth has started to be embraced, but some analysts still think a return to double-digits is possible. |

Source: Authors’ elaboration, 2016.

China’s potential growth has declined, from about 10 percent to 5, and even such level could soon become an ambitious target. Between 1980 and 2010, growth was driven by the interplay of three domestic factors – i.e., the captive savings model (rural labor-surplus, financial repression and subsidized lending to SOEs). Since 2010, the risks stemming from the captive savings model started to offset its benefits. In 2012, the Chinese authorities, aware of the need for transformation, implemented gradual measures to relax family planning restrictions, open the capital account, increase salaries, decrease lending to inefficient SOEs and reduce growth targets for regional and local authorities. Going forward, growth will decelerate to low single digits (Box 3), subduing[76] the global economy for a substantial period of time. For years, China has increased the purchasing power of its trading partners, while reducing the purchasing power of its own citizens. Now it needs to do the reverse.

This is the first of three papers on China’s economic performance. Paper I focuses on past growth dynamics, paper II on present challenges, and paper III on future prospects. We thank Mert Yildiz for comments and suggestions, PulsarKC for data collection. All errors are ours.

[1] In late-1978, the CPC initiated the “process of economic reform” and gradually transformed central planning into a “socialist market economy”. The word “market” was included as an economic goal in 1992, during the 14th CPC congress.

[2] Real GDP growth averaged 9.8 percent per annum, three-and-half times the global average (2.8 percent) and 50 percent faster than the second-best-performing G20 economy, South Korea (6.3 percent). In the same period, India grew at 6.1 percent, Indonesia at 5.3 percent and Brazil at 2.6 percent. Over 1981-2014, only Equatorial Guinea (a small economy, around USD 15bn in 2014) experienced higher real GDP growth: 16.0 percent in average.

[3] In PPP terms, China’s contribution to global GDP rose from 2.3 percent in 1980 to 4.1percent in 1990, 7.4 percent in 2000, 13.8 percent in 2010 and 17.1 percent in 2015.

[4]According to the IMF, between 1990 and 2010 for every 1 percentage point increase in China’s growth – if sustained over five years – global growth would benefit from an added 0.4 percentage points.

[5] By W. Arthur Lewis, 1954.

[6] China’s growth has historically presented low correlation with global growth. The correlation coefficient between China’s and world’s GDP growth stood at 0.15 before China joined the World Trade Organization (WTO) versus the average correlation of 0.39 for low and middle income countries and 0.80 for the United States. WTO accession increased the correlation, but overall, it remained low at 0.40 versus the average correlation of 0.76 for low and middle income countries and 0.90 for the United States. Trend growth was only mildly affected by the 1997 Asian financial crisis or the 2008 great financial crisis. Similarly, the current deceleration trend owes more to internal dynamics than to global sluggish growth.

[7] Globally, investment moved in the opposite direction, declining from 26.1 percent in 1978 to 22.2 percent in 2013 (Source: WDI, 2016). In 2015, China’s investment as percentage of GDP stood at 43.3 percent – higher than in 1980 (34.8) but lower than in 2014 (45.9) – and down from a peak of 47.3 in 2011.

[8] The urbanization rate (urban population as percentage of total population) rose from 17.9percent in 1978, to 26.4 percent in 1990, 36.2 percent in 2000, 49.9 percent in 2010 and 54.8percent in 2014. According to the National Bureau of Statistics of China, rural population peaked at 859 mn in 1995, decreasing to 619 mn in 2014 from 790 mn in 1978. In 2014 there were 274 mn rural laborers working in China’s cities, making up about 35 percent of China’s total workforce of around 773 mn. Growth in migrant workers, declined noticeably over the last five years from 5.5 percent in 2010 to just 1.9 percent in 2014.

[9] Source: Oxford Economics, 2016. In particular: industrial production (CHXIPI.Y) and manufacturing labour cost (CHXWCMF.F).

[10] In 2014, the proportion of migrant workers employed in manufacturing fell to 31.3percent from 36.7 percent in 2010. The number of migrant workers in the construction industry by contrast increased to 22.3 percent in 2014 from 16.1 percent in 2010.

[11] The concept was introduced in 1973 by Edward S. Shaw and Ronald I. McKinnon to define the effect of the creation of captive domestic markets for government debt. Financial repression can be disguised as “macro prudential regulations”, i.e.: the government efforts to mitigate systemic risks in the financial system. See Box. 2.

[12] In 1979, guided by the leadership of Deng Xiaoping, China started a comprehensive and gradual reform which became crucial for Chinese economic development. Regulating the inflow and outflow of capital has been a cornerstone of China’s development reforms. Capital controls are like a bear trap for savings.

[13] Households, companies, and banks need to follow strict rules when moving money in or out of the country. The limit for individuals is currently USD 50,000 a year, while corporate investments need government approval.

[14] People’s Bank of China (PBOC) defines shadow banking as credit intermediation involving entities and activities outside the regular banking system” that serves to provide “liquidity and credit transformation” and “which could potentially” be a source of “systemic risk or regulatory arbitrage. According to IMF estimates, China’s shadow banking accounted for 35.0 percent (CNY 19.9tn) of its GDP in 2014. Types of lending or other financial activitiesincluded are trust loans & leases, entrusted loans, bank acceptances, interbank entrusted loan payment, microfinance companies, financial leasing, bond markets and wealth management products among others.

[15] The skewed interest rates offered by China’s banks represent a tax on depositors and a subsidy for industry. They distort the economy, suppressing consumption, services and private business in favor of investment, industry and the state. And controls on capital outflows prevent sound investments abroad, resulting in large piles of foreign-currency reserves.

[16] Until 2004 all the major banks in China were 100 percent owned by the state. After 2004 a process called “equitization” gradually transformed them into join-stock corporations albeit maintaining the majority stake of the government.

[17] In 2013, five big state-owned commercial banks (Industrial and Commercial Bank of China (ICBC), Agriculture Bank of China (ABC), Bank of China (BOC), China Construction Bank (CCB) and Bank of Communications (BOCOM)) accounted for 55.2 percent of the total deposits and 62.7 percent of the total individual savings.