Fed raisesPlay Video0:53

the guardian : US manufacturing growth accelerates

US jobless claims lower than expected

The Federal Reserve chief pointed to the improving economy.

RELATED COVERAGE

RELATED COVERAGE

Malaysian Troubles

RELATED COVERAGE

RELATED COVERAGE

Singapore, May 3, 2016 (AFP)

The dollar extended its losses against the yen and euro Tuesday as fresh data indicating a slowdown in the US manufacturing sector lowered expectations the Federal Reserve will hike interest rates any time soon.

The greenback was already under pressure against the yen after the Bank of Japan on Thursday refused to expand its stimulus programme despite a string of weak economic indicators and two deadly earthquakes that closed factories.

On Monday a closely watched gauge of US factories for April showed the rate of growth eased, leading to concerns about the state of the world's number one economy.

That came after data last week showed consumer spending rose only slightly in April, while the economy expanded slower than expected in the first three months of the year.

The readings mean it is highly unlikely the Fed will hike interest rates at its June policy meeting, while some analysts say September would be the earliest, if at all this year.

On Tuesday in Asia the dollar fell to 106.06 yen at one point before edging up marginally to 106.19 yen, but still well down from the 106.42 yen late in New York. The greenback is wallowing at lows not seen since October 2014.

Remarks by Japanese finance minister Taro Aso hinting at a possible market intervention to staunch the yen's rise seemed to have little impact.

The manufacturing figure also came after a similar gauge in the eurozone pointed to a pick-up in activity, sending the euro above $1.15 for the first time in nine months Monday. Early Tuesday the single currency was at $1.1532.

However, the dollar rallied 0.8 percent against its Australia counterpart after the country's central bank cut interest rates to a record low after inflation last week came well below expectations.

United Overseas Bank (UOB) said focus will now turn to the release on Friday of April jobs figures, a key gauge of the health of the US economy.

UOB said the data "could swing market expectations for (the) Federal Reserve's future course of interest rate actions".

Trading was thin with the Japanese financial markets closed until Friday for public holidays.

The greenback has come under pressure in recent weeks after the Fed decided against hiking interest rates and stood by its stance that any further rises would be slow and small as economic growth remained relatively weak.

Washington, May 2, 2016 (AFP)

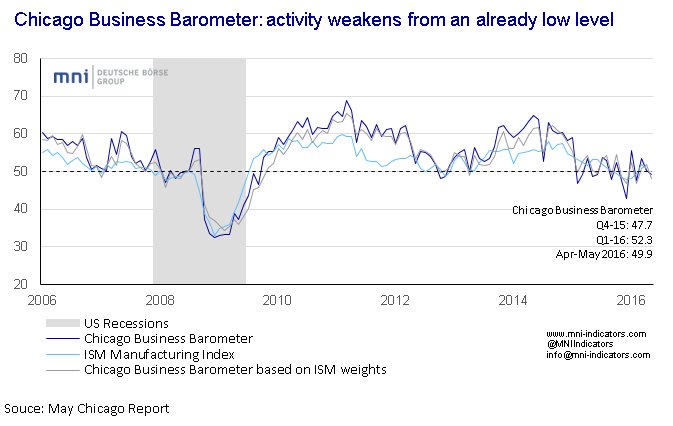

US manufacturing activity sputtered in April, falling to near the no-growth line in the ailing sector after mostly contracting for the past six months.

The manufacturing sector has been puttering along, hampered by slow global growth and the impact of the strong dollar on exports.

The Institute for Supply Management said its purchasing managers index for the manufacturing sector fell to 50.8 in April from 51.8 in March.

The one-point April slide was larger than the 0.4 point dip consensus estimate of analysts, and brought the PMI index closer to striking distance of the 50 level that divides growth and contraction.

Before March, the PMI index had been in contraction territory since October, with the five-month streak the longest stretch of its kind since 2009 amid the Great Recession, according to Briefing.com.

The April data showed new orders, a key driver of activity, fell a hefty 2.5 points to 55.8, but that was after a large gain in March, and production also slowed.

The employment index improved but still remained in contraction.

Of the 18 manufacturing industries surveyed, only 11 reported growth in April, led mainly by wood, printing and paper products.

Reflecting the downturn in the energy industry amid low prices, petroleum and coal products were the worst hit among the four manufacturing industries in the red.

"With the value of the dollar having moved lower since the beginning of the year and with financial stress largely having abated, we expect manufacturing output to move largely sideways this year before eventually returning to a modest positive trend," said Rob Martin of Barclays Research.

la times: Growth by the U.S. economy fell off sharply in the first three months of 2016, posting its worst quarterly performance in two years amid a global slowdown, the Commerce Department said Thursday.

The broadest measure of the nation's economic output, known as gross domestic product, increased at an annual rate of 0.5% from January through March. That was down from a weak 1.4% reading in the fourth quarter and 0.2 percentage points below analysts' forecasts.

The last time the economy performed worse was in the first quarter of 2014, when severe winter weather in much of the nation caused GDP to contract at a 0.9% annual rate.

This year's first-quarter slowdown was driven by declines in business investment, exports and federal government spending, the Commerce Department said.

Growth in consumer spending, a key driver of the economy, also declined as Americans became more cautious in the wake of a financial market downturn earlier this year.

The 1.9% increase in consumer spending was down from 2.4% in the fourth quarter of 2015 and the weakest in a year.

The Commerce Department stressed that Thursday's estimate was just the first of three for first-quarter growth and was based on data that were incomplete or subject to revision. A second estimate will be released May 27.

First-quarter growth "looks grim, but the second quarter will be much better," said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

The stock market plunge in January was a key factor in the poor first-quarter performance, he said. But the market has recovered and Shepherdson expects growth to improve as well.

Still, the slowdown in U.S. economic growth will be a factor as Federal Reservepolicymakers consider whether to continue raising a key interest rate. The central bank inched up its benchmark federal funds rate in December after keeping it near zero for seven years.

The Fed said Wednesday that "labor market conditions have improved further even as growth in economic activity appears to have slowed."

Initial jobless claims, a key labor market indicator, increased slightly to 257,000 last week, the Labor Department said Thursday. But claims remained historically low -- the 256,000 average over the previous four weeks was the fewest since 1973.

Economists expect that job growth was solid again in April, with forecasts calling for the creation of 200,000 net new positions and the unemployment rate holding steady at 5%.

Fed policymakers must balance the strengthening jobs market with weaker overall economic growth. After a two-day meeting this week, the Fed opted to hold the rate steady at between 0.25% and 0.5%.

The Fed next meets in June, and its most recent forecast indicated plans for two small 0.25 percentage point rate hikes this year.

"Today’s anemic growth numbers fully justify the Federal Reserve’s decision this week to not further increase short-term interest rates," said Josh Bivens, research and policy director for the Economic Policy Institute, a think tank focused on the needs of low- and middle-income workers.

Singapore, May 3, 2016 (AFP)

The dollar extended its losses against the yen and euro Tuesday as fresh data indicating a slowdown in the US manufacturing sector lowered expectations the Federal Reserve will hike interest rates any time soon.

The greenback was already under pressure against the yen after the Bank of Japan on Thursday refused to expand its stimulus programme despite a string of weak economic indicators and two deadly earthquakes that closed factories.

On Monday a closely watched gauge of US factories for April showed the rate of growth eased, leading to concerns about the state of the world's number one economy.

That came after data last week showed consumer spending rose only slightly in April, while the economy expanded slower than expected in the first three months of the year.

The readings mean it is highly unlikely the Fed will hike interest rates at its June policy meeting, while some analysts say September would be the earliest, if at all this year.

On Tuesday in Asia the dollar fell to 106.06 yen at one point before edging up marginally to 106.19 yen, but still well down from the 106.42 yen late in New York. The greenback is wallowing at lows not seen since October 2014.

Remarks by Japanese finance minister Taro Aso hinting at a possible market intervention to staunch the yen's rise seemed to have little impact.

The manufacturing figure also came after a similar gauge in the eurozone pointed to a pick-up in activity, sending the euro above $1.15 for the first time in nine months Monday. Early Tuesday the single currency was at $1.1532.

However, the dollar rallied 0.8 percent against its Australia counterpart after the country's central bank cut interest rates to a record low after inflation last week came well below expectations.

United Overseas Bank (UOB) said focus will now turn to the release on Friday of April jobs figures, a key gauge of the health of the US economy.

UOB said the data "could swing market expectations for (the) Federal Reserve's future course of interest rate actions".

Trading was thin with the Japanese financial markets closed until Friday for public holidays.

The greenback has come under pressure in recent weeks after the Fed decided against hiking interest rates and stood by its stance that any further rises would be slow and small as economic growth remained relatively weak.

Washington, May 2, 2016 (AFP)

US manufacturing activity sputtered in April, falling to near the no-growth line in the ailing sector after mostly contracting for the past six months.

The manufacturing sector has been puttering along, hampered by slow global growth and the impact of the strong dollar on exports.

The Institute for Supply Management said its purchasing managers index for the manufacturing sector fell to 50.8 in April from 51.8 in March.

The one-point April slide was larger than the 0.4 point dip consensus estimate of analysts, and brought the PMI index closer to striking distance of the 50 level that divides growth and contraction.

Before March, the PMI index had been in contraction territory since October, with the five-month streak the longest stretch of its kind since 2009 amid the Great Recession, according to Briefing.com.

The April data showed new orders, a key driver of activity, fell a hefty 2.5 points to 55.8, but that was after a large gain in March, and production also slowed.

The employment index improved but still remained in contraction.

Of the 18 manufacturing industries surveyed, only 11 reported growth in April, led mainly by wood, printing and paper products.

Reflecting the downturn in the energy industry amid low prices, petroleum and coal products were the worst hit among the four manufacturing industries in the red.

"With the value of the dollar having moved lower since the beginning of the year and with financial stress largely having abated, we expect manufacturing output to move largely sideways this year before eventually returning to a modest positive trend," said Rob Martin of Barclays Research.

la times: Growth by the U.S. economy fell off sharply in the first three months of 2016, posting its worst quarterly performance in two years amid a global slowdown, the Commerce Department said Thursday.

New York, April 27, 2016 (AFP)

The dollar held steady Wednesday after the Federal Reserve said it was leaving short-term interest rates unchanged and cracked open the door to a rate hike in June.

The Federal Open Market Committee, the US central bank's policy arm, announced it was standing pat on ultra-low 0.25-0.50 percent for its benchmark federal funds rate, as expected, after raising it in December after seven years near zero.

The FOMC statement indicated policymakers were more optimistic about global economic conditions than they were in their March meeting as they noted a mixed picture for the US economy.

In March the FOMC said international economic and financial developments "pose risks."

In the new outlook, it simply said that it would continue "to closely monitor inflation indicators and global economic and financial developments."

"The language of the statement signaled that the probability of a rate hike at the June meeting is stronger now than it was at the March meeting. Unless economic data deteriorates unexpectedly, the Fed has enough to justify a rate hike in June," said IHS Global Insight economists in a client note.

The FOMC decision had only a small net effect on the dollar. Around 2100 GMT, the greenback traded at $1.1321 per euro, down a modest 0.2 percent from the same time Tuesday.

The yen ticked lower against the dollar and the euro as the Bank of Japan opened a two-day monetary policy meeting.

The Japanese central bank is widely expected to announce more stimulus Thursday for the flagging economy. Deadly earthquakes earlier this month have led to temporary factory shutdowns at a time when the world's third-largest economy is already struggling.

2100 GMT Wednesday Tuesday

EUR/USD 1.1321 1.1298

EUR/JPY 126.21 125.76

EUR/CHF 1.0994 1.1000

EUR/GBP 0.7785 0.7749

USD/JPY 111.47 111.31

USD/CHF 0.9711 0.9735

GBP/USD 1.4543 1.4582

barron: By Amey Stone

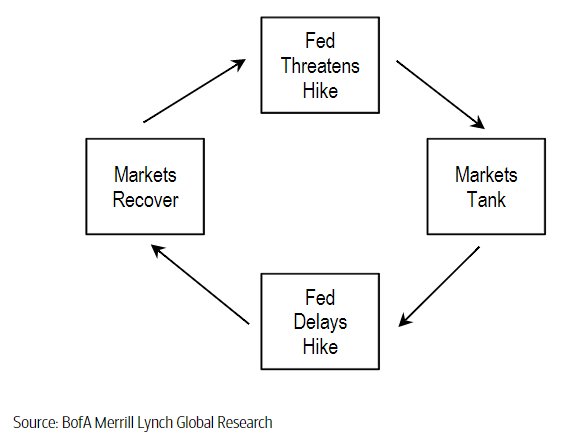

The Federal Reserve is always weighing upside and downside risks to any policy action. But going into its April meeting, currency markets have it stuck in what several economists are calling a “negative feedback loop.”

Peter Boockvar of The Lindsey Group used that phrase in his Wednesday morning note, which outlined 10 different economic influences the Fed is weighing. Six of them suggest the Fed should hike (like a stronger labor market and the spike in commodities prices), but he notes, “2 of which will reverse if they do pointing to the perpetual feedback loop the Fed continues to travel through.”

One example, “The US trade weighed dollar index is down almost 3%. Fed should hike but of course will then lead to a dollar rally,” he writes.

Barron’s spoke Tuesday with Sharon Stark, fixed income strategist at D.A. Davidson, who thinks that, due to the negative feedback loop, the Fed could do more harm than good by raising rates.

Here’s how that works:

The U.S. economy picks up speed, the Fed raises rates, the dollar strengthens, U.S. exports become more expensive, corporate revenues fall, the economy weakens.

And here’s another version of the negative feedback loop that we’ve already seen and some economists worry could happen again if the Fed doesn’t hike:

The Fed suggests it won’t raise rates, foreign currencies strengthen, hurting their exports, they devalue their currencies to keep their economies afloat, global markets freak out.

The Bank of Japan could create another negative feedback loop this week, notes Stark. It meets Thursday. If it lowers rates more, that could stimulate investors to buy higher-yielding U.S. Treasuries. That would strengthen the dollar against the yen and could hurt U.S. exports.

wsj.com:

Federal Reserve officials are virtually certain to hold interest rates steady when their meeting ends Wednesday but they could try to send a message to markets and outside observers about what likely comes next. With no press conference scheduled after this week’s meeting and no new economic forecasts to be released, all the attention will be focused on the Fed’s policy statement, to be released Wednesday at 2 p.m. EDT. Here are five things to watch.

-

Fed officials routinely include a line in their statement assessing the risks to their economic outlook. Risk, in this context, means the likelihood that the economy does not behave according to their projections. Sometimes there are more risks that the economy underperforms, which Fed officials call “downside risks.” Sometimes, the risks are tilted towards an overperforming economy, known as “upside risks.” Sometimes, they are in balance. The assessment offers a clue about officials’ confidence in the economy. For the past two meetings, officials have conspicuously not included a risk assessmentbecause of an internal split. The statement will show whether they have reconciled their views.

-

Observers will be parsing Wednesday’s statement closely to see whether Fed officials drop any hints about a potential rate increase at their next meeting in June. Some economists say this week’s statement could resemble the October 2015 statement, in which the Fed held rates steady but explicitly mentioned the possibility of moving “at its next meeting.” Although a hint of a coming rate increase will probably not be as explicit this week, officials could find a way to include a subtle nod towards future action.

-

Fed officials have made no secret that the global economic and financial upheavals of the past few months could threaten the U.S. economy. Those worries spiked in January when a wobble in the Chinese economy and a renewed drop in the price of oil drove investors into safer assets and threatened to derail the slow global recovery. The world looks calmer today but Fed officials remain apprehensive. “Global economic and financial developments continue to pose risks,” their March statement read. How Fed officials describe those conditions this week could tell us how worried they are about another round of turbulence.

-

Inflation has undershot the Fed’s 2% target for more than three years but officials got some promising signals in January when the personal-consumption expenditures price index rose 1.2% over the previous year, suggesting an easing of downward pressure from low energy prices and a stronger dollar. February’s inflation numbers were softer, with prices up 1% over the previous year, but analysts see a glimmer of hope in the data. Fed Chairwoman Janet Yellen, however, said at her March 16 press conference she was “wary” of relying too much on first quarter data, which could be distorted by seasonal trends. The statement Wednesday could tell us how significant Fed officials believe the recent inflation numbers are.

-

So far this year, officials have generally found consensus about holding interest rates steady, recording just one dissent at their two policy meetings. The nay vote was from Kansas City Fed President Esther George in March, when she wanted to raise rates. She could dissent again this week, having warned earlier this month that waiting to move could fuel dangerous asset bubbles. She might be joined by Cleveland Fed President Loretta Mester orJames Bullard of St. Louis, who have both recently suggested they would like to resume raising interest rates.

New York, April 26, 2016 (AFP)

The dollar extended losses against the euro and pound Tuesday after disappointing US economic data helped cement expectations the Federal Reserve will leave interest rates unchanged the next day.

US durable goods orders rose much less than expected in March, adding further evidence of weakness in the manufacturing sector. Consumer confidence in April unexpectedly fell, according to the closely watched Conference Board survey.

The data came as the Federal Reserve opened a two-day monetary policy meeting. All eyes in the market were focused on the Fed's post-meeting statement, due at 1800 GMT Wednesday.

"While no change in rates is expected from the Fed tomorrow, its policy statement could help shed light on the outlook for borrowing costs over the months ahead," said Omer Esiner Commonwealth Foreign Exchange.

"In particular, investors want to see if the Fed acknowledges any improvement in domestic or international economic conditions, which could make a quarter-point rate hike in June more likely."

The dollar, which had weakened Monday, slipped 0.3 percent to $1.1298 per euro. The greenback, meanwhile, edged higher against the yen.

"With the US central bank likely on hold for the time being, and absent any strong signals with respect to the timing of the next interest rate increase, we continue to expect only moderate US dollar performance in the near term," said Eric Viloria, currency strategist at Wells Fargo Securities.

<pre> 2100 GMT Tuesday Monday

</pre>

EUR/USD 1.1298 1.1266

EUR/JPY 125.76 125.30

EUR/CHF 1.1000 1.0987

EUR/GBP 0.7749 0.7780

USD/JPY 111.31 111.21

USD/CHF 0.9735 0.9752

GBP/USD 1.4582 1.4482

bloomberg: Emerging market stocks and currencies fell as a retreat in oil and concern that the Federal Reserve may turn more hawkish at its meeting this week damped demand for riskier assets in developing nations.

Chinese stocks extended last week’s losses after commodity exchanges moved to cool trading in raw materials and data showed stronger demand for workers, suggesting the central bank won’t offer additional measures to boost growth. Petroleo Brasileiro SA, the Brazilian state-controlled oil producer, led a gauge of developing-nation energy stocks lower as Brent crude fell from a five-month high. Saudi shares rose the most in seven weeks after approval of a plan for a post-oil era.

“It is partly jitters around the Fed this week that are causing the declines across emerging markets today, but also a reaction to the rumors last week that the Chinese central bank may be providing less stimulus in the future,” said Michael Wang, a strategist at hedge fund Amiya Capital LLP in London who favors shares in India, Mexico and Poland. “Emerging-market fundamentals are still weak, so a rise in U.S. yields would pressure emerging-market FX and eventually, equities.”

Fed Outlook

A rally in emerging-market assets since the middle of February is fading as investors look for renewed guidance about whether recent data on hiring in the U.S. warrants a quickening of interest-rate increases. While the Fed is forecast to stay on hold Wednesday, its statement may provide signals on when policy makers will add to their December rate increase. U.S. central bankers have indicated they will raise borrowing costs twice this year.

The MSCI Emerging Markets Index fell 0.7 percent to 839.20, the lowest close in two weeks. All 10 industry groups declined, led by raw-material and financial stocks.

The developing-nation stock benchmark trades at 11.8 times the projected earnings of its members in the next 12 months, a 27 percent discount to the valuation for advanced-nation shares.

The Shanghai Composite Index lost 0.4 percent after sliding 3.9 percent last week. Commodity exchanges in the Chinese cities of Zhengzhou and Dalian said late Friday that they would raise margin requirements on futures contracts of cotton and thermal coal, following similar moves on steel reinforcement-bar and iron ore contracts earlier in the week.

Brazil, Russia

Petrobras fell 4.3 percent. The Ibovespa retreated 1.6 percent. Vale SA, the world’s largest iron-ore producer, led the Brazilian benchmark gauge’s decline, tumbling 7.5 percent.

The Micex Index dropped 0.6 percent. Retailer Magnit PJSC contributed the most to the Russian benchmark’s decline, plunging 7.3 percent after posting first-quarter earnings that trailed estimates. Oil producer Lukoil PJSC dropped 1.3 percent, falling for the first time in a week. Oil is the country’s biggest export. Brent crude declined 1.4 percent to $44.48 a barrel.

The Tadawul All Share Index added 2.5 percent to the the highest close since Jan. 3, led by an 8.3 percent gain in real-estate developer Jabal Omar Development Co. Saudi Arabian stocks rallied after the nation’s king approved plans for economic development through 2030.

ETF Inflows

Investors added money to U.S. exchange-traded funds that buy emerging-market stocks and bonds for the 10th straight week, bringing the gains since mid-February to more than $11 billion. Deposits into ETFs that invest across developing nations as well as those that target specific countries totaled $658.8 million in the week ended April 22, compared with inflows of $706.5 million in the previous period, according to data compiled by Bloomberg. The current streak is the longest since the 11 weeks that ended last May 29.

The MSCI Emerging Markets Currency Index slipped 0.1 percent. Colombia’s peso weakened the most, depreciating 0.7 percent against the dollar. The South Korean won fell 0.4 percent. Brazil’s real strengthened 0.5 percent as the central bank refrained from moving to weaken it.

There’s a 65 percent chance the Fed will boost its benchmark rate this year, up from 50 percent odds as of April 15, according to data compiled by Bloomberg based on federal fund futures. Officials held off from raising borrowing costs at their March meeting and scaled back forecasts for how high rates will rise this year.

Turkish bonds fell, pushing the yield on 10-year local currency bonds up eight basis points, before a quarterly inflation report on Tuesday. Russian bonds declined with the yield on 10-year securities increasing four basis points.

The premium investors demand to own emerging-market debt over U.S. Treasuries was unchanged at 381 basis points, remaining near a four-month low, according to JPMorgan Chase & Co. indexes.

New York, April 25, 2016 (AFP)

The dollar slipped against the euro and the yen Monday in a cautious market ahead of interest rate decisions by the Federal Reserve and Bank of Japan this week.

Though the Fed was largely expected to hold ultra-low interest rates unchanged at the end of a two-day meeting Wednesday, traders hoped the post-meeting statement would shed light on the outlook for future rate hikes.

"The euro hit a technical support level at 1.12 on Friday and we have seen a little bounce-back since," said Boris Schlossberg of BK Asset Management.

"But mostly it's just the market positioning itself" before the Fed rate decision, he said.

The dollar fell to $1.1266 per euro around 2100 GMT, down 0.3 percent from Friday.

The Fed was expected to remain cautious amid worries about the global economy, including Britain's June vote on exiting the European Union and weak inflation.

"Any softening of the Fed's concern regarding international headwinds or any signs that officials see inflation pressures beginning to mount would suggest a higher probability of a hike in June and likely send the dollar higher," said Omer Esiner at Commonwealth Foreign Exchange.

The yen, meanwhile, rebounded from Friday's plunge in reaction to a Bloomberg News story that the central bank may take steps to support major financial institutions hit by its negative-rate policy.

The Japanese currency rose 0.5 percent against the greenback and 0.2 percent against the euro.

If the Bank of Japan's meeting on Wednesday and Thursday results in easier policy, that could send the yen lower, Esiner said.

But, he said, "the extent to which any yen losses can be sustained is unclear, especially against a still nervous and risk-averse global market backdrop."

<pre> 2100 GMT Monday Friday

EUR/USD 1.1266 1.1230

EUR/JPY 125.30 125.50

EUR/CHF 1.0987 1.0985

EUR/GBP 0.7780 0.7786

USD/JPY 111.21 111.75

USD/CHF 0.9752 0.9781

GBP/USD 1.4482 1.4424

</pre>

NEW YORK - Kurs dolar AS menurun terhadap sebagian besar mata uang utama pada Selasa (Rabu pagi WIB), karena data ekonomi yang keluar dari negara itu lebih lemah dari perkiraan.

Angka "housing starts" (jumlah rumah baru yang dibangun) yang dimiliki secara pribadi di AS pada Maret mencapai 1,089 juta unit pada tingkat tahunan disesuaikan secara musiman , Departemen Perdagangan melaporkan pada Selasa.

Perkiraan terbaru itu berada di bawah konsensus pasar 1,167 juta unit dan juga 8,8 persen di bawah perkiraan Februari yang direvisi.

[Baca juga: Dolar AS Melemah Akibat Data Ekonomi Suram]

Federal Reserve melaporkan pada Jumat lalu bahwa produksi industri AS turun 0,6 persen pada Maret untuk bulan kedua berturut-turut, di bawah konsensus pasar untuk penurunan 0,1 persen.

Para analis mengatakan data ekonomi suram baru-baru ini mungkin mempertahankan Federal Reserve berhati-hati dalam menaikkan suku bunga utamanya.

Indeks dolar, yang mengukur greenback terhadap enam mata uang utama, turun 0,56 persen menjadi 93,963 pada akhir perdagangan .

Pada akhir perdagangan New York, euro naik menjadi USD1,1380 dari USD1,1314 di sesi sebelumnya, dan pound Inggris naik menjadi USD1,4404 dari USD1,4285. Dolar Australia naik ke USD0,7817 dari USD0,7745.

Dolar dibeli 109,10 yen Jepang, lebih tinggi dari 108,84 yen pada sesi sebelumnya. Dolar jatuh ke 0,9600 franc Swiss dari 0,9644 franc Swiss, dan turun tipis menjadi 1,2647 dolar Kanada dari 1,2809 dolar Kanada.

(rai)

JAKARTA. Ekonomi Amerika Serikat bergerak stabil dengan beberapa tanda-tanda inflasi sehingga kebijakan suku bunga the Fed saat ini dinilai sudah tepat.

Dalam pidatonya pada Kamis malam waktu AS, Gubernur The Fed Janet Yellen mengatakan bahwa tujuh tahun setelah krisis keuangan yang besar di dunia, pasar tenaga kerja AS sekarang hampir mencapai titik tertinggi sehingga inflasi tidak akan ditahan lebih lama lagi menyusul dolar yang kuat dan rendahnya harga minyak.

“Ekonomi AS terus berkembang dengan memuaskan. Kita terus melihat data tingkat pekerjaan yang baik, beberapa bukti menunjukkan inflasi bergerak naik, itulah ekspektasi kami saat menaikkan suku bunga Desember lalu,†kata Yellen dalam pidatonya di International House seperti yang dikutip oleh Reuters, Jumat (8/4/2016).

“Ya, ada dukungan dalam kebijakan moneter yang kita miliki, tetapi keputusan untuk meningkatkan suku bunga secara bertahap adalah keputusan yang tepat,†lanjutnya.

Bank sentral AS menaikkan suku bunga acuan mereka pada Desember tahun lalu dan merupakan kenaikan pertama sejak hampir 10 tahun lalu.

http://finansial.bisnis.com/read/20160408/9/535943/janet-yellen-kebijakan-suku-bunga-sudah-tepat

Sumber : BISNIS.COM

nhk: Fed minutes: Cautious about rate hike in April

The US Federal Reserve has released the minutes of its policy meeting in mid-March. It says policymakers were cautious about raising their key interest rate at the following meeting in April.

Several expressed their concern that raising the key rate as soon as the following month would "signal a sense of urgency they did not think appropriate."

But not all agreed. Some others said going ahead with the move at this month's meeting might be warranted if data were to improve.

Many participants expressed a view that the "global economic and financial situation still posed appreciable downside risks to the domestic economic outlook."

Market players believe the Fed will forgo another rate hike this month, but could make a decision in their June meeting.

Several expressed their concern that raising the key rate as soon as the following month would "signal a sense of urgency they did not think appropriate."

But not all agreed. Some others said going ahead with the move at this month's meeting might be warranted if data were to improve.

Many participants expressed a view that the "global economic and financial situation still posed appreciable downside risks to the domestic economic outlook."

Market players believe the Fed will forgo another rate hike this month, but could make a decision in their June meeting.

INILAHCOM, Washington - Para pejabat Federal Reserve terpecah atas apakah menaikkan suku bunga acuan berikutnya pada pertemuan April, karena mereka melihat risiko-risiko cukup besar terhadap ekonomi AS dari perkembangan global, risalah pertemuan kebijakan terbaru Fed menunjukkan, Rabu (6/4/2016).

"Banyak peserta mengungkapkan pandangan bahwa situasi ekonomi dan keuangan global masih menimbulkan risiko-risiko penurunan cukup besar terhadap prospek ekonomi domestik. Beberapa mencatat bahwa gejolak pasar keuangan baru-baru ini memberikan peringatan penting bahwa kemampuan bank sentral untuk mengimbangi dampak guncangan ekonomi yang merugikan mungkin terbatas," menurut risalah pertemuan The Fed 15-16 Maret yang dirilis Rabu.

The Fed menaikkan kisaran target untuk suku bunga federal funds sebesar 25 basis poin menjadi 0,25-0,50 persen pada Desember, kenaikan suku bunga pertama dalam hampir satu dekade, menandai akhir dari sebuah era pelonggaran kebijakan moneter yang luar biasa.

Tetapi gejolak di pasar keuangan dan pelambatan ekonomi global sejak awal tahun ini telah meningkatkan kekhawatiran tentang kekuatan ekonomi AS, memaksa para pembuat kebijakan The Fed untuk menunda setiap kenaikan suku bunga lebih lanjut sejak itu.

Proyeksi diperbarui The Fed yang dirilis bulan lalu menunjukkan bahwa para pembuat kebijakan memperkirakan suku bunga federal funds akan naik menjadi sekitar 0,9 persen pada akhir 2016, menyiratkan dua kenaikan suku bunga seperempat persentase poin tahun ini, turun dari empat kali kenaikan yang diperkirakan pada Desember.

"Mereka menyatakan berbagai pandangan tentang kemungkinan bahwa informasi yang masuk akan membuat sebuah penyesuaian (dengan sikap kebijakan moneter) yang tepat pada saat pertemuan berikutnya" dijadwalkan pada 26-27 April, risalah mengatakan, mencatat bahwa sejumlah pejabat Fed melihat beberapa masalah (headwinds) yang menahan pertumbuhan ekonomi AS cenderung "mereda hanya perlahan-lahan." "Beberapa menyatakan pandangan bahwa pendekatan hati-hati untuk menaikkan suku bunga akan lebih bijaksana atau mencatat kekhawatiran mereka bahwa meningkatkan kisaran target suku bunga secepat April akan mengindikasikan rasa urgensi mereka tidak berpikir tepat," kata risalah.

Tapi beberapa pejabat Fed lainnya menunjukkan bahwa mereka cenderung untuk menaikkan suku pada pertemuan berikutnya "jika data ekonomi yang masuk tetap konsisten dengan harapan mereka untuk pertumbuhan moderat dalam output, penguatan lebih lanjut dari pasar tenaga kerja, dan inflasi naik dua persen selama jangka menengah".

"Mengingat risiko-risko terhadap prospek, saya menganggap itu tepat untuk komite melanjutkan dengan hati-hati dalam menyesuaikan kebijakan," kata Ketua Fed Janet Yellen pekan lalu, merujuk kepada Komite Pasar Terbuka Federal (FOMC), unit kebijakan moneter The Fed.

"Hati-hati ini terutama diperlukan karena, dengan suku bunga federal funds sangat rendah, kemampuan FOMC menggunakan kebijakan moneter konvensional untuk menanggapi gangguan ekonomi adalah asimetris," Yellen menambahkan, menandakan bahwa dia ingin menunggu lebih banyak waktu untuk menilai prospek ekonomi AS sebelum menaikkan suku bunga lagi.

"Asimetri ini membuat bijaksana untuk menunggu informasi tambahan mengenai kekuatan yang mendasari kegiatan ekonomi dan prospek inflasi sebelum mengambil langkah lain untuk mengurangi kebijakan akomodasi," kata risalah.

Sekitar 76 persen dari pengusaha dan ekonom akademik yang disurvei oleh Wall Street Journal bulan lalu memperkirakan bahwa Fed akan menunggu sampai Juni untuk menaikkan suku bunga acuannya. [tar]

- See more at: http://pasarmodal.inilah.com/read/detail/2286413/notula-pejabat-fed-pecah-soal-kapan-bunga-naik#sthash.GJB3Gkby.dpufmarketwatch: U.S. stocks closed with solid gains Wednesday, boosted by soaring oil prices, while minutes from the Federal Reserve’s latest policy meeting signaled reluctance to raise rates as early as this month.

Minutes from the March 15-16 meeting showed ‘several’ officials argued against an interest-rate increase in April, saying such move “would signal too much urgency they didn't think appropriate.” U.S. central bank officials also were split on whether the stubbornly low inflation would hit the Fed’s 2% target level.

“There was no new news in Fed minutes—the bigger news was when the they cut rate hike forecasts to get more in line with what the market was expecting and when [Chairwoman] Janet Yellen gave a dovish speech last week,” said Tom Siomades, head of Hartford Funds Investment Consulting Group.

The S&P 500 SPX, +1.05% closed with a gain of 21.49 points, or 1.1%, at 2,066.66, recouping all of the losses from the previous session. Health-care stocks led the advance, up 2.7%, while the energy sector rose 2.1%.

The Dow Jones Industrial Average DJIA, +0.64% added 112.73 points, or 0.6%, to finish at 17,716.05. The Nasdaq Composite COMP, +1.59% advanced 76.78 points, or 1.6%, to 4,920.72, it’s highest settlement of the year, with biotech shares leading the gains. The iShares Nasdaq Biotechnology ETF IBB, +5.99% rose 6%, it best one-day gain since late August.

Last week, Yellen reiterated the need to proceed cautiously in raising rates, citing risks emanating from emerging markets.

The minutes affirmed that “several” Fed officials are taking a cautious approach to raising rates as falling commodity prices and fear that sluggish growth abroad could wash ashore persist.

A jump in oil prices sent shares of energy companies sharply higher, boosting indexes in early trade. Oil prices soared 5.2%, to close at $37.75 a barrel after a surprise drop in inventories. The Energy Information Administration reported U.S. crude supplies in storage fell by 4.9 million barrels in the week ended April 1.

Commenting about a jump in biotechs, Karyn Cavanaugh, senior market strategist at Voya Financial said “Biotechs had been beaten down so much that a rebound was inevitable, it’s a reversion to the mean.”

NEW YORK. Bursa AS ditutup positif pada Rabu (30/3). Mengutip data Bloomberg,pada pukul 16.00 waktu New York, indeks Standard & Poor's 500 naik 0,9% menjadi 2.055,01. Ini merupakan posisi tertinggi sejak 30 Desember lalu.

Sedangkan indeks Dow Jones Industrial Average naik 0,6% menjadi 17.633,11. Indeks Nasdaq bahkan mendaki lebih tinggi sebesar 1,7% akibat lompatan saham-saham berbasis teknologi. Sementara, indeks Russell 2000 melaju 2,7%, kenaikan tertinggi dalam dua bulan terakhir.

Bursa AS sumringah setelah pimpinan The Fed Janet Yellen memberikan sinyal bahwa bank sentral AS akan lebih berhati-hati dengan langkah kebijakan kenaikan suku bunga acuan mengacu pada risiko global. Pernyataan tersebut mementahkan pendapat yang mendukung kenaikan suku bunga (hawkish) yang sebelumnya diutarakan oleh pimpinan The Fed lain.

"Yellen kembali menegaskan bahwa bank sentral akan lebih berhati-hati, dan market menemukan kenyamanan dari pernyataan tersebut. Tidak ada kejutan berarti tadi malam yang membuat pasar bergerak ke arah sebaliknya. Saat ini, investor bisa kembali mengacu pada data-data ekonomi dan kinerja emiten," papar Richard Sichel, chief investment officer Philadelpia Trust Co.

Sekadar informasi, indeks S&P sudah reli selama lima pekan berturut-turut sehingga menghapus seluruh penurunan di 2016. Jika dilihat dari posisi terendah dalam 22 bulan pada 11 Februari lalu, indeks acuan AS ini sudah melonjak 12%.

"Yellen ingin memberitahukan bahwa The Fed masih menjadi teman baik market, serta biaya pinjaman dan biaya modal masih akan rendah," jelas David Sowerby, portfolio manager Loomis Sayles & Co. Dia menambahkan, hal ini menjadi faktor utama penegerek pasar saham.

Saat berpidato pada acara Economic Club of New York, Yellen bilang, akan lebih bijaksana jika bank sentral berhati-hati dalam mengambil sebuah kebijakan. Apalagi, kondisi ekonomi dan finansial Amerika tidak sebaik bulan Desember saat The Fed menaikkan suku bunga untuk pertama kalinya dalam sembilan tahun.

Yellen juga mengatakan, perekonomian AS dan kondisi pasar tenaga kerja mulai membaik. Namun, dia mencemaskan mengenai lambatnya kemungkinan lenaikan suku bunga. Menurutnya, The Fed masih memiliki kemampuan untuk menetapkan kebijakan yang akomodatif.

New York, March 23, 2016 (AFP)

The dollar advanced Wednesday after a Federal Reserve official said the US central bank should consider hiking interest rates next month if economic data cooperate.

James Bullard, president of the Federal Reserve Bank of St Louis, said the US central bank should weigh a rate hike if the March jobs report is solid, according to Bloomberg News.

"You get another strong jobs report, it looks like labor markets are improving, you could probably make a case for moving in April," Bullard said.

The remarks came a week after the Fed kept interest rates unchanged and signaled a more gradual pace of rate increases due to slowing global growth.

But Fed officials have adopted a different tone this week, said Omer Esiner, chief market analyst at Commonwealth Foreign Exchange.

"A number of Fed speakers this week have so far sounded a generally hawkish tone with regards to the outlook for monetary policy, in a little bit of a contrast to what we saw last week in the Fed policy statement," he said.

"That's what's basically supporting the dollar."

<pre> 2100 GMT Wednesday Tuesday

EUR/USD 1.1183 1.1216

EUR/JPY 125.72 126.01

EUR/CHF 1.0905 1.0911

EUR/GBP 0.7923 0.7890

USD/JPY 112.43 112.35

USD/CHF 0.9751 0.9727

GBP/USD 1.4116 1.4215

</pre>

The dollar advanced Wednesday after a Federal Reserve official said the US central bank should consider hiking interest rates next month if economic data cooperate.

James Bullard, president of the Federal Reserve Bank of St Louis, said the US central bank should weigh a rate hike if the March jobs report is solid, according to Bloomberg News.

"You get another strong jobs report, it looks like labor markets are improving, you could probably make a case for moving in April," Bullard said.

The remarks came a week after the Fed kept interest rates unchanged and signaled a more gradual pace of rate increases due to slowing global growth.

But Fed officials have adopted a different tone this week, said Omer Esiner, chief market analyst at Commonwealth Foreign Exchange.

"A number of Fed speakers this week have so far sounded a generally hawkish tone with regards to the outlook for monetary policy, in a little bit of a contrast to what we saw last week in the Fed policy statement," he said.

"That's what's basically supporting the dollar."

<pre> 2100 GMT Wednesday Tuesday

EUR/USD 1.1183 1.1216

EUR/JPY 125.72 126.01

EUR/CHF 1.0905 1.0911

EUR/GBP 0.7923 0.7890

USD/JPY 112.43 112.35

USD/CHF 0.9751 0.9727

GBP/USD 1.4116 1.4215

</pre>

ID: Menurut Lana Soelistianingsih, likuiditas global cenderung terus bertambah setelah sejumlah bank sentral beberapa negara maju menetapkan kebijakan suku bunganya.

Pekan lalu, The Fed memutuskan untuk mempertahankan suku bunga acuannya pada posisi 0,25-0,50%. The Fed cenderung menunggu lebih lama untuk menilai prospek ekonomi AS, sebelum menaikan suku bunganya.

“Aksi The Fed menambah daftar ekspansi bank sentral dunia, setelah BoJ menerapkan suku bunga negatif dan ECB meluncurkan stimulus. Pengaruh aksi ketiganya adalah menambah uang beredar di global,” ujar dia.

Kecuali mempertahankan Fed funds rate (FFR), The Fed dalam pertemuan Komite Pasar Terbuka Federal (FOMC) di Washington pekan lalu mengisyaratkan hanya akan dua kali menaikkan suku bunga acuan tahun ini ke level 0,90%. The Fed sebelumnya mengindikasikan penaikan FFR hingga empat kali masing-masing 25 bps sepanjang tahun ini.

Sejalan dengan itu, tren suku bunga negatif melanda sejumlah negara, seperti Denmark (-0,65%), Swiss (-0,75%), dan Swedia (-0,50%), sedangkan ECB memberlakukan suku bunga minus 0,30%. Kanada, Inggris, dan Norwegia juga memberlakukan suku bunga rendah, masing-masing 0,25%, 0,50%, dan 0,75%.

Lana menjelaskan, para pengelola dana asing (hedge funds) selalu mencari tempat investasi dengan hasil investasi (return) menjanjikan. Ini berarti, meski sentimen sepanjang pekan ini sebetulnya cukup sepi, IHSG bakal terdorong oleh aksi beli asing.

Indeks diprediksi bergerak dalam kisaran 4.780-4.930 pekan ini, sebelum menembus level psikologis 5.000 dalam jangka menengah. (az/gor)

Baca selanjutnya di

Federal Reserve officials held off from raising borrowing costs and scaled back forecasts for how high interest rates will rise this year, citing the potential impact from weaker global growth and financial-market turmoil on the U.S. economy.

The Federal Open Market Committee kept the target range for the benchmark federal funds rate at 0.25 percent to 0.5 percent, the central bank said in a statement Wednesday following a two-day meeting in Washington. The median of policy makers’ updated quarterly projections saw the rate at 0.875 percent at the end of 2016, implying two quarter-point increases this year, down from four forecast in December.

“The committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will continue to strengthen,” the FOMC said. “However, global economic and financial developments continue to pose risks.”

Kansas City Fed President Esther George dissented from the decision, preferring a quarter-point rate increase.

Yields on Treasury securities fell following the Fed’s actions, with the rate on the 10-year note dropping to 1.92 percent at 2:10 p.m. in New York from 1.99 percent just before the announcement.

‘Dovish’ Hold

“The tone of the FOMC statement and accompanying economic projections was dovish,” Neil Dutta, head of U.S. economist at Renaissance Macro Research LLC in New York, said in a research note. The reference to global risks “pushes the Fed in the role of the world’s central bank. In this role, the Fed needs to let inflation in the U.S. surge to offset disinflation in the rest of the world.”

Fed Chair Janet Yellen is scheduled to hold a press conference at 2:30 p.m. in Washington to explain the committee’s decision.

Weaker-than-forecast global growth has clouded the U.S. outlook and led investors to expect a slower pace of tightening since the Fed raised rates in December for the first time in almost a decade. Yellen said in February that market turbulence had “significantly” tightened financial conditions by pushing down stock prices, causing the dollar to strengthen and boosting some borrowing costs.

“Economic activity has been expanding at a moderate pace,” with household spending gaining amid “soft” company investment and net exports, the Fed said. While inflation has “picked up in recent months,” market-based measures of inflation compensation are still low, the central bank said.

Median Dot

The median of Fed officials’ projections, known as the “dot plot,” saw the federal funds rate at 1.875 percent at the end of 2017, compared with 2.375 percent forecast in December. The end-2018 level fell to 3 percent, from 3.25 percent, with the longer-run projection at 3.25 percent, down from 3.5 percent.

Policy makers maintained their projections on how soon inflation will return to the Fed’s 2 percent target, while cutting their inflation forecast to 1.2 percent this year from 1.6 percent. Officials still see the preferred price gauge rising 1.9 percent in 2017 and 2 percent in 2018.

Officials maintained their forecast for a 4.7 percent U.S. unemployment rate in the fourth quarter of this year. The median projection for 2017 fell to 4.6 percent from 4.7 percent, and in 2018 to 4.5 percent from 4.7 percent. The rate stood at 4.9 percent in February.

Job Market

“A range of recent indicators, including strong job gains, points to additional strengthening of the labor market,” the FOMC said.

The Fed reiterated that the “stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.”

Economists in a Bloomberg survey conducted earlier this month put the probability of an April rate increase at 15 percent and chances of a June move at 42 percent. That compares to market-implied projections of 25 percent for April and 54 percent for June, according to pricing in fed funds futures as of Tuesday.

Fed officials have differed publicly about economic prospects, with Governor Lael Brainard on March 7 arguing for patience in tightening monetary policy while Vice Chairman Stanley Fischer on the same day pointed to the “first stirrings” of inflation.

Yellen and her colleagues have singled out uncertainty over China’s outlook as a risk to U.S. growth.

Yellen and her colleagues have singled out uncertainty over China’s outlook as a risk to U.S. growth.

Payrolls Climb

The domestic U.S. economy has mostly been solid, however. Payroll gains have averaged 235,000 over the last six months as the jobless rate matched the Fed’s goal for maximum employment, though measures of long-term unemployment and wage growth suggest the labor market still has room to grow.

Some progress has also been made on the inflation side of the Fed’s dual mandate. The personal consumption expenditures price index, which the Fed targets at 2 percent annual gains, rose 1.3 percent in January from a year earlier, after 13 consecutive months with rises below 1 percent, owing to a slide in energy prices.

The separate consumer price index released Wednesday showed prices, excluding food and energy, rose by a greater-than-anticipated 0.3 percent in February from the previous month.

Oil Prices

Oil prices have surged around 40 percent since mid-February, when the cost for a barrel of crude fell to about $26, the lowest since 2003.

U.S. stock markets, which had slumped by more than 10 percent by mid-February from the start of the year, have also regained ground, with the Standard and Poor’s 500 Index now down just 1.4 percent this year through Tuesday. Meanwhile the dollar, whose strength in 2015 hurt U.S. exports and dented growth, has slipped about 1.3 percent against a broad basket of currencies since Dec. 31.

The Fed’s tightening bias contrasts with aggressive easing abroad.

The European Central Bank unleashed another round of unprecedented stimulus last week that included a cut in a key interest rate further below zero.

In Tokyo, the Bank of Japan held fire on further stimulus Tuesday but laid the groundwork for additional easing after cutting its deposit rate to minus 0.1 percent in January.

China’s central bank cut the main interest rate to a record low in six successive reductions through October, and recently made another reduction to the required-reserve ratio for major banks.

(Updates with Treasury yields and economist comment in fifth and sixth paragraphs.)

WASHINGTON (MarketWatch) — The Federal Reserve held interest rates steady Wednesday and signaled it will lift them more slowly than previously indicated because of a weak global environment and volatile stock market.

The Fed said in a statement said its rate-setting Federal Open Market Committee decided to leave the central bank’s benchmark interest rate in a range of 0.25%-0.5%. The decision was widely expected.

The big change was in the Fed’s so-called “dot plot,” where officials penciled in only two quarter-point hikes this year, down from four in December.

“We continue to see risks,” Fed Chairwoman Janet Yellen said in a press conference after top officials met. But she also pointed out that “the U.S. economy has been very resilient in recent months.”

Just a few months ago, the Fed appeared ready to embark on a series of interest-rate increases after determining the economy was strong enough to handle it. Yet big losses in the stock market early in the year, slowing U.S. growth and fresh worries the global economy spurred the Fed to back off.

Financial markets don’t expect a rate hike before June.

More recently the U.S. economy seems to have stabilized, easing some of the Fed’s concerns. The central bank on Wednesday pointed to improved consumer spending, a stronger housing market and “strong job gains.”

Yet the Fed acknowledged that exports and business investment remain soft. Inflation is expected to remain on the low side this year, even though there are some signs that price pressures are building.

The Fed predicted its preferred PCE inflation gauge will end 2016 at 1.2%, down from a prior forecast of 1.6%. The bank wants to see inflation rise to the 2% level it considers a sign of a healthier economy.

”What the Fed is saying is that they are willing to tolerate some more inflation,” said John Canally, an economist and investment strategist at LPL Financial.

The FOMC vote was 9-1. Kansas City Fed President Esther George dissented in favor of a quarter-point rate increase.

JAKARTA. Sebagian besar analis yang terdaftar dalam konsensus Bloombergmemprediksi Fed Rate yang akan diumumkan besok, Kamis 17 Maret 2016 (dini hari) tidak akan berubah.

Rapat Fed Rate telah digelar per hari ini dimana akan dibahas penentuan suku bunga acuan Amerika Serikat. Sebelumnya, suku bunga acuan telah ditetapkan berada di level 0,5% pada 16 Desember 2015 setelah satu dasawarsa stagnan di level rendah.

Dari 98 analis AS yang terdaftar di konsensus Bloomberg, sebagian besar 96% atau 94 analis memperkirakan Fed Rate tidak akan berubah alias stagnan.

Hanya 4 analis yang memperkirakan bahwa Fed Rate akan naik 25 basis poin (bps) ke level 0,75%.

Rapat umum Fed Rate digelar selama dua hari sejak per hari ini dan akan diumumkan besok atau Kamis dinihari WIB.

http://finansial.bisnis.com/read/20160316/11/528610/prediksi-fed-rate-96-analis-perkirakan-fed-rate-tetap

Sumber : BISNIS.COM

per tgl 15 Mar 2016: Investing.com - The dollar remained broadly higher against the other major currencies on Monday, as investors continued to focus on the Federal Reserve’s upcoming policy meeting this week.

EUR/USD slid 0.46% to 1.1097.

The single currency remained under pressure after the European Central Bank cut interest rates across the euro zone to new record lows and boosted its quantitative easing program last Thursday.

The ECB cut its benchmark interest rate to a record-low of zero from 0.05% and boosted its quantitative easing program by €20 billion per month to €80 billion, starting in April.

USD/JPY was little changed at 113.78.

Investors were turning their attention to the outcome of Japanese and U.S. central bank policy meetings scheduled this week.

The Fed was not widely expected to raise interest rates at the conclusion of its meeting on Wednesday, given recent signs of weakness in the global economy

But the U.S. central bank was likely to signal that rates will rise fairly soon as long as U.S. inflation and jobs continue to strengthen.

The Bank of Japan was also expected to keep monetary policy unchanged when its meeting ends on Tuesday after its shock decision to adopt negative interest rates in January, which did little to weaken the yen.

The dollar was higher against the pound and the Swiss franc, with GBP/USD down 0.47% at 1.4316 and with USD/CHF advancing 0.42% to 0.9867.

Meanwhile, the Australian and New Zealand dollars were weaker, with AUD/USD down 0.79% at 0.7504 and with NZD/USD retreating 0.89% to 0.6684.

USD/CAD climbed 0.56% to 1.3289. The commodity-related loonie weakened as oil pricespulled back from three-month highs after Iranian Oil Minister Bijan Zanganeh said his country won't join a group production freeze until it doubles its post-sanctions output.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, was up 0.43% at 96.64, pulling away from Friday’s one-month low of 95.94

Slow wage growth can’t be pinned only on labor market slack and inflation could remain in check for now

WASHINGTON (MarketWatch) — Slow wage growth since the Great Recession is not necessarily a sign of a weak labor market, but rather is due to special factors including higher-paid baby boomer retirement, according to new research released Monday by the San Francisco Federal Reserve.

The report suggests it could be a mistake for the Fed to wait for a pickup in wages before raising interest rates. In other words, the labor market may be stronger than it appears on the surface. But neither should policy makers jump to conclusions about inflation, which could remain in check for the near term.

Wages, or lack of thereof, have been a key puzzling factor in trying to pin down interest rate expectations. A decline in average hourly earnings was one negative in an otherwise solid job report for February released late last week.

Slow wages are often seen as a sign of low inflation and labor-market slack, two forces that allow the Fed to be patient in raising interest rates.

In fact, over the past two years, average wage growth across four separate measures of wages has been hovering around 2.25% for the past two years despite steady improvement in labor market conditions. That’s significantly below the 3.25% average wage growth from 1983 to 2015.

The findings, by Mary Daly, senior vice president and associate director of research at the San Francisco Fed, Bart Hobijn, a professor of economics at Arizona State University, and Benjamin Pyle, a research associate at the San Francisco Fed, found that special factors are holding down wages.

One factor is that low-wage workers are moving to full-time jobs. The vast majority of these new workers earn less than the typical full-time employee, so their entry pushes down the average wage, the researchers found.

In addition, the exit of higher-paid retirees have also pushed down wage growth. This “silver tsunami” is expected to be a drag on wage growth for some time.

“Correcting for worker composition changes, wages are consistent with a strong labor market that is drawing low-wage workers into full-time employment,” the study found.

Will this boost inflation? Not necessarily. As long as employers can keep their wage bills low, labor cost pressures for higher inflation could remain muted “for some time,” the researchers said.

However, if the lower-wage workers are less productive, companies may face a spike in their unit labor costs that they’ll presumably be forced to pass along in higher prices.