AEI: CHINA'S MONETARY POLICY PLANS: EFFECT ON CONSUMERS AND INVESTORS

Monetary policy is important because it has an immense impact on financing conditions in the economy. It influences prices, the availability of credit, bank’s willingness to assume risk, inflationary expectations and ultimately consumption and investment.

The People’s Bank of China, China’s central bank, has committed to the “moderately loose” monetary policy

that has helped the economy recover from the global economic slump. Over the next two quarters, the central bank

will pay attention to the increase in domestic

prices and inflation

by fine-tuning its monetary policy, according to a recent article

In its quarterly monetary policy

report, the PBOC said, “In the period ahead, the People’s Bank of China (PBOC) will unswervingly implement the appropriately loose monetary policy while fine-tuning policy with market-oriented tools in line with economic changes at home and abroad.” Liu Yuhui, the director of the Center for Chinese Economic Evaluation at the Chinese Academy of Social Sciences told China Daily that the bank has already initiated some micro-tightening measures like openmarket

operations. In addition, China’s top banking regulator urged lenders to limit lending and focus on strengthening the credit

When the central government wants to tighten monetary policy it tries to absorb excessive liquidity. The bank is currently selling more bills to mop up cash, since M2, the broadest measure of money

rose a record 28.5 percent in June 2009 compared to a year earlier. Furthermore, the central bank has kept interest

rates and reserve requirements for banks unchanged this year after cutting them at the end of 2008 to combat the global credit crisis. These actions hint that stricter monetary policy is on its way, causing investors to worry. The expectation of higher borrowing

costs will result in lower investment

The Effect on Consumers and Investment:

Tighter monetary policy means that the cost of borrowing will increase. Recently, China’s central bank decided to keep its interest rate at the same level after slashing interest rates at the end of 2008. China cut its interest rate from 6.66% in October 2008 to 5.31% in December 2008. Since then it has remained at the same level. The bank’s decision to keep interest rates at 5.31% for the time being is a way the central bank is moderating its loose monetary policy and transitioning to a tighter monetary policy to support the economy as it recovers.

Investors and consumers are worried about the effect a tighter monetary policy will have on the economic recovery. Interest

rates may affect consumer spending. When interest rates are higher, consumers will spend less and save more, weakeningdemand

in the short

run. They will want to spend less on illiquid assets when their financial situation worsens and thus invest less in consumer durables, such as cars, business

in the money supply by the central bank is achieved through an increase in short-term

market rates through interest rates. As a result, the real

interest rate and capital

Tight monetary policy will reduce banks’ assets either directly or indirectly, by limiting credit creation

when tighter reserve requirements are imposed. This will lead to reduction in loans, thus in investment. Consumers are worried that central banks will increase the reserve ratio, according to Wang Zheng, a fund manager at Jingxi InvestmentManagement Co. The increase in reserve ratio

will influence commercial banks’ refinancing cots. If finance costs increase (as they will with higher interest rates) banks will pass on the costs to consumers and investors (borrowers) which will discourage many from borrowing and thus decrease investment and consumer spending.

Also, an increase in interest rates may increase the risk

that some borrowers cannot pay back their loans. Banks might become reluctant to give out more loans to those borrowers (consumers or investors) and they will be forced to cut back on planned expenditures.

“In the first half, we had excessively loose monetary policy and now, in the second half, we’re moving into appropriately loose monetary policy,” Zuo Xiaolei, Galaxy Securities

Co. chief economist said Xiaolei added “The central bank is doing the right thing,” Xiaolei said, without specifying how it may tighten policy. “China needs stable

economic growth. China doesn’t need big ups and downs.” The PBOC has already begun absorbing excessive liquidity

through open market operations in order to ease inflationary threats. By withdrawing money from circulation and raising the cost of financing. In Wednesday, August 5th, the central bank released a report where they promised to “use market oriented methods to carry out dynamic fine-tuning taking into consideration domestic and international

“As the recovery becomes more solid in the third quarter, we expect an orderly winding down of stimulus policies beginning in the fourth quarter

or early next year. The key move will be the first hike in the reserve requirement,” said a report from Standard

While investors and consumers worry, others, like strategist Jerry Lou, from Hong Kong thinks the government may not go in for a tight monetary policy yet. “We assume there would be two rate increases in the second half of 2010,” he said.

Jakarta (ANTARA News) - China hari ini melemahkan tingkat referensi yuan terhadap dolar AS menjadi di atas 6,9 per dolar AS yang merupakan untuk pertama kalinya ditempuh dalam delapan tahun terakhir. Langkah ini adalah respons atas terus menguatnya dolar AS terhadap yuan yang tingkat nilainya sangat dikendalikan oleh pemerintah China.

Bank sentral China, Bank Rakyat China, mematok nilai mata uang yang juga disebut renminbi itu pada 6,9085 per satu dolar AS, turun 0,26 persen dari nilai sehari sebelumnya.

Dolar AS menguat ke posisi tertinggi dalam 14 tahun setelah pasar memperkirakan bank sentral AS Federal Reserve bakal menaikkan suku bunga bulan depan.

China hanya menoleransi yuan naik atau turun dua persen, dalam upaya mempertahankan pengendalian nilai mata uang.

Yuan telah melemah selama 12 sesi berturut-turut, termasuk kemarin, sedangkan hari ini mencapai level terendah sejak Juni 2008.

"Tidak ada alasan fundamental bagi CNY (yuan) untuk bergerak selain melemah," kata Michael Every, kepada riset pasar keuangan Asia Pasifik pada Rabobank seperti dikutip AFP.

BEIJING china daily- China's yuan fell for a ninth consecutive day on Wednesday, but experts believe there is no basis for substantial depreciation in the longer term.

Bank sentral China, Bank Rakyat China, mematok nilai mata uang yang juga disebut renminbi itu pada 6,9085 per satu dolar AS, turun 0,26 persen dari nilai sehari sebelumnya.

Dolar AS menguat ke posisi tertinggi dalam 14 tahun setelah pasar memperkirakan bank sentral AS Federal Reserve bakal menaikkan suku bunga bulan depan.

China hanya menoleransi yuan naik atau turun dua persen, dalam upaya mempertahankan pengendalian nilai mata uang.

Yuan telah melemah selama 12 sesi berturut-turut, termasuk kemarin, sedangkan hari ini mencapai level terendah sejak Juni 2008.

"Tidak ada alasan fundamental bagi CNY (yuan) untuk bergerak selain melemah," kata Michael Every, kepada riset pasar keuangan Asia Pasifik pada Rabobank seperti dikutip AFP.

💤

BEIJING china daily- China's yuan fell for a ninth consecutive day on Wednesday, but experts believe there is no basis for substantial depreciation in the longer term.

The central parity rate of the yuan weakened 97 basis points to 6.8592 against the dollar, according to the China Foreign Exchange Trading System.

It is the yuan's weakest level against the dollar in over eight years, and the longest losing streak since December 2015.

The recent yuan depreciation is partly due to stronger expectations of an interest rate increase by the US Federal Reserve, said Zhong Yue, analyst at Forextime Ltd, a global online foreign exchange transaction provider.

Political uncertainties have eased in the United States after Donald Trump defeated Democratic candidate Hillary Clinton in the presidential election, leading to a stronger dollar and an expectation of a US interest rate hike.

China's economy expanded 6.9 percent in 2015, the slowest pace in a quarter of a century. Despite signs of stabilizing in recent months, the country is still having a hard time managing an increasingly overheated property market and stemming capital outflows.

Trade relations with the US are expected to be dreary as Trump has threatened a 45-percent tariff on imports from China.

Facing uncertainty in China-US trade, it is possible that China may take the opportunity to release the pressure in advance, allowing the yuan to weaken somewhat as the dollar rises, said Huili Chang, analyst at China International Capital Corp.

Yu Yongding, economist and former central bank advisor, applauded the central bank for decreased intervention in the yuan's exchange rate, saying it will help ensure monetary policy independence.

"There is no need to fear the depreciation of the yuan. Currently, the benefits of a weaker yuan outweigh the downsides, as a weaker yuan is conducive to boosting exports and curbing capital outflows," Yu added.

Last week, trade data showed China's exports and imports fell year on year in October due to weak domestic and global demand.

China has the world's largest currency stash. It fell to $3.12 trillion at the end of October, down $45.7 billion from a month earlier, marking the lowest level since March 2011. However, a stronger dollar accounts for much of that change.

Looking ahead, the yuan may come under short-term pressure but have limited room for further weakening.

Analysts also ruled out the possibility of substantial depreciation in the longer term as China continues to witness steady economic growth, progress in economic restructuring and a stable financial market.

"There is no basis for a sustained depreciation trend for the yuan, and we maintain the forecast of 6.98 for the end of 2017," Chang said.

Because there is enough fuel in the tank to achieve the government's target of 6.5 to 7 percent economic growth for the year, analysts also think room for further monetary easing is limited.

In China's spot foreign exchange market, the yuan is allowed to rise or fall by 2 percent from the central parity rate each trading day. The central parity rate of the yuan against the dollar is based on a weighted average of prices offered by market makers before the opening of the interbank market each business day.

👽👽

Beijing, Nov 8, 2016 (AFP)

Chinese exports sank for a seventh consecutive month in October, data showed Tuesday, as weak global demand dealt a blow to the world's number two economy following recent signs of stability.

The result, which also missed forecasts, comes as the country's export-oriented companies see their margins squeezed by rising labour costs and increasing competition from southeastern Asian countries.

Overseas shipments fell 7.3 percent on-year, while imports also fell 1.4 percent, with both coming in below expectations in a survey of economists by Bloomberg News.

China is the world's biggest trader in goods and its performance affects partners from Australia to Zambia, which have been battered as its expansion has slowed to levels not seen in a quarter of a century.

With exports totalling $178.2 billion and imports $129.1 billion the trade surplus dropped to $49.1 billion in the month.

Customs earlier gave the figure in yuan terms, showing a 3.2 percent drop in exports and a 3.2 percent increase in imports on-year.

Analyst Julian Evans-Pritchard of Capital Economics said the outlook appeared challenging with "global and domestic growth unlikely to accelerate much further".

"The current pace of global growth is likely to be as good as it gets for the foreseeable future."

Though the yuan currency's value has slid to a series of six-year lows against the greenback in recent weeks, making Chinese goods cheaper for trade partners, it has not been enough to lift exports into positive territory.

The yuan weakened further Tuesday after the People's Bank of China said the country's foreign exchange reserves dropped nearly $46 billion in October, their second-largest decline this year as capital outflows eat into the world's largest stockpile.

While Tuesday's trade figures disappointed, analysts with ANZ said they suggested that external demand had "not worsened significantly" despite earlier data on factory activity that pointed to a larger decline.

Beijing is seeking to transition the economy away from being the world's factory floor for cheap goods to supplying the country's growing consumer needs.

"Trade's contribution to China's economy is now diminishing as the economy increasingly depends on domestic demand," Zhu Qibing, chief macro economy analyst at BOCI International in Beijing told Bloomberg.

Authorities have set a growth target of 6.5 to 7 percent for the year, which they are on track to meet thanks to loose credit, a red-hot real-estate sector, and fiscal stimulus spending on infrastructure.

Government figures last month showed growth was steady at 6.7 percent in the third quarter, a sign of stabilisation after years of slowing.

Investors shrugged off latest trade figures, with Chinese stocks moving solidly higher by the noon break Tuesday.

Bisnis.com, JAKARTA– Kinerja ekspor China kembali mencatatkan penurunan untuk bulan ketujuh berturut-turut, sehingga membuat para pembuat kebijakan bergantung pada pertumbuhan domestik demi mencapai target pertumbuhan ekonomi mereka.

Seperti dilansir Bloomberg hari ini (Selasa, 8/11/2016), tingkat ekspor negara tersebut drop 7,3% dalam mata uang dolar pada Oktober dibandingkan dengan setahun sebelumnya.

Sementara itu, performa impor turun 1,4%. Surplus perdagangan US$49,1 miliar.

Depresiasi sekitar 9% pada yuan sejak Agustus 2015 disebut telah melindungi pukulan dari lesunya permintaan global, tapi gagal untuk memberi dorongan berkelanjutan pada ekspor.

Meningkatnya biaya input serta melonjaknya upah telah meratakan margin keuntungan eksportir ke titik dimana tidak dapat lagi ada pemotongan maupun menaikkan harga.

Dengan lesunya permintaan global, para pembuat kebijakan mengandalkan investasi infrastruktur dan properti yang memimpin peningkatan pada permintaan lokal untuk meraih target pertumbuhan setidaknya 6,5% tahun ini.

"Permintaan eksternal belum rebound, sehingga data perdagangan lemah. Pemilihan Presiden AS yang akan datang juga memberi ketidakpastian pada China. Jika Trump menang, perdagangan akan sangat terpengaruh, tidak hanya untuk China, tapi juga secara global,” ujar Iris Pang, Ekonom senior untuk Greater China dari Natixis SA.

Pada Oktober, ekspor China ke AS dan Uni Eropa masing-masing turun 5,6% dan 8,7%, sedangkan impor dari AS melemah 6,9%.

Beijing-Kurs tengah nilai tukar mata uang Tiongkok renminbi atau yuan, melemah 38 basis poin menjadi 6,7296 terhadap dolar AS pada Kamis (13/10/2016), menurut Sistem Perdagangan Valuta Asing Tiongkok.

Di pasar spot valuta asing Tiongkok, yuan diperbolehkan untuk naik atau turun sebesar dua persen dari tingkat paritas tengahnya setiap hari perdagangan.

Kurs tengah yuan terhadap dolar AS didasarkan pada rata-rata tertimbang harga yang ditawarkan oleh pelaku pasar sebelum pembukaan pasar uang antar bank setiap hari kerja.

http://pasarmodal.inilah.com/read/detail/2331138/yuan-tiongkok-melandai-jadi-67296-per-dolar-as

Sumber : INILAH.COM

Beijing - Kurs tengah nilai tukar mata uang China renminbi atau yuan, menguat 98 basis poin menjadi 6,6646 terhadap dolar AS pada Selasa, menurut Sistem Perdagangan Valuta Asing China.

Di pasar spot valuta asing Tiongkok, yuan diperbolehkan untuk naik atau turun sebesar dua persen dari tingkat paritas tengahnya setiap hari perdagangan.

Kurs tengah yuan terhadap dolar AS didasarkan pada rata-rata tertimbang harga yang ditawarkan oleh pelaku pasar sebelum pembukaan pasar uang antar bank setiap hari kerja.

Pada akhir perdagangan New York, euro naik menjadi 1,1258 dolar AS dari 1,1230 dolar AS pada sesi sebelumnya, dan pound Inggris naik menjadi 1,2970 dolar AS dari 1,2958 dolar AS. Dolar Australia naik menjadi 0,7639 dolar AS dari 0,7617 dolar AS.

Dolar AS dibeli 100,35 yen Jepang, lebih rendah dari 101,10 yen di sesi sebelumnya. Dolar AS merosot menjadi 0,9686 franc Swiss dari 0,9697 franc Swiss, dan sedikit menguat menjadi 1,3212 dolar Kanada dari 1,3174 dolar Kanada.

http://pasarmodal.inilah.com/read/detail/2327227/yuan-china-tekan-dolar-ke-area-negatif

Sumber : INILAH.COM

INILAHCOM, New York - Banyak para pemimpin dunia mengagumi pembangunan di China yang pesat saat berkesempatan menghadiri KTT G20 di Hangzhou 4-5 September kemarin. Tetapi kenapa akademisi mengkhawatirkan sepak terjang pembangunan infrastruktur China.

Mayoritas kota-kota di China telah bertebaran gedung bertingkat, jalan yang meliuk-liuk bertingkat dan panjang, jembatan yang mega, bandara yang mewah dan jaringan kereta api cepat. Bahkan beberapa politisi, ekonom AS termasuk Presiden Barack Obama mengagumi investasi besar-besaran China untuk proyek transportasi baru.

Mereka berharap dapat melakukan hal yang sama di AS dan negaranya masing-masing. Namun sebuah penelitian di Universitas Oxford, Inggris menunjukkan pendekatan pembangunan China sebagai model yang harus dihindari. Bahkan akan bisa menjadia pemicu krisis global ke depan.

Banyak anggota parlemen dan ekonom memuji investasi yang dilakukan China untuk membangun jalan baru, kereta api, jembatan dan bandara. Langkah itu dinilai telah meningkatkan pertumbuhan ekonomi dan mengurangi pengangguran. Bahkan sebagian menilai pemerintah yang otoritas lebih mampu membangun dari pada pemerintah yang demokratis.

"Bagaimana kita hanya duduk menonton China dan Eropa membangun jembatan terbaik dan rel kereta api berkecepatan tinggi, bandara baru. Kami melakukan apa?" keluh Obama dalam pidatonya beberpa tahun lalu untuk mendesak Kongres meningkatkan anggaran pembangunan infrastruktur.

Namun dalam sebuah makalah, empat profesor dari universitas tersebut menegaskan investasi China mengabaikan beban biaya yang besar. Ini terjadi di mayoritas proyek-proyek selama tiga dekade terakhir. Namun proyek tersebut gagal memberikan manfaat yang menjanjikan dan memainkan peran dalam mewujudkan negara yang lebih makmur.

"China bukan model membangun perekonomian untuk diikuti negara lain baik negara berkembang maupun negara yang mau berkembang. Dalam hal investasi infrastruktur sebagai model yang harus dihindari," tulis profesor Atif Ansar, Bent Flyvbjerg, Alexander Budzier dan Daniel Lunn seperti mengutip marketwatch.com.

Pada peneliti tersebut menilai, pendekatan China dalam membangun investasinya jauh lebih mahal dan kurang menguntungkan tidak sebanding dengan kemegahannya. Dalam beberapa proyek terjadi manipulasi peruntukkan, dirancan dengan buruk dan diputusakan hanya secara politis. Namun kualitas, keamanan dan isu-isu lingkungan tidak dipertimbangkan. Pemerintah sering menggunakan kekuasaannhya untuk mendapatkan lahan bahkan sampai menggusur rumah warga dan menyita aset rumah dan properti.

Proyek kereta api dan jalan di China dibangun antara 1984 hingga 2008. Peneliti membandingkan dengan proyek serupa di negara lainnya termasuk yang berazaz demokrasi maka terdapat overruns biaya rata-rata 30 persen untuk tiga seperempat proyek di China. Ini jauh berbeda dengan penelitian proyek di AS, Eropa dan Jepang.

Kemudian bagaimana dengan gelombang pesat pertumbuhan ekonomi China yang dimulai pada akhir tahun 1980 an sehingga menjadikan China sebagai negara dengan ekonomi terbesar kedua di dunia? Para peneliti menegaskan China meningkatkan pertumbuhan dengan investasi yang cukup rendah. Mereka masih memprioritaskan reformasi hukum liberalisasi ekonomi. Langkah ini memiliki peran lebih besar untuk kebangkitan ekonomi.

Kebijakan sekarang justru mengandung bahaya. Investasi yang ditingkatkan sebagai upaya menjaga perekonomian tumbuh dengan tinggi tetapi gagal memberikan tingkat pengembalian modal. Kekuatan politik masih lebih dominan. Walaupun dari data tahun 2014, China menyumbang seperempat dari investasi tetap secara global. Naik 2,1 persen dari tahun 1982 silam.

Namun hasilnya, nilai utang pemerintah China dan sektor swasta lebih tinggi dari negara yang berazaz demokrasi. "Dengan demikian kita menolak teori ortodoks bahwa investasi besar dalam infrastruktur mendorong pertumbuhan," tulis para peneliti tersebut.

China telah bergeser dari investasi infrastruktur berkualitas tinggi ke yang lebih rendah. China sedang menuju krisis keuangan dan ekonomi nasional yang berbasis infrastruktur. Namun karena peran penting China dalam perekonomian global, mungkin juga menjadi krisis internasional.

Kekhawatiran tentang investasi tinggi China dan meningkatnya tingkat utang tidak dapat dihindari. Pengamat sudah memberikan peringatan. Bahkan situs web resmi IMF mengatakan kalau China masih memiliki banyak pekerjaan berat.

"Ekonomi China seperti besar, bak kapal bertenaga tinggi yang berlayar masih cepat. Tetapi dalam kondisi miring," tulis LOngmei Zhang, ekonom IMF untuk Asia Pasifik.

Namun yang pasti, situasi di AS berbeda. Banyak jalan, jembatan dan jaringan transportasi penting yang belum memakan biaya pemeliharaan yang tinggi. Namun AS bisa memerlukan puluhan triliun dolar selama dekade ke depan untuk menjaga ketersediaan infrastruktur. Dan kedua kandidat capres, Hillary Clinton dan Donald Trump sudah berjanji untuk mengalokasikan anggaran lebih banyak.

- See more at: http://pasarmodal.inilah.com/read/detail/2323060/peneliti-sebut-ekonomi-china-simpan-bahaya-krisis#sthash.IvgKLdH9.dpuf

Beijing-Kurs tengah nilai tukar mata uang Tiongkok renminbi atau yuan, melemah 65 basis poin menjadi 6,6620 terhadap dolar AS pada Kamis (8/9/2016), menurut Sistem Perdagangan Valuta Asing Tiongkok.

Di pasar spot valuta asing Tiongkok, yuan diperbolehkan untuk naik atau turun sebesar dua persen dari tingkat paritas tengahnya setiap hari perdagangan.

Kurs tengah yuan terhadap dolar AS didasarkan pada rata-rata tertimbang harga yang ditawarkan oleh pelaku pasar sebelum pembukaan pasar uang antar bank setiap hari kerja.

http://pasarmodal.inilah.com/read/detail/2323042/yuan-tiongkok-kalah-jadi-66620-per-dolar-as

Sumber : INILAH.COM

Di pasar spot valuta asing Tiongkok, yuan diperbolehkan untuk naik atau turun sebesar dua persen dari tingkat paritas tengahnya setiap hari perdagangan.

Kurs tengah yuan terhadap dolar AS didasarkan pada rata-rata tertimbang harga yang ditawarkan oleh pelaku pasar sebelum pembukaan pasar uang antar bank setiap hari kerja.

http://pasarmodal.inilah.com/read/detail/2323042/yuan-tiongkok-kalah-jadi-66620-per-dolar-as

Sumber : INILAH.COM

JAKARTA sindonews - Menteri Keuangan Sri Mulyani Indrawati mengatakan, China saat ini sudah mengalokasikan dana 60% APBN negaranya untuk menutup pabrik-pabrik mereka akibat kelebihan produksi. Hal ini seiring dengan perekonomian global yang belum membaik dan tergerusnya ekonomi negara berkembang dan maju, termasuk China.

Di sana, kata Sri Mulyani, sama seperti negara-negara lainnya yang ekonominya mengalami penurunan, dibahas mengenai stagnasi produktifitas yang luar biasa.

"Menteri keuangan Republik Rakyat China (RRC) ini bilang dalam forum G20, bahwa mereka mengalokasikan 60% dari APBN itu untuk menutup pabrik. 60% dari local governance," kata Ani--sapaan akrabnya--saat rapat dengan Komisi XI DPR RI, Jakarta, Rabu (7/9/2016).

China sendiri melakukan hal tersebut bukan tanpa alasan. Ani menjelaskan, Negeri Tirai Bambu tersebut merasa harus melakukan lantaran lemahnya permintaan dari negara-negara mitra dagang mereka.

Sehingga, bukan tidak mungkin, kegiatan ekspor impor RRC selama beberapa tahun terakhir juga menurun lantaran kondisi tersebut. "Apa yang akan terjadi sama China ya seperti itu sekarang. Ekspor impor mereka belum membaik ditambah mereka harus tutup pabrik karena demand produk-produk mereka menurun," kata Ani.

Sedangkan dari sisi korporasi dan private sector pun demikian. Pengusaha di sana, meski memiliki uang, mereka mengurungkan niat untuk melakukan investasi.

"Begitu juga dengan konsumsi rumah tangga, mereka lebih bersikap konservatif, sehingga engine dari demand di keduanya masih lemah sampai saat ini," pungkasnya.

(ven)

INILAHCOM, Beijing - Kurs tengah nilai tukar mata uang China renminbi atau yuan, melemah 182 basis poin menjadi 6,6602 terhadap dolar AS pada Kamis (25/8/2016), menurut Sistem Perdagangan Valuta Asing China.

Di pasar spot valuta asing China, yuan diperbolehkan untuk naik atau turun sebesar dua persen dari tingkat paritas tengahnya setiap hari perdagangan.

Kurs tengah yuan terhadap dolar AS didasarkan pada rata-rata tertimbang harga yang ditawarkan oleh pelaku pasar sebelum pembukaan pasar uang antar bank setiap hari kerja.

Kurs dolar AS menguat terhadap sebagian besar mata uang utama lainnya pada Rabu di AS. Investor menunggu pidato penting dari Ketua Federal Reserve AS Janet Yellen akhir pekan ini.

Yellen akan berbicara di Simposium Kebijakan Ekonomi di Jackson Hole, Wyoming, Jumat. Para investor berharap untuk mendapatkan lebih banyak petunjuk dari pidatonya tentang waktu kenaikan suku bunga berikutnya.

Di sisi ekonomi, perlambatan oleh tingkat persediaan rendah di banyak bagian negara, penjualan "existing-home" di AS kehilangan momentum pada Juli dan turun dari tahun ke tahun untuk pertama kalinya sejak November 2015, menurut National Association of Realtors, Rabu. [tar]

- See more at: http://pasarmodal.inilah.com/read/detail/2319673/yuan-china-melemah-terhadap-dolar-as#sthash.p5hDDLR2.dpuf

bloomberg: The shadow financing that is fueling China’s economic growth is unsustainable and “eerily similar” to developments in the U.S. before the global financial crisis, says Logan Wright at research firm Rhodium Group.

The nation has at most about 18 months before this funding -- derived largely from wealth-management products offering higher returns on riskier underlying investments -- hits a wall, says Wright, director of China markets strategy for New York-based Rhodium. Banks will then be unable to generate new credit needed to maintain the current pace of economic growth, which is likely to slow to a range of 5 to 5.5 percent for about two years, he says.

“It’s pretty shocking just how important this has become and how the funding structures for this type of asset creation have changed,” he said. “Everyone assumes it’s a stable system, it’s deposit-funded. It’s just not true any more.”

The financial engineering being employed to generate credit needed to fuel growth is reminiscent of the notorious structured investment vehicles and special purpose vehicles that played a central role in triggering the U.S. and global financial crisis in 2007-2008, said Wright, who has covered China since 2006. Still, the equally notorious credit default swaps that were also a key factor in the financial crisis are largely absent in China, which indicates any future shock may not be so short and sharp.

Here are excerpts of the conversation:

Question:

Why do you think China can’t keep muddling through for more than another 18 months?

Answer:

Because of the financial imbalances that are building and the impact that will have on asset growth should they start to unwind. Back in 2011-2012, whatever you wanted to say about the Chinese financial system, it was pretty stable. It was largely deposit funded, its assets were largely loans even though there were a lot of them. There were pretty steady balance of payments surpluses for years, basically about $30 billion a month in reserve accumulation from 2003 to 2011.

Starting at the end of 2011, with European bank deleveraging, you saw a reversal in China’s financial account that went into deficit. You saw the emergence of pressure on the currency and you no longer had these very steady balance of payments surpluses. Now, you still have this political pressure to generate assets, but the banks already have pretty stretched balance sheets so they can’t expand assets based on their own loan volumes.

They’re not getting the returns out of banks to recapitalize out of retained earnings because return on assets for the whole system is around 1 percent. So therefore you have to restructure assets into different non-loan forms in order to grow assets at the same rate. And at the same time you no longer have the steady source of deposits externally so you have to keep issuing wealth management products and use riskier forms of liability structures to continue to attract funding, which appears fine because everything looks guaranteed. What has happened is that the funding rate for the system has increased and the assets that it’s chasing are increasingly speculative and based on returns that can’t be justified in the real economy. So these are big shifts.

Question:

Isn’t the central bank well-equipped to keep the party going?

Answer:

For the banks that’s plausible, but the question is: Can you really get liquidity in the right place and do you know that that’s the case? What’s really changed in the inter-bank market is who’s borrowing and lending and small banks aren’t really borrowing in any size any more. It’s largely non-bank financial institutions that are borrowing.

What does that mean for the assets that they are generating? What kind of assets are being funded by that bank financial engineering, which is very similar to SIVs or SPVs during the global financial crisis where banks are basically levering up via their issuing wealth management products, promising rates of return, moving assets off balance sheet and they are providing additional leverage via the pledged repo market to deliver these returns. So it’s a question of which assets are being used and it does seem that corporate bonds are very central to that.

The PBoC can certainly liquefy the banks and maintain liquidity to any institution it wants to. The question is: Does that deliver the stabilization that they need in asset prices, in asset markets, and in the health of the broader financial system in terms of its ability to keep generating assets because it’s not that this is froth that they can easily skim. This is the key story of how assets are being created.

Question:

How will this unfold?

Answer:

Things that are unsustainable will eventually stop. The real question is exactly how they do so. What happens is hard to say but the reason we talk about that kind of time frame is because you do compress portfolio spreads on some of these investments to such a range that they can’t go much lower. Sure, bond prices can keep trending higher for quite some time, but ultimately if it’s not justified by the underlying fundamentals we will see a market reversal. The corporate bond market should be the center of that thinking because spreads to government bonds are narrowing further and yet at the same time, demonstrably, credit risk is higher than it was previously.

Question:

What impact will there be on the macro economy? It brushed off the equity market collapse last year while barely breaking stride.

Answer:

The equity market was kind of a sideshow. Very few households are invested in the domestic equity market and it was primarily among the very rich who don’t have a high propensity to consume. But there was also a pretty massive liquidity injection that really helped to mitigate those losses. The corporate bond market would be far more central given the dependence upon short-term interest rates and risk premiums for the overall health of the financial system.

This is a huge banking system with $33 trillion in assets and half those are short term in nature, which means short-term interest rates really matter if you are essentially re-creating over 150 percent of gross domestic product in assets every year. If you get a sudden reversal in corporate financing conditions that way, or a sudden reversal in these asset markets, that’s a concern.

Question:

One difference with the U.S. is there are no credit default swaps betting on the other side. So a shock in China may not be so short and sharp as it was in the U.S.?

Answer:

It’s very hard to say exactly how this would shake out but I definitely do think that’s a meaningful distinction. It could be a more gradual process, absolutely. The concern is just what kind of assets are these structures funding and what will happen to those markets. Credit growth in the non-bank financial sector might fall and that could create additional pressure on asset markets that have been bid through that process even if there’s no one bidding on the other side.

— With assistance by Kevin Hamlin

Washington - Tiongkok, pembeli utama surat utang negara Amerika Serikat, mengurangi kepemilikannya pada Juni, data terbaru dari Departemen Keuangan AS menunjukkan, Senin.

Tiongkok memangkas surat utang AS yang dipegangnya sebesar 3,2 miliar dolar AS pada Juni, dengan total kepemilikan 1,2408 triliun dolar AS. Negara ini menambah 1,2 miliar dolar AS surat utang negara AS pada Mei, tetapi memotong kepemilikannya pada April dan Maret.

Jepang, pemegang asing terbesar kedua surat utang AS, meningkatkan kepemilikannya sebesar 14,5 miliar dolar AS menjadi 1,1477 triliun dolar AS pada Juni.

Pada akhir Juni, secara keseluruhan kepemilikan asing atas surat utang negara AS meningkat menjadi 6,281 triliun dolar AS dari 6,2099 triliun dolar AS pada Mei.

http://pasarmodal.inilah.com/read/detail/2317453/china-kurangi-kepemiikan-surat-utang-as

Sumber : INILAH.COM

BEIJING, KOMPAS.com – Bank sentral China melaporkan cadangan devisa dalam valas yang dimiliki negara itu jatuh ke posisi 3,20 triliun dollar AS per Juli 2016.

Data yang dirilis pada Minggu (7/8/2016) tersebut sejalan dengan prediksi para analis dan lebih rendah dibandingkan posisi per Juni 2016 yang tercatat sebesar 3,21 triliun dollar AS.

China merupakan negara dengan cadangan devisa terbesar di dunia dan mengalami penurunan cadangan devisa sebesar 4,10 miliar dollar AS pada bulan Juli.

Pada bulan Juni, cadangan devisa sempat merangkak 13,4 miliardollar AS pada bulan Juni dan merupakan peningkatan setelah sempat mencapai posisi terendah dalam lima tahun pada bulan Mei 2016.

Cadangan emas China dilaporkan naik ke 78,89 miliar dollar ASpada akhir Juli 2016 dari 77,43 miliar dollar AS pada akhir Juni 2016.

Adapun penjualan valuta asing secara net oleh Peoples’s Bank of China (PBoC) pada bulan Juni 2016 melonjak ke level tertinggi dalam tiga bulan.

Mengutip Channel News Asia, hal itu sejalan dengan usaha bank sentral melindungi mata uang yuan di tengah volatilitas pasar seiring kepuutusan Inggris meninggalkan Uni Eropa atau Brexit.

Bank sentral pun menyatakan China akan mampu menjaga arus modal lintas batas, berkat situasing ekonomi yang relative stabil, surplus transaksi berjalan, dan cadangan devisa yang cukup.

Cadangan devisa China jatuh hingga mencapai rekor 513 miliardollar AS pada tahun lalu setelah keputusan devaluasi yuan pada bulan Agustus 2015.

Pada akhirnya, ini memicu arus modal keluar yang mengguncang pasar global. Dalam pernyataannya, bank sentral menyatakan China akan menjaga mata uang yuan tetap stabil dan melanjutkan reformasi suku bunga berbasis pasar.

Perekonomian China pun menggeliat lebih cepat dari yang diperkirakan pada kuartal II 2016 namun pertumbuhan investasi swasta masih melambat ke rekor terendah.

Hal ini menunjukkan pelemahan masih terjadi dan mendorong pemerintah melakukan serangkaian upaya untuk mendorong ekonomi.

BEIJING - Cadangan devisa (cadev) China pada akhir Juli tercatat mengalami penurunan meski tidak terlalu besar menjadi USD3,201 triliun. Angka ini lebih kecil dibanding bulan sebelumnya yang mencapai USD3,205 triliun.

Seperti dikutip dari Xinhua, Minggu (7/8/2016), data tersebut pada dasarnya sejalan dengan ekspektasi pasar setelah terjadi kenaikan tak terduga yang cukup mengejutkan bagi para investor pada Juni.

China mulai melihat tren turunnya cadangan devisa pada November 2015, karena kekhawatiran atas melemahnya mata uang yuan dan modal outflow. Sehingga, penurunan ini tidak begitu mengejutkan, apalagi penurunannya tidak terlalu besar.

Namun, cadangan kembali ke pertumbuhan pada Maret karena kekhawatiran mereda di tengah tanda-tanda stabilisasi pertumbuhan ekonomi.

Diberitakan sebelumnya, China kembali menunjukkan keajaibannya, dengan mencapai pertumbuhan ekonomi pada kuartal II/2016 sebesar 6,7%. Angka ini di luar perkiraan para ekonom negara tersebut, yang meramalkan pertumbuhan ekonomi China maksimal 6,6%.

(izz)

eiu: China experiences a hard landing

High probability, Very high impact; Risk intensity =

July 20th 2016Introduction

We assess the prospect of a sharp economic slowdown in China - in which economic growth drops by 2 percentage points or more compared with the previous year - as our top risk scenario.

Analysis

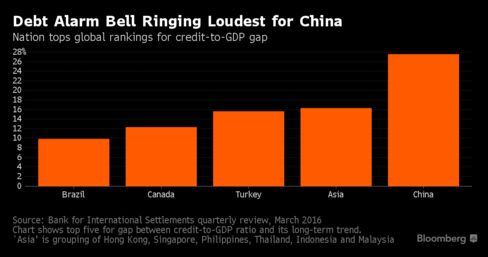

Continued deterioration in the country's services and manufacturing sectors, the ongoing build-up of the country's debt stock (which is now equivalent to at least 240% of GDP) and occasional downward pressure on the renminbi as capital outflows persist have highlighted structural weaknesses in the economy. The government's means to revive economic confidence are limited. Its huge stimulus in 2009 led to a build-up of bad debt - a problem the government has only exacerbated by the stepping up lending once again in the first half of 2016 - and the People's Bank of China burnt through US$300bn of reserves between September and February in order to prop up the renminbia. Meanwhile, poorly managed official attempts to shore up the stockmarket have highlighted concerns that the government's promise to put a floor under economic growth might not be credible - as well as showing the shallow nature of the government's commitment to allowing market forces to play a role in raising productivity.

Conclusion

If China's economy slows by more than we currently expect, it will further feed the ongoing global commodity price slump (especially in oil and, in particular, metals), with a hugely detrimental impact on those Latin American, Middle Eastern and Sub-Saharan African states that had benefited from the earlier Chinese-driven boom in commodity prices. In addition, given the growing dependence of Western manufacturers and retailers on demand in China and other emerging markets, a prolonged deceleration in growth there would have a severe knock-on effect across the EU and the US - far more than would have been the case in earlier decades.

INILAHCOM, Washington - Dana Moneter Internasional (IMF) mengumumkan keputusan dewan mengubah metodologi pembulatan untuk menentukan rekening mata uang dalam keranjang Special Drawing Right (SDR).

Tujuannya untuk persiapan teknis memasukkan mata uang Tiongkok, Renminbi, dalam keranjang SDR, demikian keterangan resmi lembaga moneter internasional, Senin (25/7/2016).

Metodologi diubah memungkinkan jumlah mata uang akhir untuk menghasilkan bobot mata uang yang sangat dekat dengan bobot yang diadopsi oleh IMF IMF juga membuat perhitungan jumlah mata uang yang lebih mudah untuk menjawab pengguna SDR dan pelaku pasar.

Menurut IMF, jumlah mata uang adalah jumlah unit masing-masing mata uang dalam keranjang SDR. Jumlah mata uang memainkan peran sentral dalam penilaian harian dari SDR. Karena nilai SDR adalah jumlah dari jumlah tersebut, dinilai pada kurs nilai tukar mata uang harian terhadap dolar AS.

Jumlah mata uang ditentukan pada hari kerja terakhir sebelum keranjang SDR baru menjadi efektif dan masih tetap selama periode valuasi SDR.

Tahun lalu, IMF memutuskan untuk memasukkan RMB dalam keranjang SDR sebagai mata uang kelima, bersama dengan dolar AS, euro, yen Jepang dan pound sterling, efektif 1 Oktober 2016.

Jumlah mata uang akhir untuk periode penilaian baru akan ditentukan dan diumumkan pada 30 September tahun ini dan akan tetap selama lima tahun. [tar]

JAKARTA, KOMPAS.com - Kepala Ekonom Asia Ex-Jepang Daiwa Capital Markets Kevin Lai menyatakan perekonomian China saat ini sudah mengalami hard landing.

Dengan berbagai masalah ekonomi yang dialami negara tersebut, ada kemungkinan China mengalami krisis finansial dan mata uang.

"Ada 30 persen kemungkinan krisis mata uang," kata Kevin pada acara Bahana Economic Forum: The end game for China di Jakarta, Selasa (14/6/2016).

Menanggapi prediksi tersebut, Kepala Grup Ekonomi Departemen Kebijakan Ekonomi Bank Indonesia (BI) Yoga Affandi menyatakan tidak menutup kemungkinan krisis finansial bakal terjadi di China.

Pasalnya, China memiliki utang yang sangat besar. "Debt over GDP-nya 250 persen. Belum lagi shadow banking-nya," jelas Yoga.

Tidak sedikit masyarakat di China yang berani menyentuh dan berkecimpung dalam shadow banking yang akhirnya membuat sektor keuangan China tidak terkendali.

"Di sana itu pinjam melalui internet tidak diatur. Makanya meledak dan bisa krisis," ungkap Yoga.

Lebih lanjut, Yoga memandang, apabila ada guncangan finansial di China maka pasti akan ada dampaknya ke Indonesia.

Ia memberi contoh, risiko keluarnya Inggris dari keanggotaan Uni Eropa pun bisa memberikan dampak pada pergerakan pasar uang dunia, tidak terkecuali di Indonesia.

"Tentu namanya guncangan finansial akan berdampak ke kita," jelas Yoga.

Beijing - Kurs tengah nilai tukar mata uang Tiongkok renminbi atau yuan, menguat 25 basis poin menjadi 6,5593 terhadap dolar AS pada Rabu (8/6/2016).

Dalam Sistem Perdagangan Valuta Asing Tiongkok, pasar spot valuta asing Tiongkok, yuan bergerak untuk naik atau turun sebesar dua persen dari tingkat paritas tengahnya setiap hari perdagangan.

Kurs tengah yuan terhadap dolar AS didasarkan pada rata-rata tertimbang harga yang ditawarkan oleh pelaku pasar sebelum pembukaan pasar uang antar bank setiap hari kerja.

Sebelumnya, kurs dolar AS melemah terhadap sebagian besar mata uang utama lainnya di New York pada Selasa (7/6/2016) waktu AS, setelah Ketua Federal Reserve Janet Yellen gagal memberikan petunjuk tentang waktu kenaikan suku bunga acuan.

Pada sesi sebelumnya, Yellen melakukan pidato publik terakhirnya sebelum pertemuan kebijakan Fed Juni pada pekan depan.

Dia menyatakan optimisme tentang ekonomi AS dan mengatakan bahwa kenaikan suku bunga selanjutnya mungkin sedang dalam perjalanan, tetapi tidak menyebutkan waktu kenaikannya.

"Jika data yang masuk konsisten dengan kondisi-kondisi penguatan pasar tenaga kerja dan inflasi membuat kemajuan menuju target 2,0 persen kami, seperti yang saya harapkan, kenaikan bertahap lebih lanjut dalam suku bunga federal fund cenderung tepat," kata Yellen di Dewan Urusan Dunia Philadelphia, Senin.

http://pasarmodal.inilah.com/read/detail/2301422/yuan-kuasai-pergerakkan-pasar-valas-china

Sumber : INILAH.COM

SHANGHAI Cadangan devisa asing (cadev) Tiongkok berkurang hampir US$ 28 miliar pada Mei 2016 menjadi US$ 3,19 triliun. Meski turun ke level terendah sejak 2011 tapi dengan cadev sebanyak itu masih yang terbesar di dunia.

Penurunan disebabkan pelemahan nilai tukar yuan, yang membuat mata uang ini menjadi kurang menarik untuk dipegang sehingga modal keluar dari Tiongkok.

Data yang dirilis People's Bank of China (PBoC) pada Selasa (7/6) ini mengakhiri kenaikan cadev selama dua bulan sebelumnya. Bloomberg News menyatakan, penurunan cadev Tiongkok pada Mei adalah yang terbesar dalam lebih empat tahun.

Para analis menyebut penurunan disebabkan oleh pelemahan renminbi karena ekspektasi kenaikan suku bunga acuan di Amerika Serikat (AS). “Nilai cadev Tiongkok seperti diperkirakan turun bulan lalu karena renminbi kembali melemah terhadap dolar AS dan arus keluar modal naik meski kecil,†kata Capital Economics.

Antisipasi terhadap kenaikan fed funds rate (FFR) pada Juni atau Juli tahun ini menyebabkan nilai tukar yuan anjlok terhadap dolar AS. Bank sentral Tiongkok mulai membiarkan mata uang domestic bergerak turun. PBoC pada 30 Mei 2016 menetapkan nilai tukar yuan pada level terendah dalam lima tahun lebih terhadap dolar AS. Nilai tukar yuan diturunkan 1,86% terhadap dolar AS berdasarkan level penetapan harian.

Tiongkok sempat mengguncang para investor global tatkala secara tiba-tiba mendevaluasi yuan pada Agustus 2015. Nilai tukar yuan ketika itu diturunkan hampir 5% dalam tempo satu pekan.

Para analis ketika itu memandangnya untuk meningkatkan ekspor. Tapi Pemerintah Tiongkok mengklaim dalam kaitan transformasi perekonomian yang selama ini didorong oleh investasi dan ekspor untuk menjadi lebih berbasis konsumsi dalam negeri.

Namun begitu, Capital Economics menyatakan bahwa pelemahan nilai tukar yuan belakangan mengisyaratkan penguatan dolar AS karena prospek perekonomian AS lebih cerah.

Depresiasi ini mencerminkan penguatan dolar, bukan karena ada upaya dari PBoC untuk mendevaluasi renminbi,†tambah Capital Economics.

Lembaga ini mengestimasikan arus keluar modal bersih sebesar US$ 32 miliar pada Mei 2016 atau naik dibandingkan US$ 26 miliar pada bulan sebelumnya. “Kenaikan arus keluar modal kemungkinan didorong oleh pelemahan renminbi terhadap dolar bulan lalu," kata Capital Economics.

Tanda-tanda orang menjadi enggan untuk memegang yuan adalah penurunan peringkatnya menjadi keenam, dari sebelumnya kelima sebagai alat pembayaran global pada April 2016. SWIFT atau penyedia layanan messaging menyebutkan, peringkat yuan disabet oleh dolar Kanada. (afp/sn)

http://id.beritasatu.com/home/cadangan-devisa-tiongkok-berkurang-us-28-miliar/144918

Sumber : INVESTOR DAILY

SHANGHAI Cadangan devisa asing (cadev) Tiongkok berkurang hampir US$ 28 miliar pada Mei 2016 menjadi US$ 3,19 triliun. Meski turun ke level terendah sejak 2011 tapi dengan cadev sebanyak itu masih yang terbesar di dunia.

Penurunan disebabkan pelemahan nilai tukar yuan, yang membuat mata uang ini menjadi kurang menarik untuk dipegang sehingga modal keluar dari Tiongkok.

Data yang dirilis People's Bank of China (PBoC) pada Selasa (7/6) ini mengakhiri kenaikan cadev selama dua bulan sebelumnya. Bloomberg News menyatakan, penurunan cadev Tiongkok pada Mei adalah yang terbesar dalam lebih empat tahun.

Para analis menyebut penurunan disebabkan oleh pelemahan renminbi karena ekspektasi kenaikan suku bunga acuan di Amerika Serikat (AS). “Nilai cadev Tiongkok seperti diperkirakan turun bulan lalu karena renminbi kembali melemah terhadap dolar AS dan arus keluar modal naik meski kecil,†kata Capital Economics.

Antisipasi terhadap kenaikan fed funds rate (FFR) pada Juni atau Juli tahun ini menyebabkan nilai tukar yuan anjlok terhadap dolar AS. Bank sentral Tiongkok mulai membiarkan mata uang domestic bergerak turun. PBoC pada 30 Mei 2016 menetapkan nilai tukar yuan pada level terendah dalam lima tahun lebih terhadap dolar AS. Nilai tukar yuan diturunkan 1,86% terhadap dolar AS berdasarkan level penetapan harian.

Tiongkok sempat mengguncang para investor global tatkala secara tiba-tiba mendevaluasi yuan pada Agustus 2015. Nilai tukar yuan ketika itu diturunkan hampir 5% dalam tempo satu pekan.

Para analis ketika itu memandangnya untuk meningkatkan ekspor. Tapi Pemerintah Tiongkok mengklaim dalam kaitan transformasi perekonomian yang selama ini didorong oleh investasi dan ekspor untuk menjadi lebih berbasis konsumsi dalam negeri.

Namun begitu, Capital Economics menyatakan bahwa pelemahan nilai tukar yuan belakangan mengisyaratkan penguatan dolar AS karena prospek perekonomian AS lebih cerah.

Depresiasi ini mencerminkan penguatan dolar, bukan karena ada upaya dari PBoC untuk mendevaluasi renminbi,†tambah Capital Economics.

Lembaga ini mengestimasikan arus keluar modal bersih sebesar US$ 32 miliar pada Mei 2016 atau naik dibandingkan US$ 26 miliar pada bulan sebelumnya. “Kenaikan arus keluar modal kemungkinan didorong oleh pelemahan renminbi terhadap dolar bulan lalu," kata Capital Economics.

Tanda-tanda orang menjadi enggan untuk memegang yuan adalah penurunan peringkatnya menjadi keenam, dari sebelumnya kelima sebagai alat pembayaran global pada April 2016. SWIFT atau penyedia layanan messaging menyebutkan, peringkat yuan disabet oleh dolar Kanada. (afp/sn)

http://id.beritasatu.com/home/cadangan-devisa-tiongkok-berkurang-us-28-miliar/144918

Sumber : INVESTOR DAILY

INILAHCOM, Hong Kong - Beban utang non-produktif di China membengkak di tahun 2015. Utang tersebut untuk menaikkan aset harga melampaui data di AS.

Demikian hasil survei kepala ekooom Deutsche Bank, Torsten Slok. Temuan Slok ini bila dibandingkan dengan tingkat pertumbuhan keredit di AS dan China menghasilkan 1 persen pertumbuhan PDB.

Pada pejabat China berjanggungjawab untuk ekspansi kredit tahun lalu. Bank Rakyat China mengurangi persyaratan dalam pengucuran kredit agunan dalam menyalurkan dana dari bank sentral negara itu, demikian mengutip marketwatch.com.

Kucuran kredit itu awalnya bertujuan untuk memacu pertumbuhan ekonomi, mempercepat perlambatan pada tahun lalu. Hal ini bersamaan dengan munculknya kekhawatiran penurunan ekonomi global.

Pada tahun 2015 lalu, pertumbuhan ekonomi di negara dengan ekonomi terbesar kedua ini hanya 6,8 persen dari target pemerintah 7 persen. Pada kuartal pertama 2016 ini, ekonoi hanya tumbuh 6,7 persen sebagai pertumbuhan paling lambat 2009.

Selama tahun 2015 lalu, banyak saham baru diperdagangkan di China mulai dari sektor komoditas seperti biji besi dan emiten baja. Penawaran yang agresif tersebut karena mudahnya kredit dan mendukung untuk spekulasi di bursa. Namun ini sudah memusingkan investor karena berpotensi mengalami krisis.

"Masalahnya, perbankan telah berperan dalam pengucuran kredit yang agresif. Namun dalam ekonomi yang lesu, kredit tidak untuk menciptakan lapangan kerja baru, membangun pabrik tetapi untuk memburu laba dari aset keuangan," jelas Slok.

- See more at: http://pasarmodal.inilah.com/read/detail/2299790/survei-kredit-bank-justru-untuk-main-saham#sthash.lDhAVxxg.dpuf

The fall followed Monday's drop of 294 basis points, which dragged the central parity rate of the yuan to its weakest point in more than five years.

The tumble came after U.S. Federal Reserve Chair Janet Yellen said at Harvard University on Friday that an interest rate hike in the next few months would probably be appropriate if economic data improves. Her comments boosted the U.S. dollar against other major currencies.

Despite the fluctuations, there remains only limited concern over the yuan's depreciation pressure among market observers.

"China has allowed greater flexibility in the renminbi exchange rate while maintaining its stability," according to a report issued by investment bank China International Capital Corp. (CICC) on Monday.

As the dollar moves, the renminbi may show more fluctuations in the second and third quarter, but a large one-off devaluation is unlikely, CICC forecast.

The yuan is undergoing a lengthy transition from a highly managed regime to more of a floating one, according to a HSBC report, which predicted that China would remain committed to foreign exchange reforms.

Since August 11, 2015, when China's central bank decided to adjust the "central parity system" to make it better reflect market development in the exchange rate of the Chinese yuan against the U.S. dollar, the renminbi has experienced several rounds of volatile adjustments.

After the rate fixing reform, daily central parity quotes reported to the China Foreign Exchange Trade System before the market opens are required to be based on the closing rate of the inter-bank foreign exchange rate market on the previous day, supply and demand in the market, and price movement of major currencies.

On the day following the policy change, the central parity rate of the yuan weakened sharply to 6.2298 against the U.S. dollar, down nearly 2 percent to the lowest point since April 2013.

In China's spot foreign exchange market, the yuan is allowed to rise or fall by 2 percent from the central parity rate each trading day.

The central parity rate of the yuan against the U.S. dollar is based on a weighted average of prices offered by market makers before the opening of the interbank market each business day.

BEIJING (Dow Jones) -- The People's Bank of China set its daily yuan-fixing at the weakest level against the U.S. dollar in more than five years Wednesday.

The so-called yuan fix was set at 6.5693, the weakest level against the greenback since March 2011, and 0.3% weaker than Tuesday's level of 6.5468. The figure serves as a reference point for the onshore yuan, which can trade 2% higher or lower than the PBOC's central reference rate.

The onshore yuan weakened 0.2% to 6.5642 afterwards, a three-month low, while its offshore counterpart, which trades around the clock in Hong Kong, was unchanged at 6.5677.

Analysts said the move reflected strength in the U.S. dollar overnight, after new-home sales rose at the fastest pace since January 2008.

The fixing methodology used by the People's Bank of China to determine the yuan's daily fixing takes into account the moves of related currencies, especially the U.S. dollar.

The U.S. dollar index, which tracks the greenback's strength against a basket of six currencies, has gained 0.4% in the past two days to reach a two-month high of 95.607 as expectations build that the Federal Reserve may resume raising interest rates at its June meeting.

Today's move in the yuan was largely a reaction to that, said Eddie Cheung, Asia FX strategist at Standard Chartered. "The move we had today was still predictable," he says. "It's still following the rules."

Markets have been unnerved by the yuan's moves since a botched shift to a market-determined exchange rate in August last year, which resulted in a devaluation of the currency.

The Wall Street Journal reported Tuesday that the People's Bank of China had quietly abandoned the new mechanism, essentially returning to the old way of adjusting the yuan's daily value higher or lower based on whatever suits Beijing best.

The U.S. Treasury said Tuesday it is confident that China is gradually shifting the yuan toward a market-based exchange rate."

bloomberg: Charlene Chu, a banking analyst who made her name warning of the risks from China’s credit binge, said a bailout in the trillions of dollars is needed to tackle the bad-debt burden dragging down the nation’s economy.

Speaking eight days after a Communist Party newspaper highlighted dangers from the build-up of debt, Chu, a partner at Autonomous Research, said she was yet to be convinced the government is serious about deleveraging and eliminating industry overcapacity.

She also argued that lenders’ off-balance-sheet portfolios of wealth-management products are the biggest immediate threat to the nation’s financial system, with similarities to Western bank exposures in 2008 that helped to trigger a global meltdown.

The former Fitch Ratings analyst uses a top-down approach to calculating China’s bad-debt levels as the credit to gross domestic product ratio worsens, requiring more credit to generate each unit of GDP.

While Chu is on the bearish side of the debate about the outlook for China, she’s not alone. In a report on Monday, Societe Generale SA analysts said that Chinese banks may ultimately face 8 trillion yuan ($1.2 trillion) in losses and a bailout from the government, citing the scale of soured credit within state-owned enterprises.

Interviewed in Hong Kong last week, Chu estimated as much as 22 percent of all China’s outstanding credit may be nonperforming by the end of this year, compared with an official bad-loan number for banks in March of 1.75 percent.

Question

What do you see as the biggest risk in the financial system?

Answer

“China’s debt problems are large and severe, but in some respects a slow burn. Over the near term, we think the biggest risk is banks’ WMP portfolios. The stock of Chinese banks’ off-balance-sheet WMPs grew 73 percent last year. There is nothing in the Chinese economy that supports a 73 percent growth rate of anything at the moment. Regardless of all of the headlines and announcements about the authorities cracking down on WMPs, they have done very little, really, and issuance continues to accelerate.

“We call off-balance-sheet WMPs a hidden second balance sheet because that’s really what it is -- it’s a hidden pool of liabilities and assets. In this way, it’s similar to the Special Investment Vehicles and conduits that the Western banks had in 2008, which nobody paid attention to until everything fell apart and they had to be incorporated on-balance-sheet.

“The mid-tier lenders is where these second balance sheets are very large. China Merchants Bank is a good example. Their second balance sheet is close to 40 percent of their on-balance-sheet liabilities. Enormous.”

“We call off-balance-sheet WMPs a hidden second balance sheet because that’s really what it is -- it’s a hidden pool of liabilities and assets. In this way, it’s similar to the Special Investment Vehicles and conduits that the Western banks had in 2008, which nobody paid attention to until everything fell apart and they had to be incorporated on-balance-sheet.

“The mid-tier lenders is where these second balance sheets are very large. China Merchants Bank is a good example. Their second balance sheet is close to 40 percent of their on-balance-sheet liabilities. Enormous.”

Question

Who buys a WMP?

Answer

“The products used to be predominantly sold to the public, but now they’re increasingly being sold to banks and other WMPs. We’re starting to see layers of liabilities built upon the same underlying assets, much like we did with subprime asset-backed securities, collateralized debt obligations, and CDOs-squared in the U.S. The range of assets is much more diverse than mortgages, but we have significantly less visibility on the assets than we did with subprime.”

Question

After the People’s Daily commentary, is it clear that the government is serious about deleveraging?

Answer

“The word deleveraging should not be used when discussing China. Deleveraging means negative credit growth, or a contraction in the ratio of credit to GDP. China is nowhere close to deleveraging. Over the years, I have learned from watching the authorities respond to issues like WMPs that there is often a large divergence between official rhetoric and actual action. It’s encouraging to see policy makers acknowledge the severe overcapacity problem, but I am sceptical that much headway will be made any time soon, given how painful implementation will be and the pushback they will inevitably receive at local levels.”

Question

Is a financial crisis or a very dramatic economic slowdown now inevitable?

Answer

“Not yet, but we’re getting there because the problem is getting so big. We’re still adding 10 to 20 percentage points to the ratio of credit to GDP every year -- that has not changed despite the fact that credit growth has decelerated. If the government was to come out with a very aggressive -- and it would have to be incredibly aggressive -- bailout package for corporates, as well as financial institutions, it would do a lot in terms of dealing with some of this debt overhang and getting rid of the black cloud that’s hanging over the country. However, the idea that China needs a massive bailout in the trillions of U.S. dollars isn’t something I think the authorities are on board with or accept yet. They still believe they can grow out of it.”

Question

Could your assessment of China’s debt situation be based on faulty assumptions?

Answer

“If we’re wrong, and there’s always a chance of that, it’s going to be because we’re under-appreciating the economic growth potential in China -- that there is some more strength to the consumption story and services story than we sense now, and that these are about to take off and propel the country out of these debt problems.”

Question

How does China’s debt build-up compare to Japan’s previously?

Answer

“If you look at Japan, the credit expansion wasn’t anywhere close to the size of China’s, and China’s continues to grow at a rapid rate. There is also a somewhat Wild West, chaotic nature to a lot of the shadow banking going on in China that is different from the shadow credit we saw in Japan. What’s positive for China is that they’ve got a leadership team that is not as afraid as the Japanese leadership is of radical change. So, if China’s authorities ever do decide debt is the center of their problems and they need to do something about it, we won’t have decades of complacency with nothing really done. On the negative side, China has a much weaker social safety net and a much poorer population, which makes social and political instability a real concern.”

Question

What’s your assessment of China’s capital flows?

Answer

“The party line is that outflows are all about offshore debt repayment, but that accounts for a minority of the flows we are seeing. We think most of the money is leaving through trade mis-invoicing, which is very hard to shut down. Although capital outflows have quieted down, the underlying motivations for people to move their money out of the country are still there. This problem has not gone away.”

reuters: Two of the three types of hedge funds which bet heavily on a sharp devaluation of China's yuan last year have backed off the trade, leaving only some ultra-bearish "Black Swan" investors holding long-term bets, fund managers and bankers said.

Hedge fund sales desks at four of Wall Street's biggest banks told Reuters that many U.S. players had made money betting against China by the time Beijing took aggressive steps to prop up the currency in early January.

Heavy official intervention, limits on some capital movement and a reduction in the amount of yuan available offshore prompted many players either to cut exposure or walk away from the trade by the Lunar New Year holiday last month, they said.

That has left in place chiefly "tail risk" funds like Mark Hart's Texas-based Corriente Partners or Kyle Bass, who have suggested China would have to devalue the yuan by up to 50 percent to rebalance its economy.

The yuan fell almost 7 percent in a steady depreciation in offshore markets that started in November and bottomed out at 6.75 yuan per dollar on Jan. 7. Since then it has recovered roughly half of that value.

Derivatives pricing for the yuan has fallen back to levels not seen since the end of November.

"It would seem China would like to hold the line, for a while maybe. We've seen a lot more outflows, a lot of defending of the currency," Hart told Wall Street pay video service www.RealVision.com.

"There have been a couple of engineered short squeezes, which have primarily effected those who had a spread on or those who were short spot CNH."

Hart said he still believes China will need to devalue.

RETREAT

The big trade in December and January for hedge funds like Hart's was the low-delta risk reversal, an option contract that only pays out in the event of a very sharp move away from current exchange rates.

Data from the U.S. Commodity Futures Trading Commission and banks' options desks showed large bets going on such options, betting on a fall in the yuan to 7.5-8 per dollar within the next year.

"There isn't a hedge fund on the planet that did not have this trade on somehow but the peak of that positioning is past," said the head of hedge fund sales with one of the six biggest currency trading banks in London.

"It's still a very popular long but it is not at the same peak. The more active FX guys who have been in and out of the spot, a lot of them were squeezed out in February. Then you have the buy and hold, tail-risk sorts of investors. They are still in."

Even so, other bankers and fund managers note that the retreat in pricing on a yuan depreciation has been far less pronounced than it was after Beijing tried and then retreated on a sharp one-off devaluation last August.

Whereas from September the six-month low-delta option fell from highs of 4.4 percent to 1.8 percent, this time it has retreated from 4.6 percent to just under 3 percent.

The one-year contract in the same periods for comparison went from 9.6 to 4.5 percent last year, and 10.7 to 7 percent.

"There is a huge divergence between what happened then and what happened in the past month," said Chris Morrison, Head of Strategy with Omni Macro Fund in London.

"After the August move subsided the forward points went lower, vols (implied volatility) went lower. This time that has not happened; the market is clearly saying that this stability is temporary.

"Ultimately for China it is a stay of execution."

(Editing by Catherine Evans)

China's economy resumed its grind toward slower growth in April, weighed by overcapacity industries such as steel and coal.

Industrial production climbed 6 per cent in April from a year earlier, down from 6.8 per cent in March and missing economists' estimates for 6.5 per cent. Retail sales also missed analyst forecasts, rising 10.1 per cent, while fixed-asset investment increased 10.5 per cent in the January-April period versus economists' expectation for 11 per cent.

After a rocky start to 2016 marked by a sliding yuan, capital outflows and tumbling shares, China's economy had stabilised and even picked up since March, led by a surge in new credit and rebound in the housing market. A pullback in lending and Saturday's tepid readings dash hopes the economy had turned a corner. Top leaders this week signalled a shift away from debt- and stimulus-fuelled growth, stressing the need for deleveraging, upgrading industrial capabilities and cutting excess capacity.

"All the engines suddenly lost momentum," said Zhou Hao, an economist at Commerzbank in Singapore. "The policy tightening will be only a short-term phenomenon."

The slower industrial output was due to weak external demand, a sharp drop in mining, high energy-consumption and overcapacity sectors including steel and coal, as well as seasonal effects, the National Bureau of Statistics said in a statement released after the data. It pointed out that the output of the steel and coal industries both fell from a year earlier.

Retail sales were weighed by a pullback in automobile sales, which increased 5.1 per cent from a year earlier versus a 12.3 per cent jump in March, the NBS said.

Slowest pace

Private investment in fixed assets decelerated to the slowest pace since at least 2012.

"Due to weak market demand, companies' reluctance to invest and market entrance barriers, China's private fixed-asset investment has been decelerating since the start of this year," the statistics bureau said in a statement. "This will hurt the steady growth of investment and it deserves a lot of attention."

Data Friday showed China's broadest measure of new credit rose less than expected last month. Aggregate financing was 751 billion yuan ($158 billion) in April, the People's Bank of China said, below all 26 analyst forecasts in a Bloomberg survey. New yuan loans were 555.6 billion yuan, compared with the median estimate for 800 billion yuan.

China's central bank sought to reassure investors that monetary policy will continue to support the economy after the sharp slowdown in new credit. The deceleration was mainly due to a pick-up in a program to swap high-cost local government debt for cheaper municipal bonds, with no less than 350 billion yuan of such swaps conducted last month, while aggregating financing growth was affected partly by a decrease in corporate bond issuance, according to the central bank.

China's monetary policy remains prudent and policy moves must support economic growth while fully considering the impact on future prices and the need to prevent financial risks, People's Bank of China research bureau chief economist Ma Jun said in an emailed statement from the bank.

"The recovery appears to be fragile," said Shen Jianguang, chief Asia economist at Mizuho Securities Asia in Hong Kong. "The reduction in loan extension in April as well as housing tightening policy may be having some negative impact already."

Bloomberg

Read more: http://www.smh.com.au/business/china/chinas-production-investment-retail-sales-all-disappoint-in-april-20160514-gov8p0.html#ixzz493Uqtz54

Follow us: @smh on Twitter | sydneymorningherald on Facebook

bloomberg: Fund managers are hoarding cash, largely because of concerns about Brexit and China, according to a Bank of America Merrill Lynch survey of investors overseeing $619 billion.

Cash makes up an average 5.5 percent of holdings, the bank said in a report on Tuesday, citing responses from 205 fund managers. That matches levels seen following the 2008 collapse of Lehman Brothers Holdings Inc. and last year when China devalued the yuan.

The possibility of the U.K. voting to leave the European Union is seen as the biggest so-called tail risks to markets, and it has contributed to investors cutting exposure to British stocks to the lowest in more than seven years, Bank of America Merrill Lynch said. Possible devaluation and defaults in China were also cited as risks, along with the potential for central-bank easing failing to revive growth, it said.

Uncertainty about the June 23 U.K. referendum has contributed to the pound falling more than 5 percent, the worst performance among 10 major currencies tracked by Bloomberg Correlation-Weighted Indexes. Issuance of sterling leveraged-loan issuance has also cooled to a 16-year low as private equity firms shun buyouts in the country.

Still, 71 percent of the respondents in the Bank of America Merrill Lynch survey expect the U.K. to vote in favor of remaining in the EU.

the AUSTRALIAN: payments: As global financial institutions report an 18 per cent rise over two years in the use of the yuan for payments with China and Hong Kong, the Australian take-up has been less enthusiastic.

Australia’s share of customer-initiated and institutional payments using yuan (also known as renminbi), has been 1.1 per cent, placing it ninth by quantity, according to the latest data from SWIFT, the inter-bank communications agency.

Vina Cheung, HSBC’s global head of yuan internationalisation, told The Australianyesterday that this “relatively modest take-up” had been recorded despite the implementation of the free trade agreement between China and Australia, as well as continued growth in trade and investment flows, and despite “Australia being at the top of countries in which renminbi use has been actively promoted”.

She said that a surge in yuan use around the world was expected after October, when the International Monetary Fund would include the currency in its Special Drawing Rights basket of currencies.

Ms Cheung said that HSBC — whose China operations are centred in Hong Kong, which accounts for 74 per cent of the use of the yuan for payments worldwide — was encouraging companies such as Australian importers to consider switching to the currency.

Australian firms, she said, “can structure hedging solutions to manage their RMB exposure”.

She conceded that large-scale commodity trades, which continue to dominate Australian exports to China by value, “tend to remain very much US dollar-denominated. The currency supporting such trades must be very sophisticated.” But she noted that Malaysia, whose ringgit has been falling in value like the Australian dollar, had increasingly been negotiating its commodity settlements with China in yuan.

She said it was often the Chinese parties, either as exporters or as importers, that were most reluctant to shift to using yuan, especially those in the electronics industry — perhaps because they were themselves paying for inputs in US dollars, or because they had set up complex operations using US dollars and were reluctant to change, in a climate of concern about a falling yuan, while the greenback was rising.

Chinese companies may also have concerns that shifting to yuan payments may somehow increase their vulnerability to regulation.

Nevertheless, Ms Cheung said that, while a maturing yuan market would see cyclical patterns coming into play, causing its use to fluctuate over time, convenience and lower transactional costs would continue to attract more firms to trade in the currency.

As Australian trade in services with China grows, she said increasing numbers of Chinese students, for instance, would welcome being able to pay their fees in yuan to Australian educational institutions.

Bisnis.com, SURABAYA--Kepala Perwakilan Bank Indonesia (BI) Jatim Benny Siswanto mengatakan perdagangan internasional di Indonesia berpotensi menggunakan renmimbi (RMB) atau mata uang Tiongkok, tujuannya untuk mengurangi dominasi dolar.

"Selain itu kalau diamati perdagangan internasional Indonesia lebih banyak didominasi Tiongkok, Singapura, Jepang, Korea dan Malaysia. Dengan tertinggi adalah Tiongkok yang mencapai 23 persen," ucap Benny, dalam acara sosialisai RMB sebagai mata uang alternatif transaksi perdagangan internasional, di Surabaya, Selasa.

Alasan lain, kata Benny, penggunaan RMB dalam valuta asing masih kecil yakni mencapai Rp120 miliar per hari atau hanya 0,1 persen dari keseluruhan mata uang intenasional.

"Artinya ini potensi cukup besar, dan sebagai upaya untuk lepas dari dominasi mata uang dolar yang sering digunakan dalam perdagangan internasional," ucapnya.

Benny mengatakan, pengunaan RMB juga sebagai persiapan karena mata uang tersebut mulai tanggal 1 Oktober 2016 akan menjadi mata uang internasional yang tercatat di Bank Dunia, menyusul dolar, euro, yen, kemudian renmimbi.

Benny menjelaskan, saat ini mata uang dolar menguasai sekitar 87 persen transaksi global, sedangkan di Indonesia dolar menguasai 90 persen transaksi perdagangan.

"Jika kita ingin mengurangi dominasi dolar, perlu ada perubahan paradigma atau cara pandang terhadap RMB," ujarnya.

Sementara itu Pengamat Ekonomi dari Universitas Gadjah Mada Prof Tri Widodo mengakui hal yang sama, potensi penggunaan RMB cukup besar diterapkan dalam perdagangan internasional di Tanah Air, sebab 60 persen transaksi Indonesia adalah ke Tiongkok.

"Penggunaan mata uang RMB adalah sebuah terobosan, tapi ke depan perlu terbungkus dalam integrasi ekonomi di wilayah Asia dengan kesepakatan bersama negara-negara di Asia, sehingga akan kuat," ucapnya.

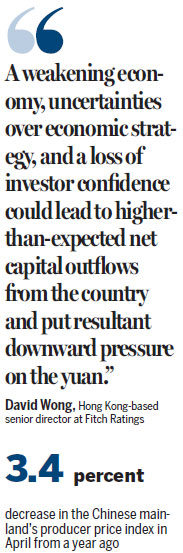

chinadaily: China 's consumer prices remained stable last month as declines in producer prices eased further , raising hopes that the economy could be bottoming out from a downward growth cycle , analysts said .The consumer price index rose by 2.3 percent in April from a year earlier , but was unchanged from March .Declines in the producer price index , a key gauge that measures prices of goo at the factory gate , eased to 3.4 percent last month from a year earlier , compared with a fall of 4.3 percent in March .

In month-on-month terms , the PPI increased by 0.7 percent , the second consecutive rise , the National Bureau of Statistics said on Tuesday .Niu Li , director of macroeconomics at the State Information Center , attributed the "significant moderation " in producer prices to rising commodity prices since February and a higher level of production driven by increased infrastructure investment and recovery in the construction sector ."The month-on month spike in the PPI brings some hope that deflationary risks are easing ,and is a good sign that the economy is continuing to recover ," Niu said .

Lian Ping , chief economist at the Bank of Communications , said raw material prices at the factory gate continued to edge up last month , pointing to a possible return of producer inflation toward the end of the year .However , Zhou Hao , an economist at Commerzbank in Singapore , said the month-on-month PPI increase may be linked to speculation driven by a short-term rise in raw material prices .Niu said the stable CPI reading means that inflation remained below 3 percent , leaving ample room for policymakers to continue easy-money policies , if necessary , in the face of weak demand .On Monday , People 's Daily quoted an "authoritative figure " as saying that China 's economic growth will follow an L-shaped path as downward pressures continue to be felt .The source warned that more targeted measures need to be taken to tackle emerging problems , such as soaring real estate prices , , an increase in non performing loans , local government debt and financial market risks .

China 's economy expanded by 6.7 percent in the first quarter , the slowest quarterly pace since 2009.

Bisnis.com, SURABAYA--Kepala Perwakilan Bank Indonesia (BI) Jatim Benny Siswanto mengatakan perdagangan internasional di Indonesia berpotensi menggunakan renmimbi (RMB) atau mata uang Tiongkok, tujuannya untuk mengurangi dominasi dolar.

"Selain itu kalau diamati perdagangan internasional Indonesia lebih banyak didominasi Tiongkok, Singapura, Jepang, Korea dan Malaysia. Dengan tertinggi adalah Tiongkok yang mencapai 23 persen," ucap Benny, dalam acara sosialisai RMB sebagai mata uang alternatif transaksi perdagangan internasional, di Surabaya, Selasa.

Alasan lain, kata Benny, penggunaan RMB dalam valuta asing masih kecil yakni mencapai Rp120 miliar per hari atau hanya 0,1 persen dari keseluruhan mata uang intenasional.

"Artinya ini potensi cukup besar, dan sebagai upaya untuk lepas dari dominasi mata uang dolar yang sering digunakan dalam perdagangan internasional," ucapnya.

Benny mengatakan, pengunaan RMB juga sebagai persiapan karena mata uang tersebut mulai tanggal 1 Oktober 2016 akan menjadi mata uang internasional yang tercatat di Bank Dunia, menyusul dolar, euro, yen, kemudian renmimbi.

Benny menjelaskan, saat ini mata uang dolar menguasai sekitar 87 persen transaksi global, sedangkan di Indonesia dolar menguasai 90 persen transaksi perdagangan.

"Jika kita ingin mengurangi dominasi dolar, perlu ada perubahan paradigma atau cara pandang terhadap RMB," ujarnya.