inves + trading cara maen saham @ warteg (EXCEL FILE)

KONTAN.CO.ID - NEW YORK. Hasil notulensi rapat The Federal Open Market Committee (FOMC) Desember yang dirilis tadi malam menunjukkan, petinggi The Federal Reserve memprediksi pemangkasan pajak korporat dan individu akan mengerek anggaran belanja dan bisnis. Meski demikian, bank sentral AS ini masih tidak yakin dampak yang diakibatkan dari undang-undang perpajakan yang baru.

Anggota FOMC menaikkan ekspektasi pertumbuhan PDB 2018 dari 2,1% menjadi 2,5%.

"Mayoritas partisipan mengindikasikan perubahan yang prospektif pada kebijakan pajak federal merupakan faktor yang dapat mendorong mereka meningkatkan proyeksi pertumbuhan PDB riil dalam beberapa tahun ke depan," demikian hasil notulensi tersebut seperti yang dikutip dari CNBC.

FOMC merupakan unit pemutus kebijakan moneter The Fed. Komite ini pada rapat tersebut memilih untuk menaikkan suku bunga acuannya menjadi 1,25% hingga 1,5%. Suku bunga ini berhubungan erat dengan suku bunga kredit konsumen.

Mayoritas diskusi yang terefleksi dari hasil notulensi menunjukkan besarnya pengamatan terhadap ekonomi. Hasil kesimpulan rapat merujuk pada perbaikan yang signifikan terhadap tingkat upah seiring dengan turunnya angka pengangguran ke level 4,1%.

Notulensi tersebut juga menulis, anggaran liburan sangat kuat di sejumlah distrik. Mayoritas anggota FOMC memprediksi, pemangkasan pajak mendongkrak anggaran belanja konsumen. Sebagai tambahan, FOMC mengamati bahwa harga di pasar saham juga semakin membaik, di mana indeks S&P 500 melonjak sekitar 20%.

"Indeks harga saham yang luas naik selama periode intermeeting, yang mungkin mencerminkan persepsi sebagian investor terhadap kemungkinan kenaikan akibat perundang-undangan pajak federal dan potensi dorongan pendapatan perusahaan," demikian bunyi risalah tersebut.

Melihat kondisi secara lebih luas, dokumen tersebut mengatakan: "Aktivitas ekonomi riil tampaknya tumbuh dengan kecepatan yang solid, didukung oleh keuntungan dalam belanja konsumen dan bisnis, kondisi keuangan yang mendukung, dan ekonomi global yang membaik."

Namun, notulensi FOMC itu juga beberapa kali mencatat bahwa para anggota The Fed tetap tidak yakin mengenai seberapa banyak dorongan dalam perekonomian yang berasal dari kebijakan pajak. Misalnya, anggota FOMC "tidak yakin" tentang dampak pemotongan pajak terhadap pasokan tenaga kerja.

Ada juga kekhawatiran, seperti disampaikan dari kontak bisnis, perusahaan seperti mendapatkan rejeki nomplok dari pemotongan pajak akan menggunakannya untuk dividen dan pembelian kembali saham.

Para anggota rapat juga tetap berselisih ketika sampai pada pembahasan inflasi. The Fed telah secara konsisten tidak berhasil mencapai tingkat inflasi sebesar 2%, dan para anggota mendiskusikan panjang lebar mengenai alasan mengapa inflasi tetap rendah.

Pejabat Fed secara kolektif melihat inflasi cenderung memenuhi target dalam jangka menengah. Namun dua anggota FOMC -Neel Kashkari dan Charles Evans- memilih untuk tidak mengerek suku bunga karena mereka ingin melihat lebih banyak kemajuan pada target inflasi tersebut.

🍣

Bisnis.com, JAKARTA – Bank Sentral Amerika Serikat, Federal Reserve, menaikkan suku bunga acuan sebesar 0,25% pada hari Rabu, (13/12/2017) waktu AS, namun tidak mengubah prospek suku bunga bahkan di saat pertumbuhan ekonomi AS jangka pendek diproyeksikan naik.

Langkah tersebut, yang datang sebagai kebijakan terakhir tahun 2017 dan menyusul data ekonomi yang relatif bullish, merupakan kemenangan bagi bank sentral yang telah berjanji untuk melanjutkan pengetatan kebijakan moneter secara bertahap.

Setelah menaikkan Fed Fund Rate (FFR) yang ketiga kalinya tahun ini ke kisaran 1,25% - 1,50%. The Fed memproyeksikan tiga kenaikan lebih lanjut di masing-masing di tahun 2018 dan 2019 sebelum tingkat jangka panjang sebesar 2,8% tercapai. Ini tidak berubah dari perkiraan terakhir pada bulan September.

"Aktivitas ekonomi telah meningkat pada tingkat yang solid. Kenaikan lapangan kerja telah cukup baik," ungkap komite kebijakan The Fed dalam sebuah pernyataan seperti dikutip Reuters.

Bursa saham AS menguat AS kenaikan setelah rilis pernyataan kebijakan tersebut, sementara imbal hasil obligasi turun ke posisi terendah. Dolar AS jatuh terhadap sejumlah mata uang lainnya.

Ketua Dewan Gubernur The Fed Janet Yellen, dalam konferensi pers terakhirnya sebelum masa jabatan empat tahun berakhir pada awal tahun depan, merujuk pada usulan kebijakan pajak Trump sebagai dorongan untuk menaikkan prakiraan pertumbuhan ekonomi para pembuat kebijakan.

The Fed memperkirakan produk domestik bruto tumbuh 2,5% pada 2018, naik dari perkiraan 2,1% pada bulan September. Sementara itu, laju pertumbuhan PDB diperkirakan akan mereda menjadi 2,1% pada 2019, sedikit lebih tinggi dari perkiraan sebelumnya 2,0%.

"Sebagian besar rekan saya mempertimbangkan prospek stimulus fiskal, beserta apa yang dipikirkan Kongres, ke dalam proyeksi mereka," ungkap Yellen.

Namun, Yellen mengatakan dampak yang tepat dari rencana pajak, yang mencakup pengurangan tajam pajak penghasilan perusahaan, bergantung pada berbagai faktor.

"Meskipun perubahan dalam kebijakan pajak kemungkinan akan memberikan peningkatan pada aktivitas ekonomi di tahun-tahun mendatang, besarnya dan waktu dampak makroekonomi dari kebijakan tersebut masih belum pasti," lanjutnya.

The Fed juga memperkirakan tingkat pengangguran akan turun menjadi 3,9% tahun depan dan tetap pada level yang sama di 2019. Sebelumnya, tingkat pengangguran diperkirakan 4,1% untuk dua tahun tersebut.

Namun, inflasi diproyeksikan akan pada target bank sentral sebesar 2% untuk tahun depan, dengan kelemahan di sisi depan masih cukup memprihatinkan sehingga para pembuat kebijakan tidak melihat alasan untuk meningkatkan target laju kenaikan suku bunga.

🍳

NEW YORK okezone - Saham-saham di Amerika Serikat (AS), Wall Street ditutup mixed pada pada perdagangan waktu setempat. Pernyataan terbaru dari Janet Yellen terkait kebijakan moneter membuat investor wait and see.

Indeks Dow Jones Industrial Average turun 11,77 poin atau 0,05% menjadi 22.284,32 poin. Sementara itu, indeks S&P 500 naik tipis 0,18 poin atau 0,01% menjadi 2.496,84 poin, dan indeks komposit Nasdaq naik 9,57 poin atau 0,15% ke 6.380,16 poin.

BERITA REKOMENDASI+

"Dengan penyesuaian bertahap dalam kebijakan moneter, inflasi akan stabil dalam target FOMC (Komite Pasar Terbuka Federal) sekira 2% selama beberapa tahun ke depan, disertai dengan beberapa penguatan lebih lanjut dalam kondisi-kondisi pasar tenaga kerja," kata Yellen.

Federal Reserve telah menaikkan suku bunga dua kali tahun ini. Pekan lalu, para pembuat kebijakan menunjuk satu kenaikan suku bunga lagi tahun ini dan tiga kali untuk tahun depan setelah berakhirnya pertemuan kebijakan dua hari.

Di sektor ekonomi, penjualan rumah keluarga tunggal baru AS pada Agustus berada pada tingkat tahunan disesuaikan secara musiman 560.000 unit, gagal memenuhi konsensus pasar, kata Departemen Perdagangan pada Selasa (26/9).

Indeks Kepercayaan Konsumen dari Conference Board mencapai 119,8 pada September, turun dari 120,4 pada Agustus dan umumnya sesuai dengan perkiraan pasar.

Indeks Harga Rumah Nasional AS NSA menurut data dari S&P CoreLogic Case-Shiller dilaporkan mencatat kenaikan tahunan 5,9 % pada Juli, meningkat dari 5,8 % di bulan sebelumnya.

(rzk)

👀

KONTAN.CO.ID - Bank sentral Amerika Serikat (AS) The Federal Reservememulai langkah penarikan kembali stimulus ekonomi yang diguyurkan sejak krisis finansial 10 tahun lalu. The Fed akan memulai pengurangan neraca bulan depan.

Neraca The Fed telah menggelembung higga US$ 4,5 triliun. Aset ini terutama berupa surat utang pemerintah AS dan efek beragun aset KPR yang dulu dibeli lewat program quantitative easing.

Pengurangan aset ini akan dimulai bulan Oktober. The Fed mengumumkan rencana ini setelah rapat Federal Open Market Committee (FOMC) hingga Rabu (20/9) yang berakhir semalam. Pada saat bersamaan, bank sentral AS menahan suku bunga acuan di level 1%-1,25%. Tapi, bank sentral mengindikasikan peluang satu kali lagi kenaikan suku bunga pada tahun ini.

Selain itu, para pejabat The Fed memperkirakan bahwa kenaikan suku bunga akan lebih lambat hingga tahun 2019. Setelah revisi prediksi, kemungkinan akan ada tiga kali kenaikan suku bunga pada 2018 dan dua kali pada 2019.

Dewan Gubernur The Fed juga mengerek prediksi pertumbuhan ekonomi. Juni lalu, FOMC memperkirakan pertumbuhan ekonomi sebesar 2,1%. Pada rapat kemarin, The Fed menaikkan prediksi produk domestik bruto AS menjadi 2,2%.

Keputusan lain, bank sentral menurunkan outlook inflasi dari 1,7% tahun ini menjadi hanya 1,5%. Federal Reserve juga memangkas prediksi inflasi tahun depan dari 2% menjadi 1,9%. Artinya, The Fed memperkirakan target inflasi 2% baru tercapai tahun 2019. "Pengukuran inflasi berdasarkan survei masih rendah, sedangkan untuk jangka panjang, ekspektasi inflasi hanya sedikit berubah," ungkap The Fed.

💁

NEW YORK, KOMPAS.com - Kerugian ekonomi yang diderita AS akibat bencana badai Harvey dan Irma ditaksir mencapai 150 miliar hingga 200 miliar dollar AS.

Angka tersebut hampir setara dengan kerugian ekonomi akibat badai Katrina yang terjadi tahun 2005 silam. Estimasi tersebut dipublikasikan oleh Moody's Analytics.

Badai Harvey sebabkan hujan lebat dan banjir menghantam negara bagian Texas, sementara badai Irma menerjang negara bagian Florida dan beberapa negara bagian di pesisir tenggara AS.

Kepala ekonomi Moody's Analytics Mark Zandi menyebut, rekonstruksi pasca dua badai tersebut akan mendorong ekonomi AS pada kuartal IV 2017 hingga tahun 2018 mendatang.

"Meski saat ini sulit diketahui seberapa besar (kerusakan), namun badai-badai itu kemungkinan menyebabkan total kerugian 150 miliar hingga 200 miliar dollar AS terhadap rumah, kendaraan, properti komersial, dan infrastruktur publik," kata Zandi seperti dikutip dari ABC News, Selasa (12/9/2017).

Zandi menyatakan, faktor penting dalam menghitung kerugian terhadap ekonomi adalah seberapa besar dana asuransi dan bantuan pemerintah mengucur ke daerah-daerah yang terdampak. Selain itu, seberapa cepat pula dana tersebut sampai ke korban.

Ia juga menyebut, waktu dan magnitudo rekonstruksi terhadap pertumbuhan ekonomi AS akan bergantung pada ketersediaan tenaga kerja di Texas dan Florida. Sebelum badai terjadi, sudah ada kondisi kekurangan tenaga kerja di dua negara bagian itu.

Sebelumnya, presiden AccuWeather Joel Myers menyatakan, pihaknya mengestimasi kerugian ekonomi akibat badai Irma mencapai 100 miliar dollar AS.

Adapun kerugian ekonomi akibat badai Harvey mencapai 190 miliar dollar AS, sehingga total kerugian mencapai 290 miliar dollar AS.

"Kerugian ekonomi termasuk disrupsi pada bisnis, peningkatan angka pengangguran, kerusakan infrastruktur, kerugian gagal panen, kerusakan properti, dan harga bahan bakar minyak yang meningkat," jelas Myers.

NEW YORK, KOMPAS.com - Badai Harvey dan Irma menghantam beberapa negara bagian di AS beberapa waktu lalu. Ekonom meyakini, kerugian ekonomi akibat badai tersebut menjadi alasan bagi bank sentral AS Federal Reserve untuk tidak menaikkan suku bunga acuan Fed Fund Rate (FFR) pada tahun ini.

Akibat dua badai tersebut, Goldman Sachs memangkas proyeksi pertumbuhan ekonomi AS pada kuartal III 2017 sebesar 1 persen. Sementara itu, Bank of America Merrill-Lynch memangkas proyeksinya sebesar 0,4 persen.

"Saya rasa ada alasan bagi The Fed untuk kembali menahan diri untuk menaikkan suku bunga. Saya pikir ini keputusan yang logis," kata Hugh Young, kepala riset Asia di Aberdeen Standard Investments seperti dikutip dari CNBC, Selasa (12/9/2017).

The Fed beberapa waktu lalu mengindikasikan satu kali lagi kenaikan suku bunga acuan pada tahun 2017.

Data inflasi yang lemah juga telah membuat The Fed melontarkan pernyataan yang tidak agresif. Sejumlah pelaku pasar meyakini The Fed tidak akan menaikkan suku bunga acuan hingga tahun 2018.

Dalam sebuah wawancara, Presiden The Fed New York William Dudley menyatakan, dua badai dahsyat yang menghantam Texas dan Florida dapat berdampak pada waktu kenaikan FFR.

"Namun, upaya rekonstruksi pasca badai dapat mendorong aktivitas ekonomi dalam jangka panjang," tutur Dudley.

Di luar dampak badai, ada beberapa faktor lain yang menghadang rencana kenaikan suku bunga acuan AS tahun ini.

Salah satu faktor tersebut adalah ketidakpastian mengenai siapa yang menjadi pimpinan The Fed berikutnya menggantikan Janet Yellen. 💢

Seperti diketahui, Fischer memilih untuk pensiun dari jabatanya di Otoritas Moneter AS pada 13 Oktober 2017 atau lebih cepat dari akhir masa jabatannya pada Juni 2018. Dia mengatakan, keputusannya itu didasarkan pada alasan pribadi dengan tanpa merincinya lebih jauh.

“Selama saya bekerja di Dewan Gubernur The Fed, ekonomi AS terus menguat dan membuat AS mampu menciptakan jutaan lapangan kerja tambahan,” tulis Fischer dalam suratnya yang ditujukan ke Trump dan Kongres AS, Kamis (7/9).

Dalam surat pengunduran diri tersebut, Fischer juga mengklaim bahwa dia telah menciptakan pijakan yang lebih kuat dan lebih tangguh pada sistem keuangan AS pascakrisis 2008. Seperti diketahui, mantan pejabat Citigroup ini diangkat oleh Barack Obama pada 2014 untuk mendampingi Gubernur The Fed Janet Yellen.

Para analis pun melihat, pengunduran diri Fischer ini akan membuat keseimbangan The Fed sedikit terganggu. Pasalnya, suara Fischer cukup memengaruhi perpecahan pendapat yang selama ini terjadi di Dewan Gubernur The Fed ketika melakukan pertemuan Federal Open Market Committee (FOMC).

Terlebih saat ini AS sedang dilanda kegamangan dalam menentukan kebijakan moneter lanjutan, setelah laju inflasi masih di bawah target 2%. Di sisi lain Fischer juga menjadi orang yang paling tegas, selain Yellen, yang mempertahankan UU Dodd-Frank yang berisi aturan utuk melindungi sektor keuangan AS pascakrisis.

"Fischer mewakili suara orang-orang yang berpengalaman di The Fed. Mundurnya Fischer akan memberikan ketidakpastian kebijakan di tubuh Bank Sentral AS," kata Kepala Eksekutif JPMorgan Chase & Co A.S. Michael Feroli, seperti dikutip dari Reuters, Kamis (7/9/2017)

Adapun, kepergian Fischer ini membuat kekosongan pada empat kursi pejabat di tubuh The Fed. Sebelumnya, pada awal tahun ini anggota Dewan Gubernur AS Daniel Tarullo telah mengundurkan diri.

✊

TRIBUNNEWS.COM, NEW YORK - The Federal Reserve menyetujui kenaikan suku bunga acuan kedua di 2017, kendati tingkat inflasi berada di bawah target bank sentral.

Selain itu, sebagai tambahan, the Fed juga memberikan penjelasan lebih detil mengenai bagaimana mereka akan menjalankan normalisasi neraca senilai US$ 4,5 triliun atau portofolio dari obligasi yang meliputi Surat Utang, surat utang berbasis KPR, dan utang lembaga pemerintah.

Seperti yang sudah diantisipasi sebelumnya oleh market, Federal Open Market Committee menaikkan target suku bunga acuan sebesar 0,25%. Dengan demikian, kisaran suku bunga acuan AS terbaru menjadi 1% hingga 1,25%. Posisi suku bunga saat ini adalah 0,91%.

Suku bunga terbaru ini lebih berdampak pada utang yang bunganya mengalami penyesuaian serta utang bergulir seperti kartu kredit dan pinjaman KPR. Tingkat bunga utama yang digunakan bank sebagai dasar untuk suku bunga biasanya meningkat setelah kenaikan suku bunga The Fed.

Bank sentral AS kini meyakini tingkat inflasi akan turun di bawah target 2% tahun ini. The Fed menyatakan, tingkat inflasi mengalami penurunan beberapa waktu terakhir meskipun anggaran belanja rumah tangga mencatatkan kenaikan dalam beberapa bulan terakhir. Pernyataan ini sedikit meningkat dibanding pernyataan pada Mei lalu yang mengatakan anggaran rumah tangga bergerak stagnan.

Pernyataan tersebut juga menggarisbawahi bahwa tingkat inflasi dalam 12 bulan ke depan diramal akan tetap di bawah target 2% dalam jangka pendek, namun stabil.

Di atas kenaikan suku bunga, komite mengatakan akan memulai proses normalisasi portofolio neraca berjalan pada tahun ini. Hasil notulensi rapat Mei lalu mengindikasikan anggota The Fed sudah mulai mendiskusikan mengenai penetapan batas jumlah nilai obligasi yang akan dilepas setiap bulannya seiring dilakukannya kebijakan prosedur penginvestasian kembali.

Meski demikian, banyak pengamat the Fed tidak menyangka FOMC akan memasukkan isu neraca dalam pernyataan resminya itu, yang mana Pimpinan The Fed Janet Yellen lebih cenderung membahas masalah ini dalam konferensi pers pasca pertemuan FOMC.

"Ini pernyataan yang cenderung hawkish dan mengejutkan. Kombinasi antara kenaikan suku bunga dan penyusutan neraca sama dengan pengetatan kebijakan moneter saat inflasi lebih rendah dari target. Itu merujuk pada hasil kurva yang mendatar," jelas Kathy Jones, senior fixed income strategist Charles Schwab.

Pernyataan The Fed mengenai program tersebut menunjukkan, kebijakan tersebut ditargetkan akan dimulai tahun ini, meski tidak dijelaskan secara spesifik mengenai tanggal pastinya.

"Komite menargetkan akan mulai mengimplementasikan proses normalisasi neraca berjalan mulai tahun ini, mengingat perekonomian sudah mengalami perubahan seperti yang diantisipasi," demikian pernyataan The Fed.

Berdasarkan informasi yang dirilis Rabu (14/6), batas nilai neraca yang akan dilepas dimulai dari US$ 6 miliar per bulan untuk tingkat cicilan pokok dari obligasi yang akan dilepaskan tanpa diinvestasikan kembali. Sisanya akan diinvestasikan kembali.

The Fed akan menaikkan batas atas mulai US$ 6 miliar dalam setiap kuartal hingga 12 bulan sampai batas atas tersebut mencapai US$ 30 miliar per bulan.

Untuk agensi dan utang KPR, batas atas yang ditetapkan akan mencapai US$ 4 miliar per bulan, dengan kenaikan kuartalan US$ 4 miliar hingga mencapai level US$ 20 miliar per bulan.

Saat kedua target tercapai, total pelepasan obligasi per bulan akan mencapai US$ 50 miliar. Sejumlah anggota The Fed mengatakan bahwa mereka memprediksi program pelepasan obligasi akan berlanjut hingga neraca mencatatkan penurunan ke kisaran US$ 2 triliun hingga US$ 2,5 triliun.

👀

Bisnis.com, JAKARTA – Pergerakan sejumlah indeks saham acuan Amerika Serikat (AS) berakhir menguat pada perdagangan Kamis (Jumat pagi WIB), menyusul rilis data ekonomi terbaru yang menunjukkan meningkatnya laju perekonomian.

Indeks Dow Jones Industrial Average ditutup menguat 0,65% ke 21.144,18, sedangkan indeks S&P 500 menanjak 0,76% ke 2.430,06 dan indeks Nasdaq Composite menguat 0,78% atau 48,31 poin ke posisi 6.246,83.

Baik indeks Dow Jones, S&P 500, dan Nasdaq kemarin mencatatkan level penutupan tertingginya.

Laporan ketenagakerjaan sektor swasta ADP menunjukkan pertambahan sebesar 253.000 pekerjaan pada bulan Mei. Angka itu jauh di atas prediksi para ekonom dalam survey Reuters untuk pertambahan sebesar 185.000 pekerjaan.

Laporan tersebut dapat mengindikasikan kuatnya laporan payroll pemerintah yang akan dirilis hari ini waktu setempat. Laporan itu mencakup perekrutan di sektor publik dan swasta, yang dapat memperkuat ekspektasi penaikan suku bunga oleh bank sentral AS The Federal Reserve dalam dua pekan ke depan.

Laporan tersebut dapat mengindikasikan kuatnya laporan payroll pemerintah yang akan dirilis hari ini waktu setempat. Laporan itu mencakup perekrutan di sektor publik dan swasta, yang dapat memperkuat ekspektasi penaikan suku bunga oleh bank sentral AS The Federal Reserve dalam dua pekan ke depan.

“Data ketenagakerjaan menjadi pendorong. Ini menjadi pertanda baik bagi The Fed. Angka kemungkinan (kenaikan) tersebut untuk Juni tentunya sangat tinggi,” kata Paul Springmeyer, direktur pelaksana investasi Private Client Reserve, seperti dikutip dari Reuters (Jumat, 2/6/2017).

Selain data ADP, sebuah laporan terpisah menunjukkan meningkatnya aktivitas pabrik pada bulan Mei setelah dua bulan berturut-turut melambat.

Ketua Federal Reserve wilayah San Francisco John Williams pada hari Rabu mengatakan meski melihat tiga kenaikan suku bunga tahun ini, ia juga berpendapat bahwa empat kenaikan suku bunga akan pantas jika ekonomi mendapat dorongan yang tidak terduga.

Sementara itu, anggota Dewan Gubernur The Fed Jerome Powell, seorang pembuat kebijakan yang berpengaruh, mengatakan kepada CNBC bahwa dia memperkirakan adanya tiga kali kenaikan suku bunga tahun ini.

Sementara itu, anggota Dewan Gubernur The Fed Jerome Powell, seorang pembuat kebijakan yang berpengaruh, mengatakan kepada CNBC bahwa dia memperkirakan adanya tiga kali kenaikan suku bunga tahun ini.

Menurut data Thomson Reuters, para pedagang saat ini melihat 88,9% kemungkinan untuk penaikan suku bunga sebesar seperempat poin oleh The Fed pada pertemuan kebijakan tanggal 13-14 Juni.

👂

reuters: By Caroline Valetkevitch | NEW YORK

U.S. stocks ended up slightly on Wednesday, with the S&P 500 hitting a record high close, after minutes of the Federal Reserve's latest meeting showed policymakers view a rate hike coming soon.

But, according to the May 2-3 meeting minutes, they also agreed they should hold off on raising interest rates until they knew a recent U.S. economic slowdown was temporary.

Stocks were volatile following the minutes' release, but eventually added to small earlier gains. The S&P financial index .SPSY, which fell right after the minutes came out, rebounded to end down just 0.04 percent. Banks tend to benefit from higher borrowing rates.

"Absent a material slowdown in the economy, Federal Reserve officials, acknowledging support from strengthening global growth, appear poised to stay on track toward interest rate normalization," said Quincy Krosby, chief market strategist at Prudential Financial, based in Newark, New Jersey.

The Dow Jones Industrial Average .DJI was up 74.51 points, or 0.36 percent, to 21,012.42, the S&P 500 .SPX gained 5.97 points, or 0.25 percent, to 2,404.39 and the Nasdaq Composite .IXIC added 24.31 points, or 0.40 percent, to 6,163.02.

It was also a fifth straight day of gains for the S&P 500.

Following the Fed minutes' release, traders scaled back bets on two more rate increases by the end of 2017.

Federal funds futures implied traders saw about a 46 percent chance the U.S. central bank would raise rates twice more by year-end, down from roughly 50 percent late on Tuesday, according to CME Group's FedWatch program.

Fed policymakers also discussed at length the reasons for the first-quarter slowdown. While recent economic data has been mixed, with signs of a dip in consumer sentiment and spending, the job market continues to strengthen.

"One thing that struck me a bit was that they registered confidence in the consumer was pretty healthy, and that's significant," said Michael Purves, chief global strategist at Weeden & Co.

Among the day's gainers, Intuit (INTU.O) jumped 6.7 percent after the tax-preparation software maker posted a profit topped estimates and also raised its revenue forecast.

The retail sector issued more results that disappointed.

Lowe's (LOW.N) dropped 3 percent after the home improvement chain reported a lower-than-expected profit and comparable sales.

Jewelry retailer Tiffany (TIF.N) sank 8.7 percent after posting a surprise drop in comparable sales. Signet Jewelers (SIG.N), which reports on Thursday, was down 7.2 percent. The two were the biggest losers on the S&P.

About 6.1 billion shares changed hands on U.S. exchanges, below the 6.8 billion daily average for the past 20 trading days, according to Thomson Reuters data.

Advancing issues outnumbered declining ones on the NYSE by a 1.30-to-1 ratio; on Nasdaq, a 1.07-to-1 ratio favored advancers.

The S&P 500 posted 49 new 52-week highs and 12 new lows; the Nasdaq Composite recorded 99 new highs and 57 new lows.

(Additional reporting by Tanya Agrawal in Bengaluru and Megan Davies in New York; Editing by Savio D'Souza and Nick Zieminski)

👀

Bisnis.com, NEW YORK— Bank Sentral AS (The Fed) kembali menegaskan rencananya untuk melakukan pemangkasan pada neraca keuangannya pada akhir tahun ini.

Presiden The Fed San Francisco Joh Williams mengatakan, kebijakan itu dirasa perlu dilakukan untuk menambah amunisi The Fed ketika menghadapi resesi di masa depan. Dia juga mendukung program pembelian obligasi AS, untuk membantu meningatkan daya tahan ekonomi AS di masa depan.

“Tujuan kami jelas yakni memangkas neraca keuangan agar kita memiliki kesiapan yang lebih baik untuk menghadapi resesi tak terduga di masa mendatang, " kata Williams seperti dikutip dari Reuters, Minggu (7/5/2017).

Seperti diketahui, The Fed berencana menyusutkan neraca keuangannya sebesar US$4,5 triliun pada tahun ini. Otoritas moneter AS itu menargetkan Desember sebagai periode yang tepat untuk melaksanakan kebijakan tersebut.

Dukungan pada kebijakan moneter The Fed itu juga diungkapkan oleh Gubernur The Fed Janet Yellen. Dalam pidatonya pada Sabtu (7/5/2017) lalu, dia menyatakan diri sebagai pendukung terbesar program pelonggaran kuantitatif tersebut.

Adapun, kebijakan serupa selama ini telah dilakukan oleh Jepang dan Eropa untuk membantu memperbaiki perekonomiannya.

Namun, rencana tersebut rupanya mendapat tentangan dari kalangan parlemen AS. Kubu Partai Republik menjadi yang paling lantang menyuarakan penolakan. Pasalnya, mereka menilai kebijakan tersebut akan memicu kegiatan pembelanjaan pemerintah yang sembrono dan tak efektif.

Penolakan serupa juga muncul dari dua kandidat utama pengganti Yellen sebagai Gubernur The Fed pada tahun depan yakni Kevin Wars dan John Taylor. Keduanya pesimis rencana The Fed tersebut akan cukup efektif untuk mendorong perekonomian Paman Sam menjadi lebih baik di masa depan.

Sebelumnya, penegasan terkait rencana pemangkasan neraca keuangan The Fed telah diungkapkan dalam pernyataan pers usai pertemuan Federal Open Market Commitee (FOMC) pada Rabu (3/5/2017).

Dalam pertemuan tersebut, selain memutuskan untuk menahan suku bunga acuannya pada level 0,75%-1%, The Fed juga menyebutkan target waktu pelaksanaan pemangkasan neraca keuangan, yakni pada akhir tahun ini.

“Kebijakan tersebut akan kami lakukan setidaknya pada Desember, dengan tetap mempertimbangkan kondisi ekonomi terbaru,” tulis The Fed.

Sumber : Reuters

| NEW YORK

Wall Street's top banks see the Federal Reserve laying out by year end its plan to scale back reinvestments in Treasuries and mortgage-backed securities in order to begin shrinking its $4.5 trillion balance sheet, a Reuters poll showed on Friday.

Five of 15 primary dealers, or banks that do business directly with the U.S. central bank, expected the Fed to start paring reinvestments by year end, while the rest forecast the central bank would do so by the end of the second quarter of 2018.

The median view of 11 dealers was for the Fed to eventually shrink its balance sheet to $2.75 trillion.

As the U.S. central bank seems prepared to tackle unwinding its bond holdings, primary dealers see the Fed raising interest rates two more times by year end and three times in 2018.

Fed policymakers have turned their focus to paring the central bank's massive bond holdings, as shown in the minutes of their March policy meeting released on Wednesday.

Last month, the Fed raised rates by a quarter percentage point to 0.75 percent-1.00 percent amid signs of an improving U.S. economy and stock prices reaching record highs.

The central bank amassed its Treasuries and MBS during three rounds of large-scale purchases known as quantitative easing, which was aimed to lower long-term borrowing costs and combat the repercussions of a severe recession that was exacerbated by the global credit crisis more than eight years ago.

On Wednesday, the Fed held $2.46 trillion in Treasuries and $1.77 trillion in MBS.

While the Fed has longed to reduce those holdings, it has been reluctant to do so due to concerns that buying fewer bonds could cause a spike in mortgage rates and other long-term borrowing costs and hurt an economy that has been stuck at a 2 percent growth rate.

The Fed's willingness to embark on this change came after Donald Trump's surprise U.S. presidential victory in November, which unleashed hopes of tax cuts, looser regulations and infrastructure spending to bolster business investments and job growth.

That optimism has cooled in recent weeks after Trump and the Republican-controlled U.S. Congress failed to pass healthcare reform. This led investors to scale back expectations on tax cuts and infrastructure spending in 2017.

Federal fiscal stimuli, analysts say, would cushion tighter financial conditions from interest rate increases and fewer bond purchases from the Fed.

A disappointing March jobs report caused traders to briefly slash their bets on a June rate hike on Friday before comments from influential New York Fed chief William Dudley on rate increases and balance sheet normalization revived those bets.

"This report doesn't take away from the Fed's near-term outlook on the economy," said Sam Bullard, senior economist at Wells Fargo, a primary dealer in Charlotte, North Carolina.

In the latest Reuters poll, 13 of 17 dealers saw the Fed hiking rates to 1.00-1.25 percent by the end of the second quarter, compared with 11 of 17 dealers in a March 15 poll.

Eight of 17 dealers saw the Fed lifting rates to 1.25-1.50 percent by the end of the third quarter, while 16 of 17 expected that rate range to be reached by year end.

(Reporting by Saqib Ahmed, Karen Brettell, Sinead Carew, Sam Forgione, Richard Leong, Chuck Mikolajczak, Dion Rabouin and Rodrigo Campos; Editing by Chizu Nomiyama and Meredith Mazzilli)

💋

Bisnis.com, JAKARTA – Pergerakan bursa saham Amerika Serikat ditutup melemah pada perdagangan Rabu atau Kamis pagi, di saat para pedagang mencermati arah kenaikan suku bunga AS serta menimbang kecenderungan reformasi pajak oleh pemerintahan Trump.

Indeks S&P 500 turun 0,3% ke posisi 2.352,95, sedangkan indeks Dow Jones turun 0,2% ke level 20.648,15.

Perusahaan perbankan dan energi bergerak naik turun di akhir sesi, dengan indeks S&P 500 Financial meluncur dari sekitar 1% menjadi turun 0,7% pada penutupan.

Di sisi lain, firma utilitas dan real estate bergerak lebih tinggi di saat imbal hasil 10 tahun turun 3 basis poin, setelah risalah rapat kebijakan Fed pada Maret dirilis.

Mayoritas pejabat Federal Reserve menyatakan akan mendukung perubahan kebijakan yang akan mulai menyusutkan neraca keuangan bank sentral tersebut senilai US$4,5 triliun.

“Potensi bahwa The Fed akan menghentikan investasi kembali lebih cepat dari ekspektasi, serta perdebatan yang berlanjut di Washington telah membebani investor,” ujar global strategist Jonestrading Yousef Abbasi, seperti dikutip dari Bloomberg (Kamis, 6/4/2017).

Menurut chief U.S. equity strategist Citigroup Inc. Tobias Levkovich, bursa AS terlihat lebih mahal dibandingkan dengan bursa global lainnya. Nilai valuasi terlihat lebih masuk akal daripada imbal hasil obligasi.

Bloomberg Intelligence Equity Strategists Gina Martin Adams dan Peter Chung turut mengamini pandangan Levkovich bahwa nilai saham menjadi lebih mahal relatif terhadap valuasi historis, namun lebih murah daripada obligasi.

👊

newsweek: Bank shares have been the runaway winners of the post-election U.S. stock market boom as investors wagered that higher interest rates, lighter regulation, lower taxes and faster economic growth would boost profits for lenders.Up 32 percent since the election of Donald Trump, the S&P 500's bank index has outpaced the wider market's gain by roughly 3-to-1. Now, however, a changing dynamic in the bond market as the U.S. Federal Reserve gears up to raise interest rates at a faster pace than many had previously expected is beginning to give pause to some early bank stock bulls.

Win an iPhone 7 Sign up to our daily newsletter for your chance to win.

With another strong U.S. jobs report in the books, the Fed is widely expected to raise overnight interest rates on Wednesday, and is now seen delivering three rate hikes in 2017.

Rising rates can boost bank profits, but bank profitability also hinges on the difference between short-term rates, like those set by the Fed and which tend to mark the cost for banks to acquire their funds, and long-term rates, which serve as benchmarks for what banks charge their customers for loans.

When that difference, or spread, is large, bank profits can rise rapidly. When it narrows, or flattens, profit growth can suffer.

At issue now is what some investors see as a growing risk of a flattening yield curve under a more aggressive rate-hike path by the Fed. Forwards pricing for 2- and 10-year Treasury yields suggests the spread between them will narrow to about 93 basis points by year-end from the current 122 points.

That is why Jeffrey Gundlach, chief executive officer at DoubleLine Capital and an early buyer of the Trump rally, said he has sold his financial stocks.

"When the Fed tightens more than once a year, historically it is very consistent with a flatter curve," Gundlach said. "The yield curve won't help the sector."

In the month after the Nov. 8 U.S. presidential election the S&P 500 bank index rose 24 percent. Since then the stocks have risen 5.7 percent as many investors awaited concrete signs of regulatory and tax reform.

"Post-election, that was the easy money on financials right there," DoubleLine's Gundlach said.

More Than the Curve

To be sure, the bank rally has been grounded on more than just rate hike expectations and yield curve forecasts. Investor interest has also been stoked by assumptions about Trump's agenda in Washington.

Investors have been betting that Trump's promises of tax cuts would boost consumer spending and company profits, which would drive loan demand. Meanwhile, his promise to slash regulations could also cut compliance costs and allow banks to expand their loan portfolios more rapidly than possible under restrictions imposed following the financial crisis.

That is among the reasons why David Lebovitz, global market strategist at J.P. Morgan Asset Management, still expects more gains for financial stocks.

Even if regulatory and tax reform looks like it will take a long time, investors will likely be patient as long as Trump's administration provides more specifics on its plans including timetables, Lebovitz said.

But he cautioned that "disappointment on the policy front is the biggest risk" to stocks right now as investors have priced in policy changes already.

Paul Nolte, portfolio manager at Kingsview Asset Management in Chicago, said that the bank sector's outperformance may be "done" but stopped short of calling for a correction.

"I'm not sure investors are looking at the shifting yields and market conditions. It seems to be buy and worry about the 'why' later," he said.

👀

marketwatch: An interest rate hike at the U.S. central bank’s policy meeting in less than two weeks is likely, said Federal Reserve Chairwoman Janet Yellen on Friday.

“At our meeting later this month, the Federal Open Market Committee will evaluate whether employment and inflation are continuing to evolve in line with our expectations, in which case a further adjustment of the federal funds rate would likely be appropriate,” Yellen said in a speech to The Executives’ Club of Chicago.

This is similar to language the Fed has used in the past to signal an impending move. The only thing in the way of a rate hike is the nonfarm payrolls report ahead of the meeting.

Yellen’s blunt speech reinforces comments from other Fed officials this week that a rate hike at the two-day meeting ending March 15 meeting was likely. Most notably, New York Fed President William Dudley said Tuesday that the case for a March move had become “a lot more compelling.”

Investors now see the odds of a March rate hike at 75%, up from 22% last week.

In her speech, Yellen said the prospects for continued moderate growth were encouraging and risks from abroad appear to have receded. The job market is strengthening and inflation is rising towards the central bank’s 2% target.

At the same time, Yellen said the Fed was not behind the curve and could still raise rates at a gradual pace. The Fed has penciled in three rate hikes this year.

On the other hand, waiting too long could require the central bank to raise rates rapidly sometime down the road, she added.

But investors should get used to a faster pace of rate hikes.

“Given how close we are to meeting our statutory goals, and in the absence of new developments that might materially worsen the economic outlook, the process of scaling back accommodation likely will not be as slow as it was in 2015 and 2016,” she said, when the central bank made one hike each year.

👅

| WASHINGTON

reuters: The Federal Reserve held interest rates steady on Wednesday in its first meeting since President Donald Trump took office, but painted a relatively upbeat picture of the U.S. economy that suggested it was on track to tighten monetary policy this year.

The U.S. central bank said job gains remained solid, inflation had increased and economic confidence was rising, although it gave no firm signal on the timing of its next rate move.

Fed policymakers are still awaiting clarity on the possible impact of Trump's economic policies.

"Measures of consumer and business sentiment have improved of late," the Fed said in a unanimous statement following a two-day policy meeting in which it left its benchmark interest rate in a range of 0.50 percent to 0.75 percent.

The Fed also highlighted that the unemployment rate, currently at 4.7 percent, was still hovering near its recent low.

Financial markets were little changed after the rate decision, while investors were still expecting the next rate increase to occur in June, according to Fed funds futures data compiled by the CME Group.

The Fed raised rates in December for only the second time in a decade and forecast three rate increases in 2017.

Fed Chair Janet Yellen recently underscored that, with the economy near full employment, the central bank risked a "nasty surprise" on inflation if it is too slow with rate hikes.

The Fed said in its statement that it still expects inflation to rise to its 2 percent target in the medium term, although it noted that inflation compensation was still low and long-term inflation expectations were little changed.

It did, however, indicate that the effects of weak oil prices had ended, something that will give it a "clean" read on inflation in the future. On Monday, the Commerce Department reported an uptick in inflation to 1.7 percent.

"The economy continues to chug along and sentiment has improved. The Fed does sound more confident about eventually getting to its 2 percent inflation target," said Brian Jacobsen, chief portfolio strategist at Wells Fargo Funds Management.

FISCAL POLICY UNCERTAINTY

Investors had all but ruled out a rate increase this week, given the uncertainty surrounding Trump's fiscal and trade policies and how they would affect the Fed's outlook.

Trump's promises on infrastructure spending, tax cuts, regulation rollbacks and a renegotiation of trade deals could quickly spur higher inflation, which may necessitate a faster pace of rate hikes.

RELATED COVERAGE

Fed may hike rates four times this year: BlackRock's Rieder

The businessman-turned-politician has offered few specifics on his economic plans or a timeline for their rollout, while the announcement of policies viewed by many as protectionist and an immigration crackdown have caused market jitters in recent days.

"There is still uncertainty about fiscal policy, so the Fed is likely waiting for a bit more data and more certainty," said Tony Bedikian, head of global markets at Citizens Bank.

Earlier on Wednesday, data showed U.S. factory activity accelerated to more than a two-year high in January while a report by a payrolls processor showed U.S. private employers added 246,000 jobs in January, far above analysts' expectations.

The Labor Department is scheduled to release its closely-watched monthly jobs report for January on Friday. Yellen may also give a clearer signal on the Fed's thinking when she provides semi-annual testimony to Congress in mid-February.

There are seven more Fed policy meetings in 2017, with the next one scheduled for March 14-15.

(Reporting by Lindsay Dunsmuir and Jason Lange; Additional reporting by Rodrigo Campos and Dion Rabouin in New York; Editing by Paul Simao)

💋

Washington, Dec 22, 2016 (AFP) A closely watched measure of US inflation was unchanged in November while growth in incomes was outpaced by consumer spending, according to Commerce Department figures released Thursday.

The department reported that the personal consumption expenditures (PCE) price index, the inflation indicator most valued by the Federal Reserve, was flat after posting positive results every month since February.

While signs of inflation have been lacking in recent months, the Fed last week raised rates for only the second time in a decade in an effort to prevent anticipate rises in prices.

Year-on-year, the PCE price index was up 1.4 percent, unchanged from the yearly result recorded for October. The result was still well below the Fed's target of 2 percent but pointed to an upward trend since July.

Core PCE inflation, which excludes more volatile food and fuel prices, was also flat for the month but was up 1.6 percent over the same month in 2015, slower than the 1.8 percent recorded for October.

Personal incomes were largely flat, growing less than 0.1 percent to $1.6 billion while personal consumption spending grew 0.2 percent to $24 billion or the month, according to the department.

The Commerce Department on Thursday also moved up its estimate for growth in the third quarter, saying the world's largest economy had expanded at a rate of 3.5 percent during the period, up 3 tenths from a prior estimate. An analyst consensus had forecast an increase of only a tenth of a point.

The figures confirmed the general picture of the economy, which saw a sharp rise in activity in the third quarter after a slower first half of 2016. The department said the faster pace was based on higher consumer spending, business fixed investment and an upturn in spending by state and local governments.

👀

NILAHCOM, Washington - Federal Reserve AS atau bank sentral AS memutuskan menaikkan suku bunga acuannya sebesar 25 basis poin sesuai dengan perkiraan, merupakan kenaikan pertama dan hanya pada tahun ini.

"Mengingat realisasi dan ekspektasi kondisi-kondisi pasar tenaga kerja dan inflasi, Komite (Pasar Terbuka Federal) memutuskan untuk menaikkan target suku bunga federal funds ke kisaran 0,50 persen hingga 0,75 persen," kata Fed dalam sebuah pernyataan setelah meangkhiri pertemuan kebijakan dua hari, Rabu (14/12/2016).

Peningkatan suku bunga federal funds dari kisaran sebelumnya 0,25 persen hingga 0,50 persen itu, merupakan kenaikan pertama sejak Desember 2015 dan hanya yang kedua dalam satu dekade terakhir.

Ekspansi ekonomi moderat, berlanjutnya penguatan pasar tenaga kerja dan peningkatan kondisi inflasi mendukung bank sentral untuk menaikkan suku bunga setelah jeda hampir satu tahun, menurut pernyataan itu.

Ekonomi AS telah meningkatkan kecepatan ekspansinya sejak pertengahan tahun ini, dengan dukungan dari belanja konsumen yang kuat, pasar kerja terus menguat dan tingkat pengangguran turun menjadi 4,6 persen pada November, tingkat terendah sejak 2007, serta inflasi telah meningkat sejak awal tahun ini, dengan inflasi inti naik menjadi 1,75 persen.

Pada Desember tahun lalu, bank sentral AS menaikkan suku bunga untuk pertama kalinya dalam hampir satu dekade.

Namun, pelambatan ekonomi global sejak awal tahun ini dan kondisi inflasi yang rendah telah membuat pembuat kebijakan Fed berhati-hati dan menunda setiap kenaikan suku bunga lebih lanjut untuk tujuh pertemuan berturut-turut tahun ini.

Para pejabat Fed menilai bahwa "risiko-risiko jangka pendek terhadap prospek ekonomi tampak kira-kira seimbang," tetapi menegaskan bahwa mereka akan terus memonitor secara cermat indikasi-indikasi inflasi serta perkembangan ekonomi dan keuangan global.

Juga pada Rabu, The Fed merilis proyeksi ekonomi terkini yang menunjukkan bahwa bank sentral memperkirakan tiga kenaikan suku bunga pada tahun depan, sementara dalam proyeksinya pada September para pejabat Fed memperkirakan hanya dua kenaikan suku bunga pada 2017.

Penyesuaian naik sedikit dari perkiraan mencerminkan pertimbangan para pejabat Fed atas penurunan tingkat pengangguran, Ketua Fed Janet Yellen mengatakan pada konferensi pers setelah pertemuan dua hari Komite Pasar Terbuka Federal (FOMC).

Pejabat-pejabat Fed sedikit mengangkat perkiraan mereka untuk pertumbuhan ekonomi tahun depan menjadi 2,1 persen dari perkiraan September sebesar 2,0 persen.

Menanggapi pertanyaan tentang kebijakan-kebijakan ekonomi Presiden terpilih Donald Trump, Yellen mengatakan bahwa semua pejabat Fed "mengakui bahwa ada ketidakpastian besar tentang bagaimana kebijakan-kebijakan ekonomi dapat berubah, dan apa yang mungkin dilakukan dan bagaimana Fed mungkin harus bereaksi."

Dia menekankan bahwa bank sentral akan mempertimbangakn kebijakan-kebijakan fiskal, bersama dengan hal-hal lainnya, seperti kondisi-kondisi global dan harga minyak, ke dalam prospek ekonomi dan memastikan kebijakan moneter yang tepat. [tar]

- See more at: http://pasarmodal.inilah.com/read/detail/2345913/inilah-keputusan-rapat-the-fed#sthash.P0W1w67R.dpuf

👀

JAKARTA. Bank Indonesia menilai proyeksi ekonomi domestik ke depan masih dipengaruhi oleh perekonomian China dan suku bunga Amerika Serikat.Deputi Gubernur Senior BI Mirza Adityaswara mengatakan ekonomi China akan mempengaruhi harga komoditas sehingga mempengaruhi ekonomi Sumatra dan Kalimantan secara langsung. BI menganalisa bahwa pemulihan ekonomi China masih akan berlanjut di 2017.Pada tahun depan, China juga memasuki tahun yang mana terdapat sidang Partai Komunis sehingga dipastikan pemerintah negeri panda itu akan menjaga perekonomian. Pemulihan pertumbuhan ekonomi China diperkirakan masih berlanjut di level 6,5%-6,7% pada 2017.

"Optimisme harga komoditas berlanjut. Itu range yang sehat itu sudah bisa melihat pemulihan harga komoditas berlanjut," katanya, di Jakarta, Kamis (1/12/2016).

Sementara itu, suku bunga Amerika Serikat akan mempengaruhi biaya yang dikeluarkan untuk mendapatkan dana (cost of fund) dan ketersediaan dana ke negara emerging market, seperti Indonesia. Sebelum Donald Trump terpilih sebagai Presiden AS, The Fed diperkirakan hanya akan menaikkan dua kali suku bunganya, bahkan ada analisa yang menyatakan The Fed tak akan menaikkan Fed Fund Rate.

"Analisa tersebut sekarang menjadi harus ditinjau kembali karena pasar memastikan kemana arah kebijakan ekonomi AS akan mempengaruhi arah kebijakan The Fed," ucapnya.

http://finansial.bisnis.com/read/20161201/9/608059/bi-china-dan-the-fed-yang-paling-mempengaruhi-ekonomi-tahun-depan

Sumber : BISNIS.COM

💃

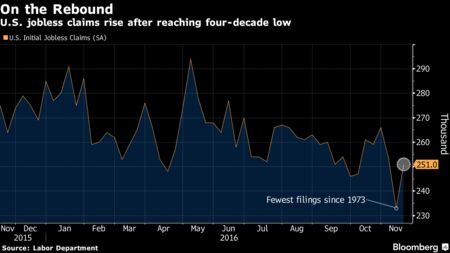

bloomberg: Filings for unemployment benefits in the U.S. rebounded last week from a four-decade low while remaining consistent with a firm labor market.

Jobless claims rose by 18,000 to 251,000 in the period ended Nov. 19, a Labor Department report showed Wednesday. The median forecast in a Bloomberg survey called for 250,000 applications. In the previous week that included the Veterans Day holiday, applications slumped to 233,000, the lowest since 1973.

Companies have balked at outright dismissals as a tighter job market leaves fewer skilled workers available for open positions. Filings for unemployment benefits have been below 300,000, a level synonymous with a thriving labor market, for 90 straight weeks -- the longest streak since 1970.

Estimates in the Bloomberg survey ranged from 225,000 to 265,000. The prior week’s reading was revised from 235,000.

The four-week average of claims, a less-volatile measure than the weekly figure, declined to 251,000 -- the lowest since the first week of October -- from 253,000 in the prior week.

The number of people continuing to receive jobless benefits climbed by 60,000 to 2.04 million in the week ended Nov. 12. The unemployment rate among people eligible for benefits ticked up to 1.5 percent from 1.4 percent. These data are reported with a one-week lag.

No states had estimated claims last week and there was nothing unusual in the data, according to the Labor Department.

💥

ID: Pascapenundaan kenaikan suku bunga acuan AS pada 2 November, ketidakpastian Fed rate kembali mencuat. Sudah berkali-kali sinyalemen pejabat Bank Sentral AS, termasuk Gubernur the Fed, Janet Yellen, akan menaikkan Fed rate, tetapi sekian kali pula tidak menyebutkan waktunya secara pasti.

Tensi ketidakpastian semakin meninggi setelah Donald Trump terpilih menjadi presiden AS. Mazhab yang dianut Partai Republik pengusung Trump cenderung protektif terhadap perekonomian domestik. Sikap inilah yang membuat dampak kebijakan moneter AS melalui Fed ratepada pasar keuangan global jadi lebih susah ditebak.

Ruang untuk menaikkan Fed rate sejatinya sangat terbuka. Sejak krisis finansial global 2008 hinggaNovember 2015, Fed rate stagnan di level 0,25% untuk meredakan krisis. Baru pada Desember 2015, Fed ratedinaikkan sebesar 25 basis poin menjadi 0,5% yang berlaku hingga kini. Artinya, secara psikologis Fed ratesudah terlalu lama ‘monoton’.

Selama stagnasi Fed rate, perekonomian AS mulai pulih kendati belum memuaskan. Pertumbuhan ekonomi AS sebesar 1,6% pada saat ini dari target 2% yang diikutidengan penambahan 147.000 lapangan kerja sepanjang Oktober, lebih rendah dari Agustus yang mencapai151.000 orang.

Tingkat pengangguran berada di level 4,8%, turun di bawah level 5% untuk kali pertama sejak 2008. Tingkat upah pun tumbuh 3,83% pada Oktober dibanding periode yang sama tahun lalu. Kelanjutan dari sinyal awal ini yang ditunggu Yellen untuk mengambil keputusan secara definitif.

Banyak analis memprediksi kenaikan Fed rate akan terjadi pada Desember. Namun, testimoni Yelen tersebut sudah cukup untuk menciptakan gejolak di pasar finansial global. Dolar AS terapresiasi terhadap mata uang utama dunia. Dollar index intraday berada di level 98,60 dan US treasury 10Y menyentuh level tertinggi di 2%. Indonesia pun terkena dampaknya. Bank Indonesia mencatat selama pekan terakhir Oktober, arus dana asing yang keluar tercatat Rp 7 triliun.

Di pasar saham, sentiment kenaikan Fed rate agaknya telah di-price-in ke dalam IHSG. Arus dana investor asing yang keluar dari lantai bursa senilai Rp 2 triliun yang menjadi catatan tertinggi sejak Juni 2016. Fenomena yang terjadi di pasar uang dan pasar modal di atas memperlihatkan bahwa ‘fatwa’ Gubernur Bank Sentral AS senantiasa didengar dan selanjutnya menjadi rujukan bagi para pelaku ekonomi dalam mengambil keputusan.

Kondisi ini terjadi karena faktor kredibilitas institusi yang telah sekian abad terbangun secara konsisten. Kredibilitas kebijakan institusi dibangun atas dasar komitmen kuat bahwa rencana kebijakan yang telah diumumkan di depan sejauh mungkin akan sama dengan realitasnya.

Dari sisi kredibilitas personalnya, Yellen memiliki persyaratan yang mumpuni untuk mendukung reputasi institusinya. Sebelum menggapai kursi nomor satu di bank sentral, dia menjadi wakil ketua pada masa bakti sebelumnya. Trackrecord yang sangat panjang menghantarkannya menjadi wanita pertama yang memangku jabatan gubernur bank sentral.

Reputasi sebagai akademisi dan praktisi sangat membantu Janet Louise Yellen –yang juga istri ekonom Amerika tersohor George Akerlof– dalam melaksanakan tugasnya. Sehingga saat baru mengumumkan akan menaikkan suku bunga saja, pasar finansial sudah bereaksi seolah-olah suku bunga benar-benar telah dinaikkan.

Ditinjau dari sudut pandang publik, kredibilitas adalah pikiran yang berkembang di benak pelaku pasar tentang seberapa dekat kebijakan yang telah digariskan dengan hasilnya. Dalam konteks ini, kebijakan bank sentral adalah kredibel jika mampu memantik kepercayaan (confidence) pelaku ekonomi untuk mendukung kebijakan tersebut.

Bagi bank sentral, pengumuman tersebut menjadi wahana signaling untuk meraba arah ekspektasi para pelaku pasar. Intinya, bank sentral sedang melakukan semacam test case sebagai simulasi. Hal ini sangat penting sebagai prakondisi bagi bank sentral dan pemerintah untuk melakukan konsolidasi dalam mempersiapkan infrastuktur pendukungnya.

Simulasi kebijakan adalah satu cara yang perlu ditempuh jika berhadapan pada ketidakpastian. Hasil simulasi ini, sebagai prosedur ilmiah yang baku sebelum kebijakan resmi diluncurkan, menjadi informasi awal untuk mendeteksi seberapa besar size dampak dan reaksi yang ditimbulkan sebagai bekal dalam menyusun alternatifalternatif strategi komplementer andaikan sasaran yang dituju meleset dari rencana.

Dari sisi pelaku pasar, pengumuman bank sentral yang hendak menaikkan suku bunga, memberikan kesempatan bagi pelaku ekonomi untuk mengenali (recognize), membuat keputusan, dan mengimplimentasikan keputusannya.

Pada fase ini, agen ekonomi secara proaktif akan mengumpulkan semua informasi yang terkait dengan kebijakan bank sentral. Dengan demikian, keputusan konkret yang diambil para pelaku ekonomi telah efisien dari semua kemungkinan yang tersedia. Kesemua proses tadi tentu saja memerlukan waktu, baik bagi bank sentral maupun bagi masyarakat yang akan terkena kebijakan. Seberapa lama waktu yang diperlukan hingga efektif sampai pada sasaran yang dituju tergantung pada seberapa cepat para pelaku ekonomi meresponsnya.

Respons masyarakat yang masih terpaku berdasarkan pada pengalaman masa lalu (adaptive behavior) akan memakan waktu lama untuk bereaksi. Sebaliknya, jika sikap pelaku ekonomi sudah berorientasi pada masa depan (forward looking behavior), responsnya akan memerlukan waktu yang singkat. Respons para pelaku ekonomi yang cepat kendati baru pada tahap signalling menjadikan keputusan perubahan Fed rate nanti pada sisa tahun ini hanya menjadi semacam formalitas belaka. Artinya, kebijakan sejatinya sudah ‘terdiskon’ dan efeknya sudah bekerja jauh hari sebelumnya.

Dalam perspektif yang lebih luas, kebijakan yang ‘terdiskon’ ini akan menggeser peranan bank sentral. Semula menetapkan suku bunga acuan sebagai instrumen untuk mengarahkan ke mana perekonomian akan melangkah menjadi mengubah suku bunga acuan untuk mengikuti ke mana arah perekonomian berkembang.

Meminjam istilah Ki Hajar Dewantara: awalnya ing ngarsa sung tuladha beralih menjadi tut wuri handayani. Alhasil, kebijakan moneter memerlukan sentuhan art, alih-alih hanya mendasarkan pada keilmuan semata.

Haryo Kuncoro, Direktur Riset SEEBI (the Socio-Economic & Educational Business Institute) Jakarta, Staf Pengajar Fakultas Ekonomi Universitas Negeri Jakarta, Doktor Ilmu Ekonomi Lulusan PPs-UGM Yogyakarta

💥

Washington, Nov 17, 2016 (AFP) US inflation picked up in September with the strongest monthly rise in six months, mainly reflecting higher prices for gasoline and housing, the Labor Department said Thursday.

The consumer price index rose 0.4 percent for the month on a seasonally adjusted basis, matching analyst expectations.

Over the prior 12 months, the index was up 1.6 percent, the biggest such gain since October 2014.

Rising fuel prices drove over half of the overall CPI gain, up 7 percent for the month, after a 6 percent gain in September. Housing prices also rose 0.4 percent for October.

Excluding food and fuel, the core consumer price index rose only 0.1 percent for the second month in a row. For the 12-month period ended October, that figure rose 2.1 percent.

US monetary policymakers have so far held off raising interest rates in 2016, waiting for signs inflation and tightening in the labor markets.

US Fed chief Janet Yellen testified in Congress on Thursday that a rate increase could occur "relatively soon." The Federal Reserve is due to consider interest rate policy next month.

Ian Shepherdson of Pantheon Macroeconomics said the 12-month gain for the overall index was on track to overtake core CPI by early 2017 -- the first time it will have done so in five years.

"This will drive up consumers' inflation expectations, even before the fiscal stimulus proposed by the new administration kicks in," he wrote in a note to clients.

"We think inflation risks for the foreseeable future are to the upside."

💑

Washington - Gubernur Federal Reserve AS, Daniel Tarullo mengisyaratkan bahwa ia terbuka untuk menaikkan suku bunga lebih lanjut.

"Pembahasan kapan saat yang tepat untuk menaikkan suku bunga untuk mencegah ekonomi dari 'overheating' terlalu banyak sekarang, dari sudut pandang saya lebih banyak di atas meja daripada sebelumnya," kata Tarullo dalam sebuah forum di Washington DC, Selasa (15/11/2016).

Tarullo adalah salah satu pejabat Fed "dove" yang menganjurkan bahwa bank sentral harus menunggu bukti kuat untuk tren kenaikan dalam inflasi sebelum menaikkan suku bunga.

Dia mengatakan bahwa ada beberapa perubahan dalam pola yang berlaku dalam inflasi dan pasar tenaga kerja untuk waktu yang lama. Indikator inflasi inti menunjukkan gerakan naik; pertumbuhan upah telah meningkat; dan tingkat partisipasi tenaga kerja cenderung hampir atau bahkan melebihi harapan, menurut pejabat itu.

"Semua itu menunjukkan kepada saya bahwa kita berada dalam situasi agak berbeda dari setidaknya yang saya pikir kita berada dalam enam atau delapan, 10, 12 bulan yang lalu," kata Tarullo.

Namun, ia menekankan bahwa Fed harus tetap berhati-hati dalam bergerak menaikkan suku bunganyat, karena masih ada pengenduran di pasar tenaga kerja dan bank sentral memiliki alat yang lebih sedikit untuk menanggapi resesi.

Menurut analis, pernyataan Tarullo pada Selasa menunjukkan bahwa dia lebih terbuka untuk kenaikan suku bunga lebih lanjut. The Fed akan mengadakan pertemuan kebijakan berikutnya, juga terakhir tahun ini, pada 13-14 Desember. Para investor secara memperkirakan Fed akan menaikkan suku bunga pada pertemuan Desember.

http://pasarmodal.inilah.com/read/detail/2339263/pejabat-fed-saatnya-bahas-kenaikan-suku-bunga

Sumber : INILAH.COM

👀

By Lindsay Dunsmuir and Jason Lange

WASHINGTON (Reuters) - The Federal Reserve kept interest rates unchanged on Wednesday in its last policy decision before the U.S. election, but signaled it could hike in December as the economy gathers momentum and inflation picks up.

The U.S. central bank said the economy had gained steam and job gains remained solid. Policymakers also expressed more optimism that inflation was moving toward their 2 percent target.

"The committee judges that the case for an increase in the federal funds rate has continued to strengthen but decided, for the time being, to wait for some further evidence of continued progress toward its objectives," the Fed said in a statement following a two-day meeting.

That suggests the bar is low for a rate increase at the Fed's final policy meeting of the year in mid-December, which has largely been factored in by financial markets.

U.S. stocks extended earlier losses and Treasury yields fell after the release of the Fed statement. The U.S. dollar (DXY) briefly pared losses before falling further against a basket of currencies.

"You are still pointing to a December hike, they just didn't pre-commit to it," said John Canally, investment strategist and economist for LPL Financial in Boston.

In the statement, the Fed's increasing confidence that prices were moving higher was reflected in its view that "inflation has increased somewhat since earlier this year" and the removal of its previous reference to inflation remaining low in the near term.

Policymakers have increasingly converged on the likelihood of a December hike. In September, Fed Chair Janet Yellen said that a move before year's end was likely as long as U.S. employment and inflation continued to strengthen.

Since then, job gains have continued at a solid rate and inflation has ticked higher, putting both close to the Fed's long-run targets. The economy also has gained momentum, growing at a 2.9 percent annual pace in the third quarter after a fairly sluggish first half.

ELECTION UNCERTAINTY

Investors had all but discounted an increase in borrowing costs this week ahead of the Nov. 8 U.S. election.

Polls showing Republican Donald Trump gaining ground on Democratic rival Hillary Clinton in the race for the White House sparked a slide on global equities markets, with the benchmark S&P 500 index headed for its seventh straight day of declines.

A Reuters/Ipsos poll released on Monday showed the former secretary of state leading Trump by 5 percentage points, but some other surveys this week put the New York businessman ahead by 1-2 percentage points.

A Trump victory could trigger financial market volatility given investor worries about his stance on trade, immigration and foreign policy. Trump has also accused the Fed of keeping rates low because of pressure from the Obama administration.

"It just reinforces that unless Trump wins and markets become dislocated, the Fed has a green light to tighten," said Jack McIntyre, portfolio manager at Brandywine Global Investment Management in Philadelphia.

The Fed has held its target rate for overnight lending between banks in a range of 0.25 percent to 0.50 percent since last December, when it raised borrowing costs for the first time in nearly a decade.

Kansas City Fed President Esther George and Cleveland Fed President Loretta Mester dissented in Wednesday's decision in favor of an immediate hike. They were among three policymakers who dissented at the last meeting in September.

Bisnis.com, JAKARTA- Dolar Amerika Serikat melemah dari level tertinggi dalam tujuh bulan terakhir di tengah spekulasi bahwa Federal Reserve akan mempertahankan laju kenaikan suku bunga bahkan jika bank sentral memperketat kebijakan akhir tahun ini.

US Dollar Index, yang melacak pergerakan mata uang dolar terhadap mata uang utama lainya di dunia, ditutup melemah 0,13% atau 0,131 poin ke level 97,888.

Pelemahan ini menyusul pidato Wakil Gubernur The Fed Stanley Fischer yang menguraikan faktor penekan pertumbuhan dan tingkat suku bunga di New York hari Senin

Sebelumnya, Gubernur The Fed Janet Yellen pada 14 Oktober menyampaikan argumen untuk mempertahankan kebijakan moneter sambal tetap menaruh kemungkinan kenaikan suku bunga tahun ini, sehingga berpotensi meredupkan daya tarik greenback.

"Dolar tertahan setelah kinerja positif dalam beberapa minggu terakhir," kata Omer Esiner, kepala analis pasar Commonwealth Foreign Exchang, seperti dikutip Bloomberg.

“Komentar Yellen konsisten dengan penurunan laju kenaikan suku bunga dalam jangka menengah dan panjang, dan hal ini menjadi sesuatu yang dapat membatasi kenaikan dolar,” lanjutnya.

Indeks dolar AS

17 Oktober

|

97,888

|

14 Oktober

|

98,019

|

13 Oktober

|

97,516

|

Sumber: Bloomberg, 2016

bloomberg: Federal Reserve Chair Janet Yellen said there are “plausible ways” that running the U.S. economy hot could fix damage caused by the Great Recession, laying out the argument for keeping monetary policy easy without taking an interest-rate hike off the table this year.

“Increased business sales would almost certainly raise the productive capacity of the economy by encouraging additional capital spending,” Yellen told a Boston Fed conference Friday dedicated to examining the elusive economic recovery. “A tight labor market might draw in potential workers who would otherwise sit on the sidelines.”

U.S. stocks fluctuated after her remarks as investors digested a speech that lacked specific observations on the outlook for the economy and monetary policy, but which may have come across as an explanation of the Fed Chair’s dovish policy position.

“If nothing else, this is another lower-for-longer prescription. However, these comments do not preclude a 25-basis-point rate hike this year as another step in the normalization process,” Thomas Simons, senior economist at Jefferies LLC in New York, wrote in a note to clients.

Minutes of the Sept. 20-21 meeting of the Federal Open Market Committee showed that “several” members of the central bank’s policy-setting panel judged that it would be appropriate to raise the benchmark lending rate “relatively soon.” Pricing in federal funds future contracts indicates that investors see a roughly two-thirds probability of a move in December versus less than 20 percent next month, when the FOMC meets a week before the U.S. presidential election.

The U.S. economic recovery that began in the middle of 2009 has proceeded at sluggish pace. It took more than six years to drive the unemployment rate close to Fed officials’ definition of full employment. Inflation has remained below the Fed’s 2 percent target since 2012, and wages haven’t grown as fast as in previous expansions. Economists at the Boston Fed conference scrutinized explanations for the slow recovery, with some arguing that demographic trends already in place before the recession are largely to blame.

Yellen pondered whether a “high-pressure economy” could reverse some of the damage done in the recession, including declines in research spending and labor force participation. In effect, that has been the Federal Open Market Committee’s bet this year, though Yellen cautioned that running a low-rate policy for too long “could have costs that exceed the benefits” by increasing financial risk or inflation.

New Research

Still, Yellen said, “the influence of labor market conditions on inflation in recent years seems to be weaker than had been commonly thought prior to the financial crisis.”

Yellen also used her remarks to prominent monetary economists to pose a list of questions that she said required new research.

These included the somewhat unorthodox idea that changes in demand might have a persistent impact on supply, and why the influence of labor market conditions on inflation has weakened in recent years and whether that was caused by the Great Recession. She also asked how policy makers can reduce the frequency and severity of future crises by understanding better the connections between the financial sector and the broad economy.

“The Fed has been easier than any of the traditional benchmarks would have suggested for quite some time now,” said Stephen Stanley, chief economist at Amherst Pierpont Securities LLC in New York. “She may have put the question out there in a prospective kind of way,” but “the reality is that they’ve already been doing this,” he said.

Asian shares were broadly lower Thursday, with Japan the regional outperformer as the yen softened against the dollar following the release of minutes from a hawkish-sounding U.S. Federal Reserve meeting.

The Nikkei Stock Average NIK, -0.39% was up 0.1% in early morning trade, recovering slightly from losses in the previous session. Australia’s S&P/ASX 200XJO, -0.91% was down 0.8%, Korea’s Kospi SEU, -0.63% fell 0.5% and Hong Kong’s Hang Seng Index HSI, -1.44% was also off 0.7%.

Overnight, the minutes of the Federal Open Market Committee’s September meeting revealed that three members voted for an immediate interest rate rise. However, the majority of members felt that “the case for an increase in the federal-funds rate has strengthened but decided, for the time being, to wait for further evidence of continued progress toward its objectives.”

Still, the minutes offered little in the way of surprises and the market continued to believe that the Fed was on track to act in December. According to CME Group’s FedWatch tool, the probability of a rate rise at the central bank’s final meeting of the year rose to 69.9% from 69.5% a day earlier.

“The minutes are the underlying driver for the region today that has seen dollar strength, which is a further boost for tightening sentiment by the Fed,” said Gavin Parry, managing director at Parry International Trading.

Exporters in Japan gained as the weaker yen made their goods cheaper to ship overseas. The currency was last down 0.2% against the greenback. Among key auto makers, Nissan Motor 7201, +1.26% umped 2.2%, Honda Motor 7267, +0.66% rose 1.7% and Mazda 7261, -0.18% as up 1.5%.

In addition to favorable currency flows, shares of Japanese auto maker Suzuki Motor7269, +1.95% surged 3.2% and Toyota Motor 7203, +0.20% gained 1.2%, after the two companies said they were in talks to develop a business partnership to share the burden of developing self-driving cars and low-cost vehicles. The two companies said it was a step that was needed to survive “unprecedented” change in the industry.

Japan’s financial sector also staged a rebound after declining sharply Wednesday following comments from the Bank of Japan’s governor that suggested the bank would deepen negative rates if needed.

In Australia, producers were hit by falling commodity prices, which chipped away at their bottom line and dragged down the wider benchmark. Shares of Rio TintoRIO, -3.06% and BHP Billiton BHP, -2.97% two of the world’s biggest copper producers, were both off 2.4%. The London Metal Exchange’s three-month copper contract was recently down 0.1%. Brent, the global crude oil benchmark, was down 0.6% at $51.48 a barrel in Asian trade.

In Hong Kong, shares of Cathay Pacific Airways 0293, -5.58% tumbled 5.2% after the premium carrier said it was seeing difficult operating conditions in the second half. HSBC downgraded its rating on the blue-chip stock to reduce from hold, telling clients that Cathay Pacific should expect an unprofitable 2017.

“Yield erosion [at the airline] continued as expected but the decline is worse than we anticipated,” HSBC said in a note.

Elsewhere, the Bank of Korea on Thursday kept its base rate unchanged for a fourth straight month. The decision to hold the rate steady at a record-low 1.25% also comes with the central bank under renewed pressure from parliament to refrain from easing policy further.

Looking ahead, the market will be watching for initial jobless claims data from the U.S. due later in the global trading day, analysts say.

New York: Bukti yang menunjukkan secara alamiah tingkat suku bunga jatuh pada level yang rendah bisa mengartikan bahwa ekonomi Amerika Serikat (AS) terjebak dalam pertumbuhan yang melemah dan sulit untuk melarikan diri dari kondisi itu. Sejauh ini, Federal Reserve masih mempertahankan tingkat suku bunga acuan di level yang rendah.

"Itu berarti perekonomian (AS) terjebak dalam kebiasaan pertumbuhan rendah. Sulit untuk melarikan diri dari hal itu," kata Wakil Ketua the Fed Stanley Fischer, seperti dikutip dari Reuters, Kamis (6/10/2016).

Fischer, ketika berbicara dalam sebuah seminar bank sentral di New York, mengatakan bahwa ia khawatir perubahan pola investasi dan menabung bisa mendorong secara alamiah penurunan tingkat suku bunga acuan. Hal itu terlihat cukup gigih terjadi.

"Kami bisa terjebak pada ekuilibirium yang panjang dengan ditandai pertumbuhan cukup lamban," kata Fischer.

Akibatnya, lanjutnya, bank sentral kemungkinan akan menghadapi sebuah tantangan di masa depan bahwa suku bunga acuan jangka pendek yang ditetapkan oleh para pembuat kebijakan di the Fed tidak pernah berada jauh di atas angka nol persen.

"Suku bunga acuan yang terlalu rendah ini mungkin mencerminkan siklus pengulangan. Akan tetapi, bisa juga menjadi indikasi bahwa potensi pertumbuhan ekonomi AS sangat redup," pungkas Fischer.

Semua data ekonomi AS yang dirilis Rabu belum signifikan mengubah keyakinan investor the Fed akan menaikkan suku bunga dari 0,50 persen ke 0,75 persen selama pertemuan FOMC Desember.

Menurut alat Fedwatch CME Group, probabilitas tersirat saat ini untuk menaikkan suku bunga dari 0,50 persen ke 0,75 persen adalah pada 17 persen untuk pertemuan November 2016, dan 64 persen pada pertemuan Desember 2016.

http://ekonomi.metrotvnews.com/globals/VNnxB9Ek-rendahnya-suku-bunga-acuan-tanda-ekonomi-as-terjebak-pelemahan

Sumber : METROTVNEWS.COM

The move was so widely anticipated that the stock market barely reacted.

The Federal Reserve made the utterly predictable decision to leave interest rates unchanged, indicating that while the economy is improving, it may not be strong enough to bear higher borrowing costs.

This means the Fed has raised rates only once — by a mere 0.25 percentage points last December — over the past decade.

“The Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent,” the Federal Open Market Committee said in a prepared statement. “The Committee judges that the case for an increase in the federal funds rate has strengthened but decided, for the time being, to wait for further evidence of continued progress…The stance of monetary policy remains accommodative, thereby supporting further improvement in labor market conditions and a return to 2 percent inflation.”

Attention now focuses on December, as the next scheduled meeting at which central bankers could possibly lift rates. While there is a Fed meeting slated for the start of November, that takes place just a week before the presidential election. And few economists expect the central bank to make a move that close to the vote. In a nutshell, the recent economic news has been okay, but not quite good enough,” said Paul Eitelman, multi-asset investment strategist for Russell Investments. “Global concerns such as China’s wobbling economy and the continued uncertainty from Brexit no doubt played a role in the Fed’s thinking, as well.”

The fact that the Fed has gone this long without raising short-term rates at least one more time is a slap in the face of savers, who’ve been suffering through more than a decade of lower-than-average rates. But as MONEY’s Athena Cao points out, savers aren’t entirely without options.

It’s also remarkable given what the Fed hinted at earlier this year. At the beginning of 2016, Fed officials were wondering aloud whether four interest rate hikes were in the cards this year.

But the economy, both globally and here at home, just hasn’t cooperated. China’s abysmal start to the year, coupled with falling energy prices and a strong dollar, lead to stocks enduring their worst start to a year ever. Britain’s decision to leave the E.U also hampered confidence.

Domestic growth has been sluggish, and jobs reports have bounced from surprising to disappointing throughout the year. Despite a recent Census report that showed American incomes grew a strong clip this year, earnings and inflation are running below Fed target.

While savers pining for more yield on their cash hope beyond hope that the Fed will give them some lift in December, another spotty employment report, or unknown disaster around the world, might have investors looking to 2017 for the next hike.

Data resmi di AS menunjukkan produksi industri turun melebihi perkiraan dan penjualan ritel di luar dugaan turun pada Agustus 2016. Dari sini lah para analis memperkirakan peluang kenaikan FFR pada pekan depan menjadi di bawah 20%. Adapun nilai tukar poundsterling melemah pada Kamis setelah Bank of England (BoE) mengutarakan kemungkinan pemangkasan lagi suku bunga acuan tahun ini.

“Data-data tersebut menunjukkan bahwa suku bunga tidak seharusnya naik. Imbal hasil naik lebih tinggi di luar negeri yang artinya permintaan berasal dari pasar obligasi kami atau bahkan pasar saham kami karena para investor yang memburu yield lebih baik akan keluar. Ini yang lebih penting dibandingkan data-data terbaru,†tutur Mark Kepner, direktur pelaksana dan pialang ekuitas Themis Trading LLC di Chatham, New Jersey, kepada Bloomberg.

Kapitalisasi pasar saham global tergerus sekitar US$ 2 triliun selama satu pekan terakhir karena kekhawatiran terhadap pasar minyak mentah berbarengan dan sinyal-sinyal bahwa bank-bank sentral utama siap mempertimbangkan ulang kebijakan moneter.

BoE mempertahankan suku bunga acuan pada Kamis. Sedangkan The Federal Reserve (The Fed) dan Bank of Japan (BoJ) dijadwalkan menggelar pertemuannya pekan depan. Sidang The Fed dijadwalkan pada 20-21 September 2016 waktu setempat.

“Pasar bergantung pada kemurahan hati bank-bank sentral, tapi ada sedikit masalah kredibilitas. Sampai kami mendapatkan gambaran sesungguhnya mengenai arah kebijakan moneter global, pasar tidak bisa -bisa mengambil patokan,†tutur Thomas Thygesen, kepala strategi lintas aset SEB AB di Kopenhagen, Denmark, kepada Bloomberg.

Indeks-indeks saham Eropa bergerak mixed pada Kamis. Indeks saham London menguat setelah BoE mengindikasikan kenaikan lagi suku bunga tahun ini.

Pada sesi perdagangan siang, indeks FTSE 100 London naik 0,2% setelah para pialang juga bereaksi atas pertumbuhan penjualan ritel. Di zona euro, indeks DAX 30 Frankfurt turun 0,4% dan indeks CAC Paris turun 0,6%. (bersambung)

http://id.beritasatu.com/international/produksi-industri-as-turun-melebihi-perkiraan/149860

Sumber : INVESTOR DAILY

marketwatch: Stocks and Bonds Both Elevated By Low Rates

Assume you worked hard your entire life and amassed a nice nest egg, allowing you to retire if you could earn an average of 5.00% annually. That plan would not have required you to take a lot of risk when CD rates were above 5.00% in the 1980s and 1990s (see below).

Search For Higher Returns

However, when CD rates started to fall well below 5.00%, you would have been forced to either lower your income expectations or add higher-yielding investments to your retirement portfolio. The search for yield has created additional demand for riskier assets, including stocks.

Higher Rates Reduce Demand For Stocks

For illustrative purposes, if we assume the Fed raised rates back to 5.00% this month, it is easy to understand how many investors would no longer feel the need to invest a portion of their portfolios in higher-volatility assets, such as stocks. Higher rates reduce demand for riskier assets, which in turn can lead to a decline in stock prices. If we knew stocks and CDs would both produce an annual return of 5.00% over the next decade, most would prefer to own the lower-volatility asset (CDs).

Bonds Have Benefited As Well